In 2025, Telegram continues to be the preferred platform for receiving cryptocurrency trading signals. With thousands of channels available, both free and paid, it distributes real-time trade suggestions to millions of global crypto traders. Its instant, mobile-friendly design and strong community focus make it a vital center for those aiming to gain an advantage in the market.

To clarify, what are these cryptocurrency trading signals? How are they generated, and is it truly beneficial to follow them for improved and profitable trading?

What’s the deal with crypto trade alerts? How do they get created, and can they really boost my trading success?

Key Takeaways:

- Crypto trading signals provide trade ideas with entry, exit, and risk levels to help traders act faster.

- Effective use of signals requires risk management, context, and your own judgment.

- Signals are a helpful tool, but they should support, not replace, your trading strategy.

What Are Crypto Trading Signals?

Cryptocurrency trading signals represent precise recommendations or notifications about trades. These are clear instructions meant to bring attention to supposed trading opportunities that others consider promising. Rather than the ambiguous “Bitcoin might be bullish,” a helpful signal offers specific, actionable details for potential implementation.

Typically, a signal will include key pieces of information:

- The Asset: Which cryptocurrency to trade (e.g., BTC, ETH, SOL, or maybe a lesser-known altcoin).

- Entry Price Zone: A recommended price range where opening the trade might make sense, according to the signal provider’s analysis.

- Take-Profit (TP) Target(s): Suggested price levels where you could close the trade to lock in profits. Often, signals might offer multiple targets.

- Stop-Loss (SL) Level: This is crucial – it’s the predetermined price point to exit the trade and cut your losses if the market turns against you. Never trade without one.

- Trade Direction: Is the signal suggesting a long position (buying, expecting the price to go up) or a short position (selling, expecting the price to drop)?

- Timeframe Idea (Sometimes): Some signals might hint at whether it’s intended as a quick scalp, a swing trade over a few days, or something longer-term.

For example:

BTC/USDT – Long

Entry: $65,500 – $65,700

TP1: $66,500 | TP2: $67,400

SL: $64,800

Leverage: 3x (optional)

(Warning: not a real trading signal!)

At its core, a well-designed trading signal provides a distinct strategy: it suggests the assets to trade, indicates appropriate entry times, and sets specific exit points – whether for maximizing profits or minimizing losses.

Where Do These Signals Originate? The Human vs. The Machine

It’s beneficial to understand that not all signals are created equally. Generally, they originate from two primary sources:

- Human-Generated Signals

These analysis tools are developed by expert traders or analysts. They often employ multiple approaches: studying price graphs and technical indicators (such as RSI, MACD, moving averages, Fibonacci levels), tracking trading volumes, responding to major news events, and potentially examining on-chain data or broader economic trends.

Manual signals usually include additional explanations or rationale, making them beneficial for understanding the reasons behind a particular trade’s appeal when there is a human analyst involved.

- Automated Signals

These results stem from automated systems or trading algorithms, which follow specific strategies. Some could be simple rule-based systems, like one that says “if indicator X surpasses threshold Y under condition Z, activate the signal.” Others use machine learning methods to modify their approach based on evolving market dynamics over time.

These entities tend to be quicker than humans and capable of handling significantly larger amounts of information, devoid of emotions. This allows them to produce numerous signals. Yet, speed does not guarantee superiority, as it may lack the subtle discernment that humans can occasionally offer.

Today, it’s quite common for signal providers to adopt a combined strategy. They might employ automation for its efficiency and preliminary screening, but they also incorporate human intervention as the concluding step to ensure thorough examination or contextual understanding.

Why Are They So Popular?

The appeal of trading signals is pretty clear, especially for certain types of traders:

- Newcomers Feeling Overwhelmed: If you’re just starting out and complex technical analysis seems daunting, signals can feel like a helpful starting point to get involved.

- Busy Individuals: Don’t have the time or desire to stare at charts all day? Signals promise pre-digested, actionable ideas, saving considerable analysis time.

- Community-Oriented Traders: Some people thrive on trading within a group, sharing insights and experiences. Many signal channels foster this kind of community environment.

