So, here we are, in the wild world of Bitcoin, where the only thing more volatile than the price is the behavior of its investors. Glassnode, the analytics firm that’s basically the Sherlock Holmes of crypto, has cracked the case on how these investors’ antics can lead to price trend reversals and continuations. Who knew investing could be so dramatic? 🎭

Glassnode Unveils the Cast of Characters in the Bitcoin Saga

In a riveting new thread on X (formerly known as Twitter, because rebranding is all the rage), Glassnode has introduced us to the five fabulous cohorts of Bitcoin investors: Conviction Buyers, First Buyers, Momentum Buyers, Loss Sellers, and Profit Takers. Sounds like a reality show waiting to happen, right? 📺

Now, let’s break it down: First Buyers, Loss Sellers, and Profit Takers are pretty much what they say on the tin. But Conviction Buyers? They’re the brave souls who buy Bitcoin even when it’s plummeting faster than my self-esteem on a bad hair day. And then we have Momentum Buyers, who only seem to buy when the price is going up, like they’re trying to catch a train that’s already left the station. 🚂💨

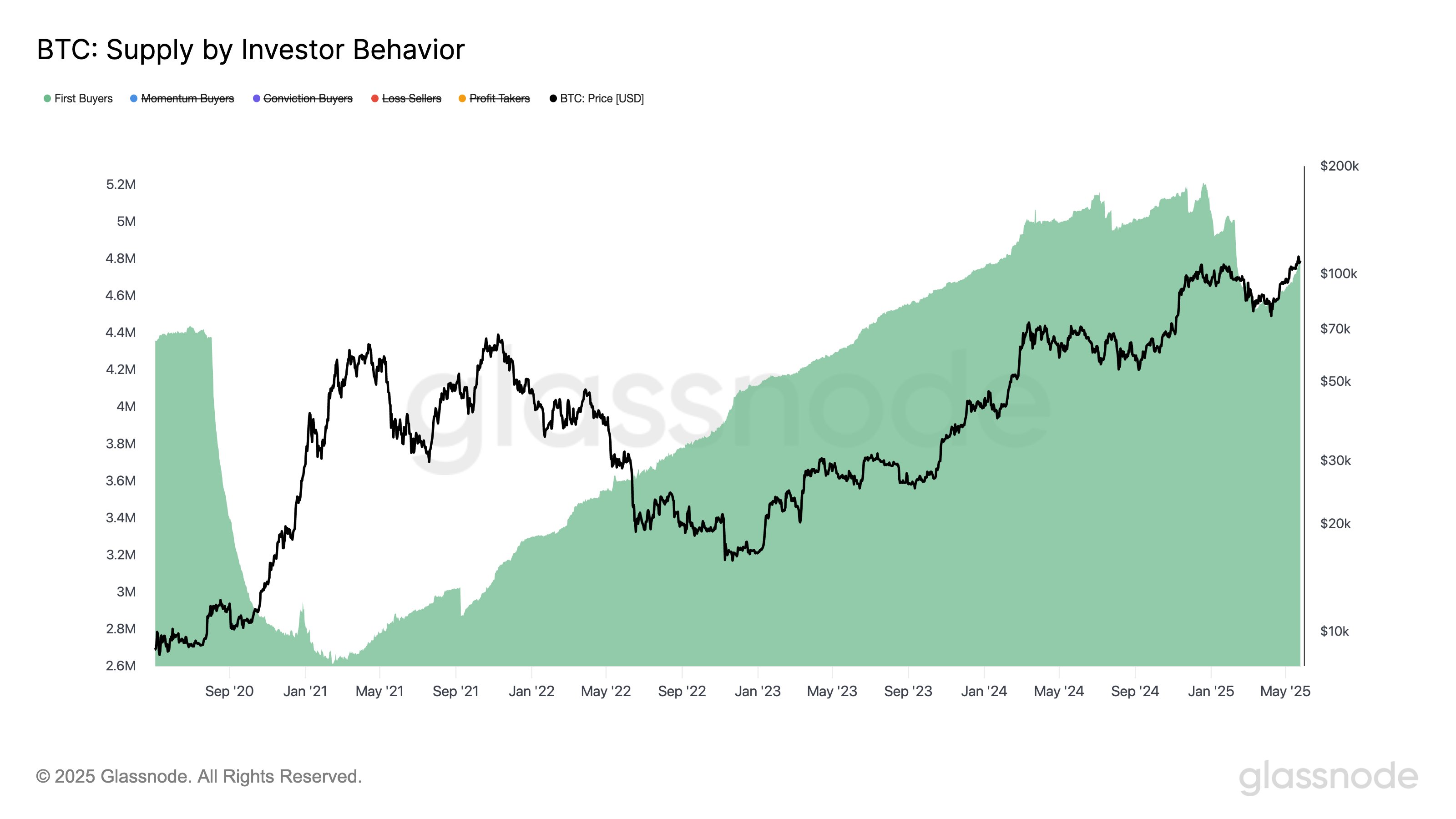

According to Glassnode, “The metric tracks the cumulative token supply held by each cohort over time.” In other words, they’re keeping tabs on who’s holding what, while conveniently ignoring exchanges and smart contracts. Because, let’s face it, nobody wants to deal with that drama. 🙄

Now, feast your eyes on the chart that shows the trend in the indicator over Bitcoin’s tumultuous history:

To really spice things up, Glassnode zoomed in on two cohorts: the Conviction Buyers and the First Buyers. Because why not make it a two-part special? 🎉

First up, the Conviction Buyers:

From the graph, it’s clear that the BTC supply held by Conviction Buyers tends to spike at the same time as the price does its dramatic dips and rises. They’re like the loyal friends who show up with ice cream when you’re down, buying the dips and stabilizing the chaos. 🍦

“But conviction alone isn’t enough to spark a rally – that’s where First Buyers come in,” Glassnode explains. Cue the dramatic music! 🎶 Below is the chart that highlights the role of the First Buyers:

As shown, demand from First Buyers surged as Bitcoin clawed its way out of the bear market, with a particularly sharp spike during the bull rally in Q1 2024. It’s like they suddenly remembered they had a wallet! 💰

However, the supply from First Buyers dipped during the consolidation phase that followed, but don’t worry, they came back in the second half of the year, helping to push Bitcoin beyond the $100,000 mark. Talk about a comeback! 🏆

This year’s Bitcoin market downturn saw a decline in First Buyers’ supply, but just when you thought it was all over, new capital inflows made a dramatic return, leading to a potential rally to a new all-time high. It’s like a plot twist in a soap opera! 📈

BTC Price

As of now, Bitcoin is trading around $109,800, up over 4% in the past week. So, if you’re not investing, what are you doing with your life? 🤷♀️

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

2025-05-28 05:23