Bitcoin’s All-Time High Lasted About as Long as My Last Diet: A Cautionary Tale

BTC Dips Below $109K as Trump’s 50% EU Tariff Sparks Market Jitters

Friday morning, the “Trump effect” arrived like an uninvited relative at Thanksgiving—loud, disruptive, and with a penchant for tariffs. President Donald Trump announced a 50% tariff on all things European, presumably including berets, bidets, and those tiny spoons you get with gelato. The result? Both traditional and crypto markets did their best impression of me after three glasses of wine: they tumbled.

Coinmarketcap reported a 1.63% drop in crypto market capitalization, now at $3.45 trillion. Stocks joined the pity party, with the S&P 500, Nasdaq, and Dow all losing just enough to make you wish you’d invested in Beanie Babies instead.

The new tariffs are set to hit June 1, so mark your calendars—or just write “panic” in big letters. Trump also threatened a 25% import tax on Apple iPhones not made in the U.S., causing Apple stock to fall 2.53%. Somewhere, a tech bro is clutching his AirPods and whispering, “Not like this.”

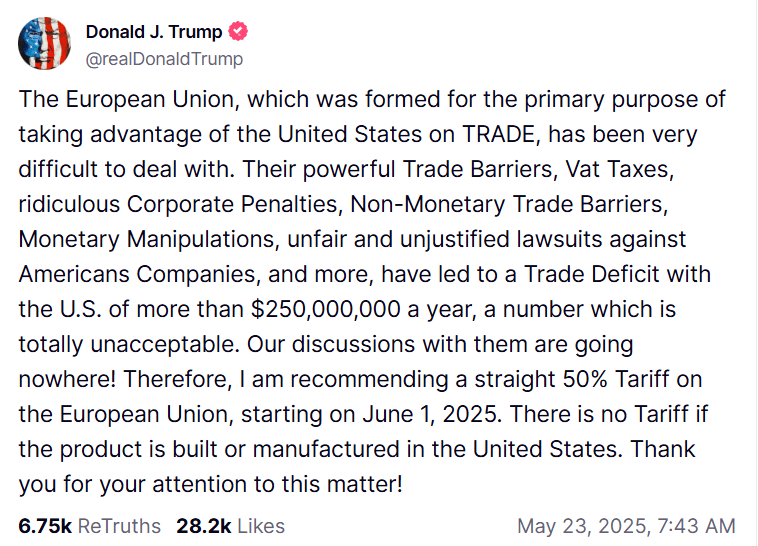

Trump, never one to understate things, wrote on Truth Social that the EU was “formed for the primary purpose of taking advantage of the United States on trade.” He then recommended a straight 50% tariff on the EU, starting June 1, 2025. I’m sure Brussels is trembling—or at least rolling its eyes.