It’s important to grasp the fundamentals, but could you explain to me how these signals are generated and transmitted consistently on a daily basis?

How to Find Trading Signals for Crypto?

How do you see the setup that has the potential for profit once a signal has been generated?

Telegram

In 2025, it remains predominantly the go-to platform for disseminating signals. The reason is simple: it’s instantaneous, mobile-compatible, enables effortless channel and group creation, and provides users with a level of privacy.

As a cryptocurrency investor, you’ll discover numerous channels here – a blend of free resources (which can serve as a launching pad, but do exercise caution with frequent upselling or potentially outdated information) and paid subscription groups that claim to offer premium features such as quicker alerts or in-depth analysis.

While navigating Telegram, always maintain a discerning eye. Seek out channels that openly display their past performance (not just focusing on successful trades), offer clear risk management tips alongside every signal (such as stop-losses), have an engaged community or readily available support, and above all, steer clear of individuals who claim “guaranteed profits.” This is a significant warning sign in trading.

Dedicated Signal Platforms & Tools

Instead of just text-based chat platforms, there are specialized systems (like 3Commas, CoinCodeCap, or Cornix) that are designed specifically for signal analysis. These platforms typically provide a more organized setup, offering performance analytics on signals, seamless integration with cryptocurrency exchanges (enabling automated trading based on these signals), and tools to sort signals by type or provider. Some of them even collaborate with Telegram bots.

Social Trading Networks (Copy Trading)

On platforms such as eToro or Zignaly, there’s an alternative method available. Here, you have the ability to instantly replicate the exact trades made by top-performing, rated traders in real-time. Although not traditional alerts, they serve a similar purpose – enabling novice traders to follow strategies with demonstrated success records.

One significant benefit in this setup is frequently the clarity it provides; you can typically review a trader’s past performance and risk indicators before choosing to mimic their strategies.

Discord Servers & Online Communities (Reddit etc.)

Some traders locate beneficial tips or perspectives in specially designed Discord groups, which frequently function as part of a larger trading network. These platforms encourage dialogue on potential trade strategies, offering a more interactive experience. On the other hand, online communities like Reddit (specifically crypto trading subreddits) can be unpredictable – they may help you find providers or warn about scams, but their vastness and abundance of opinions necessitate careful sifting to separate valuable information from the noise.

Keep in mind as well that the duration of signals can differ significantly. Some are designed for rapid trading, lasting only a few minutes to several hours, while others are more suitable for swing trading, which spans days, and still others may be intended for long-term positioning strategies.

As a result, the number of signals transmitted varies significantly – while some service providers may transmit numerous signals every day, others might be more discerning, potentially sharing just one or two strong convictions each week.

Best Cryptocurrency Trading Signals Groups in 2025

Since Telegram is so prominent, identifying some active participants can be useful, yet it’s tough to consistently find top-tier, reliable communities. Here are several groups frequently brought up in conversations:

This version aims to maintain a conversational and easy-to-understand tone while still conveying the same meaning as the original text.

Crypto Whale Pumps

This team specializes in finding quick ‘boost’ chances, frequently in fledgling digital assets like tokens or coins that trade on decentralized exchange platforms (DEXs). It appears they employ algorithms to swiftly detect changes in momentum.

Subscribers: 34,000+

Access: Free & Premium

Ideal for: Traders chasing momentum in small caps

Learn2Trade

Learn2Trade is commonly known for its structured trading signals, which are backed by technical explanations and predominantly focus on major cryptocurrency pairings. Occasionally, it also delves into Forex and indices markets as well. Some reports suggest an accuracy rate of approximately 79%, but it’s essential to independently confirm these figures.

