- ETH’s $2.7K breakout triggered a short squeeze, but rising exchange reserves signal weakening momentum

- Ethereum’s decoupling from Bitcoin raises concerns about sustainability, with L2s and retail participation faltering

Ah, Ethereum! The darling of the crypto world, has pirouetted past the $2,700 mark, leaving a trail of astonished traders and over $50 million in short liquidations on Binance, as if it were a magician pulling rabbits from hats. 🐇✨

Yet, lurking beneath this glittering surface is a murky undercurrent: rising Exchange Reserves and the ominous outflow of whales suggest that the bullish momentum might just be a mirage in the desert of digital currencies.

And lo! Ethereum’s recent price decoupling from Bitcoin—once heralded as a sign of burgeoning strength—now raises eyebrows and concerns about the sustainability of this digital ecosystem. Is it a phoenix rising or a chicken running around with its head cut off? 🐔💨

Short squeeze ignites as ETH breaks $2.7K

Ethereum’s audacious leap past the $2,700 resistance level ignited a liquidation frenzy on Binance, obliterating over $50 million in short positions, according to the ever-reliable CryptoQuant data. Talk about a party crasher! 🎉💥

This zone, a veritable liquidity cluster on the Liquidation Delta chart, became a magnet for stop-loss orders as ETH pierced through like a hot knife through butter. 🍰🔪

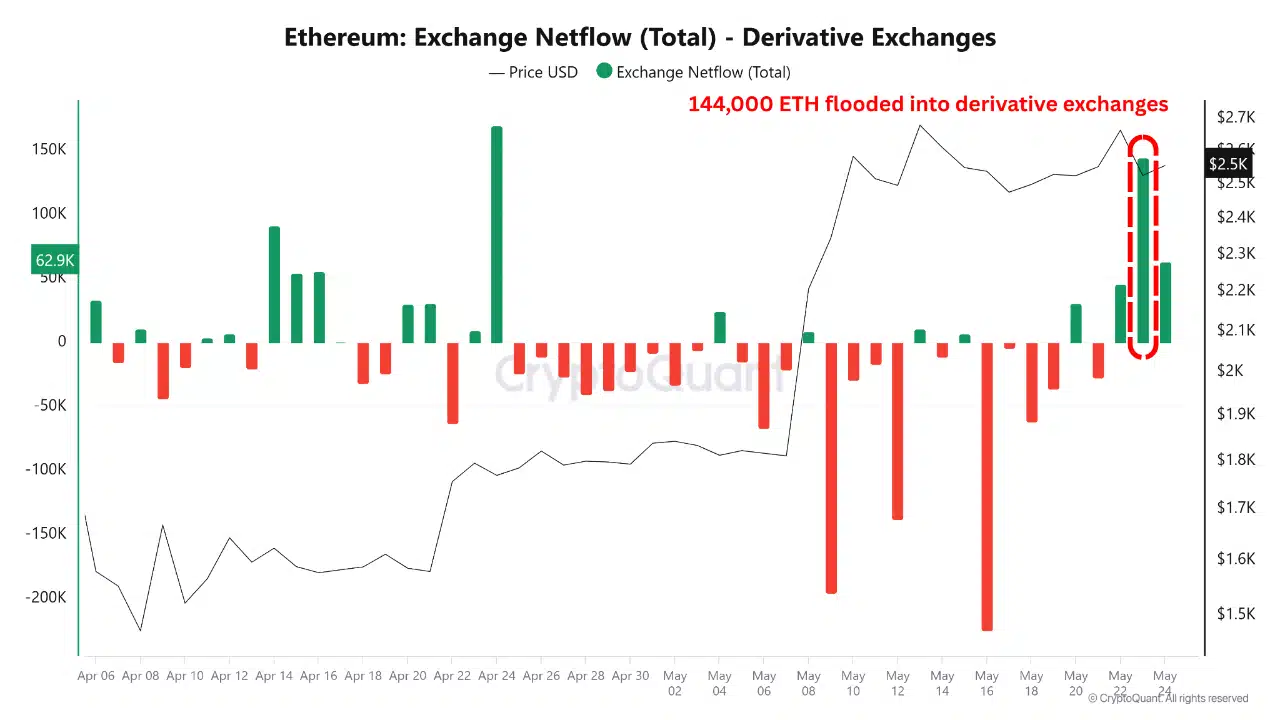

However, this euphoric squeeze was swiftly followed by a staggering 144,000 ETH flowing into Derivatives Exchange Reserves—a veritable red flag waving in the wind. Such inflows typically herald renewed short positioning, not a continuation of the trend. Oh, the irony! 😏

While the bulls may have briefly donned their victory crowns, the rapid inflows and heatmap pressure suggest that caution is the name of the game amidst this initial euphoria. 🐂⚠️

Ethereum-Bitcoin correlation collapses

For years, Ethereum and Bitcoin danced a waltz in near-perfect harmony, often sharing a correlation above 0.7. But alas, that relationship has nearly evaporated like morning dew under the sun. ☀️💧

According to CryptoQuant, ETH’s 1-year Correlation with BTC plummeted to a mere 0.05 as of May 22nd—down from a respectable 0.63 at the year’s dawn. What a fall from grace! 📉

This sudden decoupling disrupts one of the crypto market’s most consistent patterns, forcing a reassessment of traditional portfolio strategies. It’s like trying to dance without a partner—awkward and confusing! 💃🤷♂️

More critically, it coincides with ETH’s relative underperformance during Bitcoin’s recent rally. Ouch! That’s gotta sting! 🥴

Decoupling dampens momentum

Ethereum’s divergence from Bitcoin is eroding market confidence faster than a sandcastle at high tide. Without the tailwind of synchronized BTC rallies, Ethereum’s ecosystem is struggling to sustain growth. 🌊🏰

Retail participation appears to be thinning, and leading L2s like Optimism, Arbitrum, and Polygon have failed to gain traction in 2025. Forecasting models that once hinged on Bitcoin’s directionality are losing their predictive power, like a broken compass. 🧭❌

Ethereum may be evolving into a more autonomous asset driven by internal fundamentals, but that independence risks isolating it during bull cycles. It’s a double-edged sword, my friends! ⚔️

For now, the decoupling seems to be more just wind than evolution. Hold onto your hats, folks! 🎩💨

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Corporate Giants Dive into Bitcoin with $458 Million Bet: Is This the End of Fiat?

- Ether’s Wild Ride: Will It Hit $3K or Just Keep Teasing Us? 🤔💸

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Dogecoin’s Journey to $5: The Hilarious Truth Behind the Hype! 🚀💰

- Bitcoin to Moon? Tom Lee’s Wild Predictions and a Universe of Imbalance 🚀

2025-05-25 15:07