Market Metrics: Or, How I Learned to Stop Worrying and Love Volatility

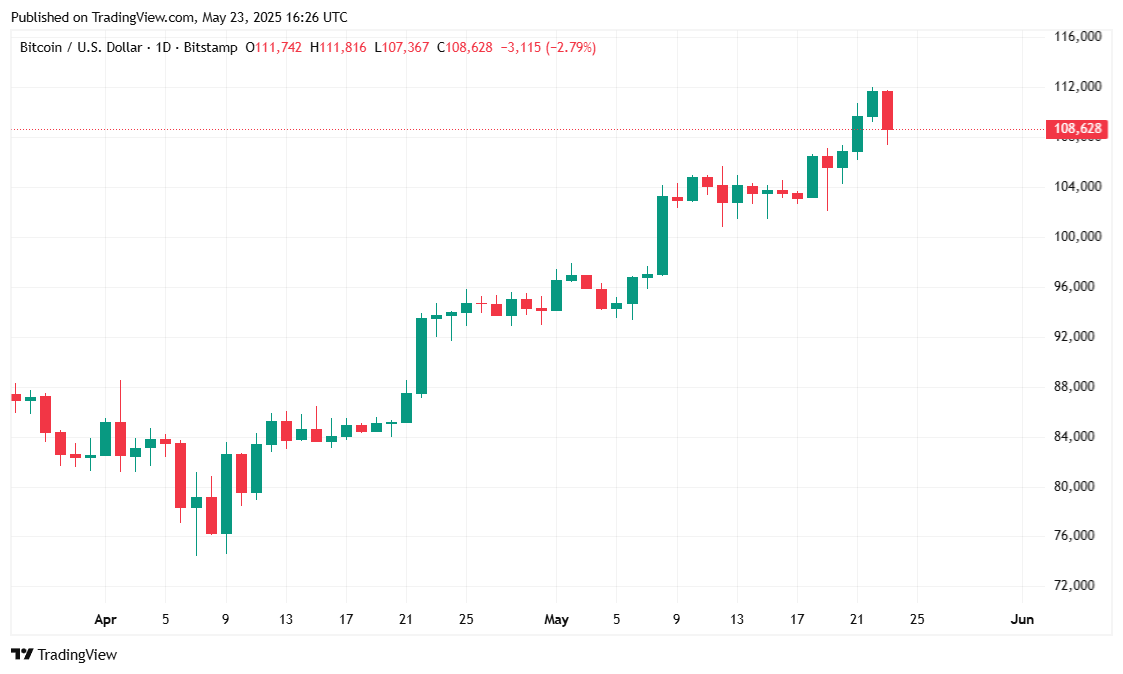

Despite Trump’s latest episode and bitcoin’s subsequent retreat, the cryptocurrency is still lounging around $108,574.13—close to its previous all-time highs and far above my checking account balance. That’s a 2.64% dip for the day but up 4.35% over the week. In the last 24 hours, BTC swung between $107,385.27 and its new all-time high of $111,970.17. If bitcoin were a person, it would need Dramamine.

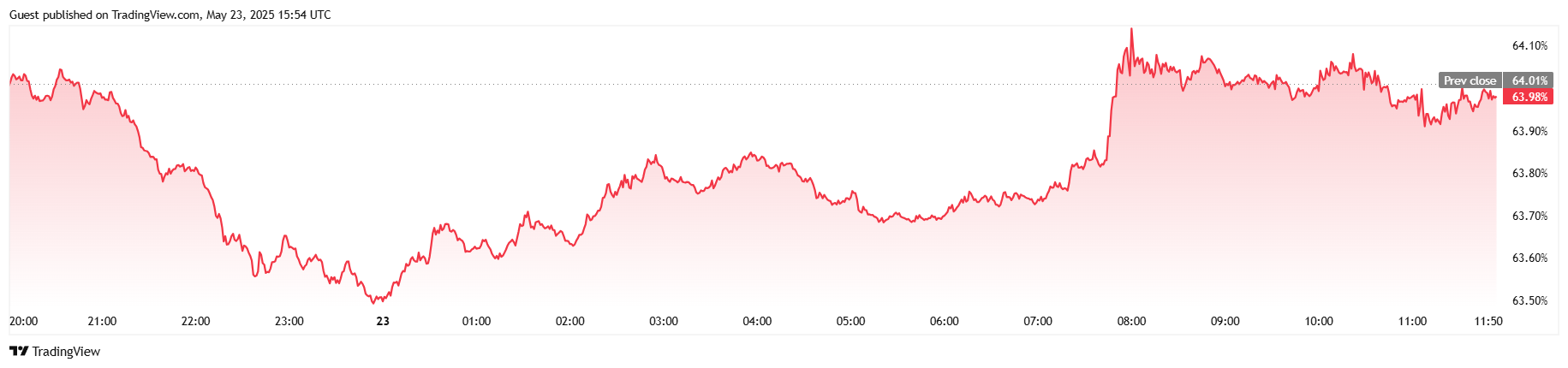

Trading activity cooled off faster than my enthusiasm for New Year’s resolutions, with volume dropping to $65.68 billion—a 25.83% decline. Bitcoin’s market cap slipped 1.87% to $2.17 trillion, while BTC dominance edged down by 0.05% to 63.98%. Maybe investors are finally realizing there are other coins in the sea—or maybe they just like shiny new things.

Meanwhile, in derivatives land (where dreams go to die), BTC futures open interest dropped by 3.12% to $78.04 billion. Liquidation data from Coinglass shows bulls took most of the pain—$3.72 million in total liquidations, with $3.28 million in long positions wiped out. Shorts lost just $440,650, which is basically lunch money in crypto terms. The lesson? Don’t overleverage when the president can move markets with a single post—and maybe keep your savings in something less volatile, like antique porcelain cats or canned beans. 🐱🥫💸

Would you like me to explain or break down any part of this code?

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Crypto Riches or Fool’s Gold? 🤑

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Whale of a Time! BTC Bags Billions!

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

2025-05-23 20:07