Subscribers: 26,000+ (free Telegram channel)

Access: Free or VIP (several tiers)

Ideal for: Traders who prefer technical setups with clear risk/reward

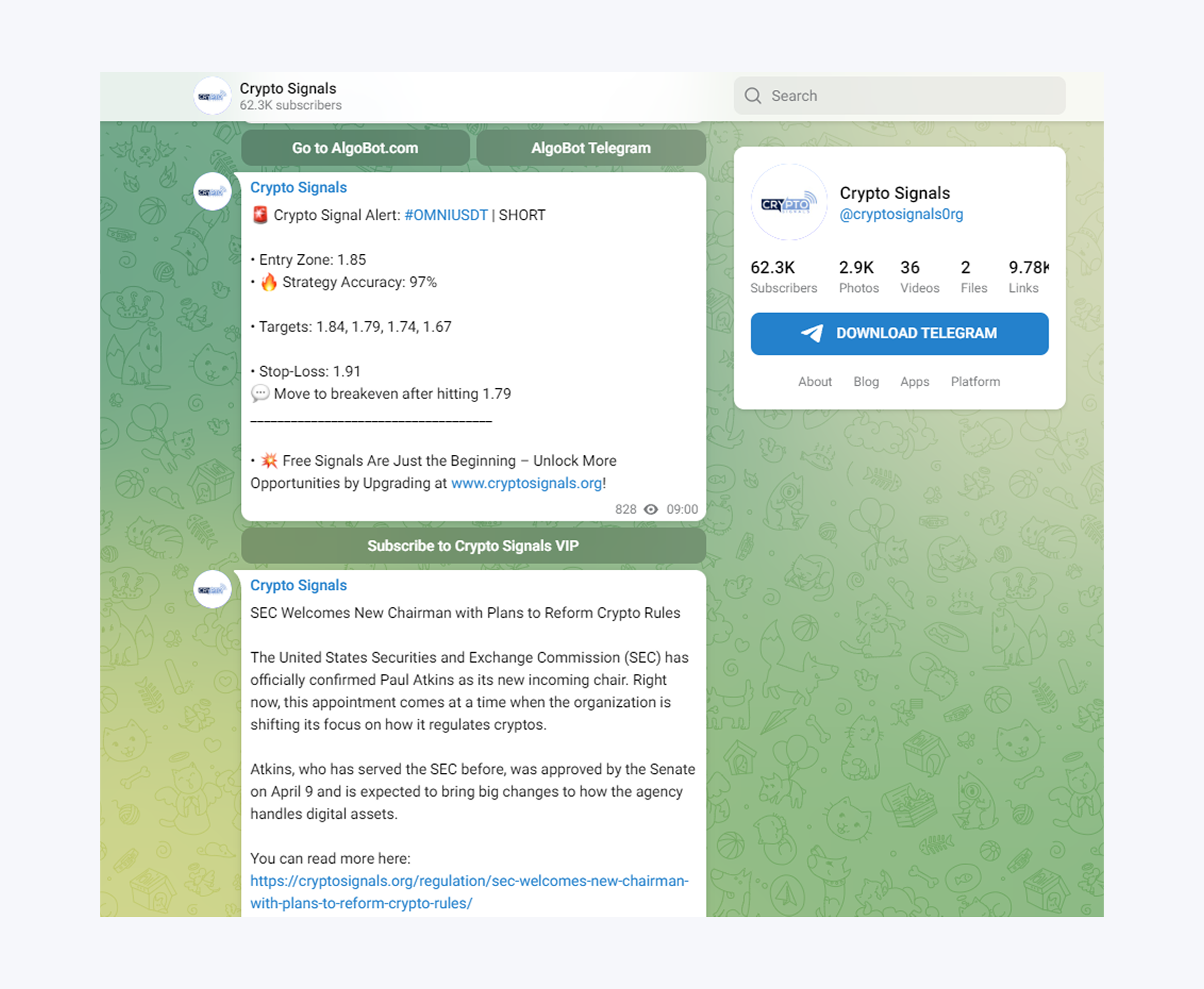

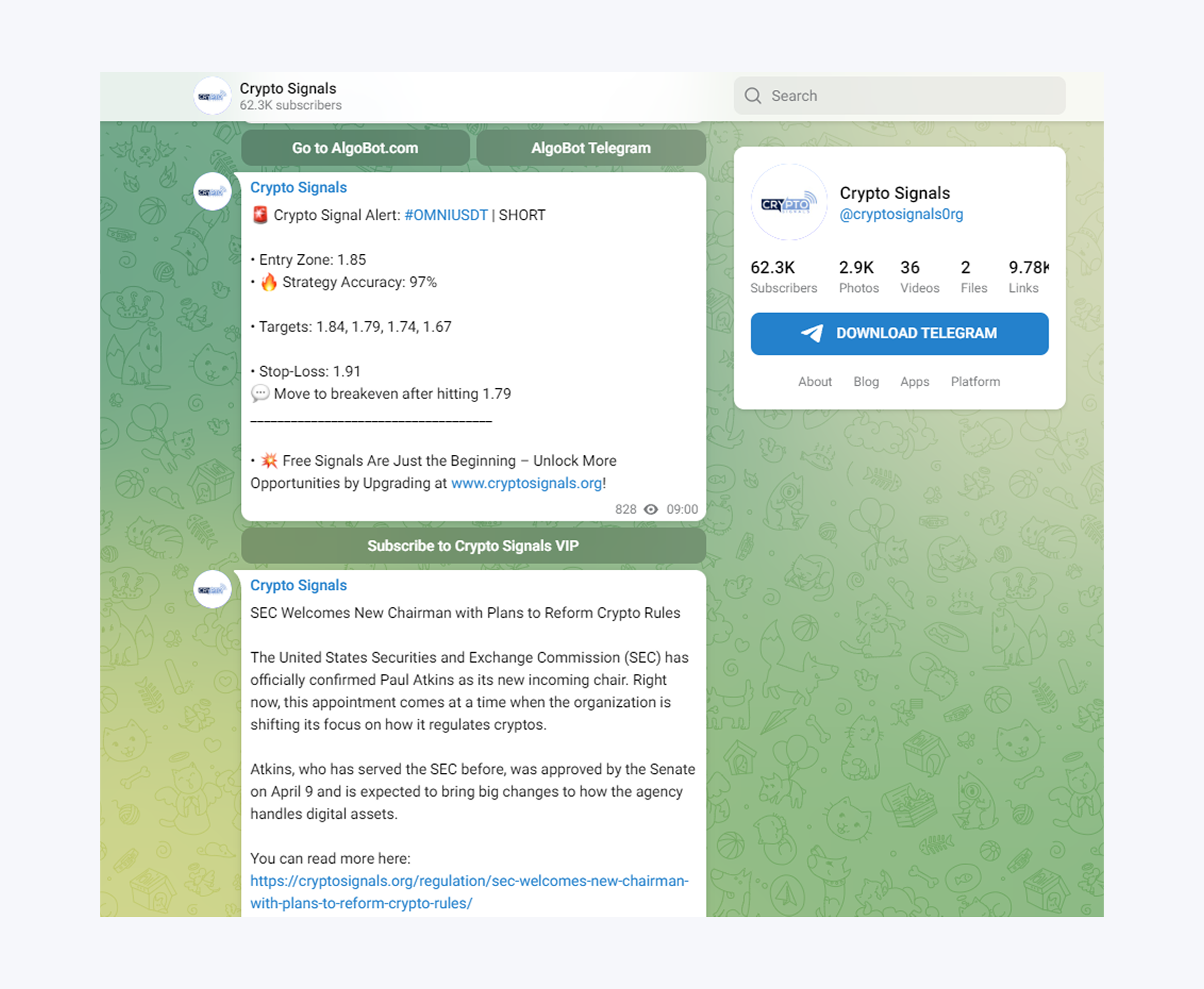

CryptoSignals.org

Established since 2014, CryptoSignals.org is well-known for its clearly structured signals, which typically incorporate technical rationale, risk levels (Stop Loss/Take Profit), and even multiple potential profit points. This service might appeal to traders seeking a provider with a more extensive history of operations.

Subscribers: 62,000+ (free Telegram channel)

Access: Free or VIP (several tiers)

Ideal for: Traders looking for professionalism and experience

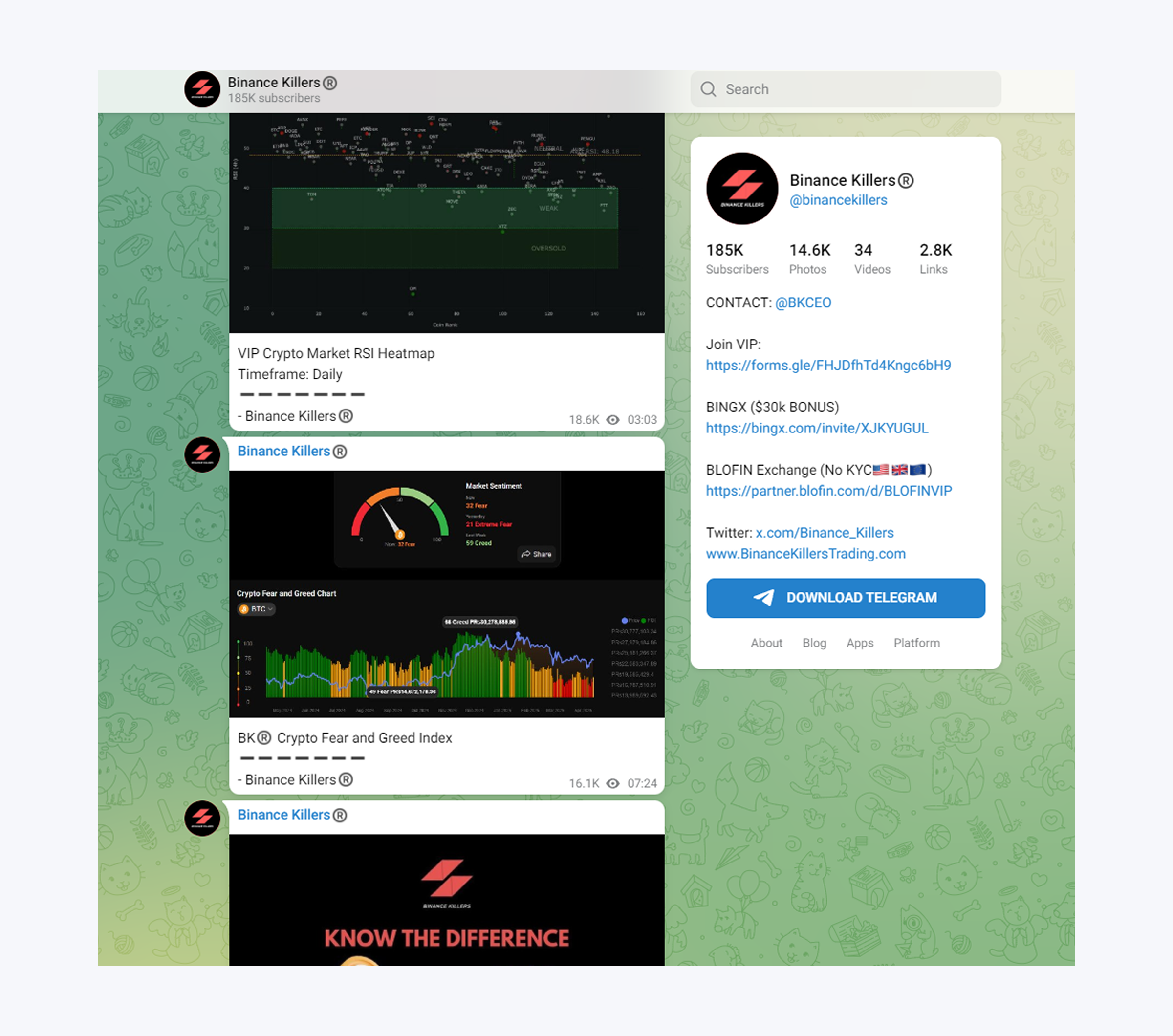

Binance Killers

Among Telegram groups, this one boasts a significant number of members due to its high subscriber count. As their moniker implies, their primary interest lies in cryptocurrencies that are traded on the Binance platform. They typically offer clear and practical trade strategies intended for immediate application.

Subscribers: 185,000+

Access: Free & VIP

Ideal for: Active Binance users and short-term traders

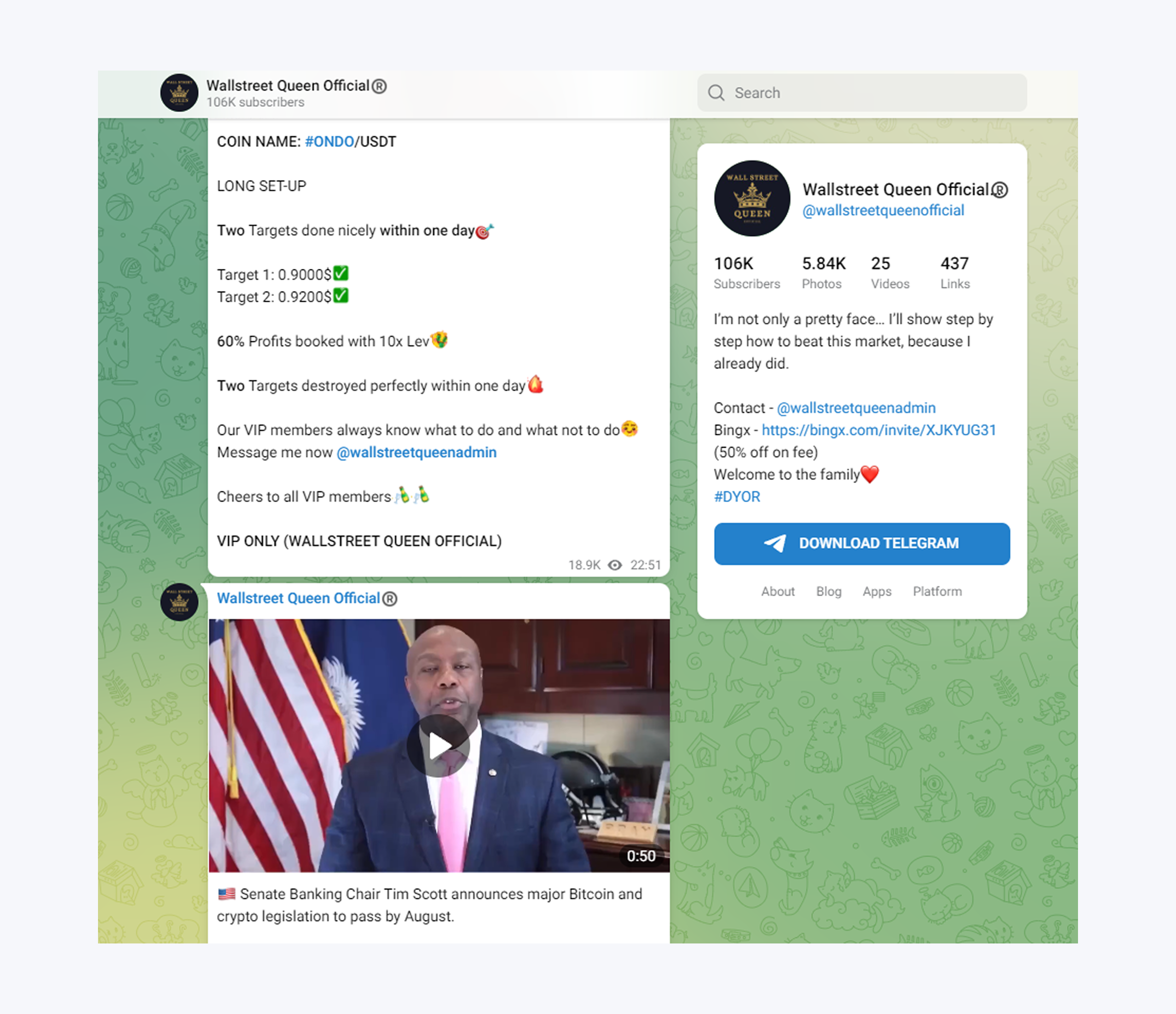

Wallstreet Queen Official

Frequently known for guidance from a skilled woman in trading (“WSQ”), this platform offers both signaling and educational resources such as labeled charts or concise analyses, fostering a sense of camaraderie within the community. Premium members may receive additional benefits like comprehensive setup explanations or mentoring.

Subscribers: 106,000+

Access: Free & VIP

Ideal for: Traders who value explanation, context, and a supportive community

Before signing up for services or following recommendations from any signal provider, it’s essential to conduct your own comprehensive research. This may involve seeking out independent evaluations (when they exist), attempting to monitor their free signals over a period of time if feasible, understanding the underlying strategies they employ, and scrutinizing any performance statistics they present.

Pros and Cons of Using Crypto Trading Signals

Trading signals for cryptocurrencies can undeniably provide several benefits, such as sparing you the effort of scrutinizing charts extensively and possibly providing you with insights that could have slipped your notice.

In essence, it’s important to remember that these tools aren’t instant solutions for consistent earnings. Over-reliance could lead to adverse outcomes. Just like any instrument you have in your trading collection, they function optimally when you are aware of their advantages as well as their genuine constraints.

What’s Good About Using Signals?

- Major Time Saver: One of the biggest plus points? Signals can free you from having to watch the charts all day. You get potentially ready-to-go trade ideas delivered to you, often complete with suggested entry, exit, and stop-loss levels.

- Great Learning Aid for Beginners: If you’re new to trading, seeing how a signal is structured – where to potentially enter, how to set profit targets, and crucially, where to place a stop-loss – can be a practical way to understand trade mechanics. It’s like looking over a more experienced trader’s shoulder, if you use it as a chance to learn, not just copy blindly.

- Access to Different Perspectives: Especially with paid groups, signals might come with analysis or commentary explaining the rationale behind the trade. This can offer valuable insights into how others interpret market movements or use certain indicators.

- Discovering New Opportunities: A good signal provider might highlight potential trades in assets or market niches (like DeFi or obscure altcoins) that weren’t even on your radar. They can broaden your horizons beyond the coins you usually follow.

- Community & Accountability: Being part of a signal group’s chat or community can sometimes provide support, allow you to ask questions, and even create a sense of accountability, knowing others are potentially looking at the same setups.

But What Are the Downsides and Dangers?

- The Risk of Over-Reliance: Just blindly following signals without developing your own understanding of the market is risky. What happens if the market suddenly changes, or the signal provider makes a mistake? You need your own judgment.

- Transparency Can Be Sketchy: Not all providers are upfront about their results. It’s easy to showcase winning trades and quietly ignore the losers. Finding providers with genuinely transparent, verifiable track records can be tough.

- Signal Overload and Confusion: If you follow multiple groups, you’ll inevitably get conflicting signals – one says buy BTC, another says sell. Without your own analysis framework, this can lead to confusion, hesitation, or ‘analysis paralysis’.

- Scams Are Everywhere: Telegram and other platforms are rife with scammers posing as trading gurus. They lure people in with promises of unrealistic, guaranteed profits, often using fake screenshots or testimonials. Be incredibly skeptical.

- They Don’t Replace a Proper Strategy: Signals are just trade ideas. They won’t help you long-term if you don’t have solid risk management, control your position sizing, manage your emotions, and have an overall trading plan. Accurate signals plus poor execution still equals losses.

Crypto alerts could indeed be a valuable addition to your investment strategy, particularly in terms of time management and idea generation. However, it’s crucial to remember that these signals are no replacement for gaining knowledge, applying critical reasoning, and cultivating responsible trading practices.

Common Mistakes That Cost Traders Money (Even With Good Signals)

It can be disheartening yet accurate to say that traders sometimes end up losing money despite using seemingly good signals. Often, it’s not the signal that causes the loss, but rather mistakes in implementation or a less-than-optimal mindset. Be vigilant for these common traps:

While it might seem counterintuitive, traders may still experience losses even with potentially strong signals. More often than not, it’s not the signal that goes wrong, but rather implementation errors or an unfavorable mental approach. Keep a watchful eye out for these common pitfalls:

- Blind Copy-Pasting: Treating Telegram crypto trading signals like infallible commands without engaging your brain. The market changes fast; context matters.

Before taking action based on any signal, remember to check the chart and assess the current circumstances to ensure the signal is still relevant.

- Forgetting About Risk: Getting overconfident after a few wins and putting way too much capital on the next “sure thing.” One unexpected market move can erase prior gains.

Stick to your risk-per-trade rule religiously. Use stop-losses. Every single time. No exceptions.

- Signal Information Overload: Being in too many groups, getting bombarded with conflicting alerts, leading to confusion and poor decisions.

Opt for a few reliable service providers that align with your preference, as fewer options can lead to less distraction and promote clearer thought processes.

- Chasing Trades You Missed: Seeing a signal, watching the price move quickly without you, and then jumping in late out of fear of missing out (FOMO). This often means buying near a temporary top or selling near a bottom.

Understand that you may not catch every opportunity. If the chance has slipped away, don’t dwell on it. Patience and discipline are more rewarding than pursuing blindly.

- Letting FOMO or Urgency Drive Decisions: The rapid-fire nature of some signal groups can create a sense of pressure to trade constantly. This leads to rushed entries and taking lower-quality setups.

Don’t feel pressured to act on every trading opportunity. Instead, exercise patience and choose wisely. Look for trades that fit within your own strategies and comfort level for risk.

- Falling for Crazy Promises: Believing anyone who guarantees profits or claims impossibly high win rates (like 95%+ consistently). Real trading involves losses.

Always choose openness over exaggeration. Seek out service providers who are open to talking about their failures as well as successes. Approach promises with a healthy dose of suspicion.

Conclusion

In the constantly buzzing, frequently turbulent realm of cryptocurrency trading by the year 2025, signals have undeniably become a valuable asset for numerous traders. They provide structure, could help save precious time, and open up possibilities that may have gone unnoticed otherwise.

However, it’s important to note that these signals are not substitutes for expertise, planning, or good judgment. The power of such signals lies in the hands of the trader who uses them.

- If you’re newer to trading, use signals as a learning tool. Focus on reputable sources, start small, manage your risk carefully, and track everything to understand what works (and what doesn’t).

- If you’re more experienced, think of signals as supplementary data or idea generators. Use them to confirm or challenge your own analysis, not dictate your actions. Stick with providers who are transparent and emphasize risk control.

As an analyst, I’ve found that utilizing signals effectively, by integrating them with my own insights and maintaining a disciplined approach, can transform them into a valuable resource. However, overreliance on these signals without proper analysis can swiftly turn them into a potential risk or burden.

FAQ:

Where to find free cryptocurrency trading signals?

You can locate no-cost trading signals across platforms like Telegram groups, Discord servers, Reddit forums, as well as specialized trading communities. Keep in mind that these signals are readily available, but it is essential to evaluate the reliability of the source prior to taking any action based on them.

How to read crypto signals?

In simpler terms, a standard cryptocurrency signal provides information such as the specific digital asset, the price at which to enter the market, the stop-loss and take-profit prices, and any additional details like leverage, timeframes, or whether it’s a long or short trade. Be sure to review all the details before proceeding with the transaction.

Are crypto trading signals legit?

Indeed, many signal groups come from reputable, transparent sources. But remember, the market is teeming with fraudulent activities and exaggerated promises. So, it’s crucial to conduct thorough research before putting faith in any such group.

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Corporate Giants Dive into Bitcoin with $458 Million Bet: Is This the End of Fiat?

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Bitcoin to Moon? Tom Lee’s Wild Predictions and a Universe of Imbalance 🚀

- Bitcoin’s Droll Dance: Profits Plummet While Prices Prance! 💃🕺

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- Dogecoin’s Journey to $5: The Hilarious Truth Behind the Hype! 🚀💰

2025-05-27 07:34