- XRP Futures ETF bursts onto the scene with a dazzling $6M in first-day trading volume! 💰

- Spot XRP ETF approval is gaining steam, despite the SEC’s best efforts to play the villain. 🎭

Ah, Ripple [XRP], the phoenix rising from the ashes of regulatory chaos! After four long years of bureaucratic shenanigans, it seems the winds of institutional interest are finally blowing in its favor. Who would have thought? 🤔

On the fateful day of May 19th, the CME Group unleashed its XRP Futures ETF upon the unsuspecting market, and lo and behold, it recorded a jaw-dropping daily trading volume of nearly $6 million on its debut! Talk about making an entrance! 🎉

Are CME’s XRP ETFs the new rockstars, outshining ETH ETFs?

Indeed, the newly minted XRP ETFs have swiftly outperformed their Ethereum [ETH] counterparts, sending ripples of excitement through the institutional crowd. It’s like watching a tortoise outpace a hare—who knew? 🐢💨

If this momentum keeps up, XRP might just throw its hat into the ring against Bitcoin [BTC] Futures ETFs. But let’s not get ahead of ourselves; BTC ETFs are like the heavyweight champions, raking in trading volumes that make XRP’s look like pocket change. 💸

Nevertheless, the early triumph of XRP products is bolstering the case for future spot ETF approvals. Fingers crossed! 🤞

Riding this institutional wave, XRP has experienced a price rally that would make even the most stoic investor crack a smile. It jumped 1.33% to $2.33, with Open Interest soaring to a staggering $4.69 billion—at least someone is having a good day! 📈

Day one of trading — The juicy details

The CME Group’s data reveals that XRP Futures had a debut that would make a Broadway star envious. On launch day, four standard contracts exchanged hands, each representing a whopping 50,000 XRP. This translated to about $480,000 in notional volume at an average price of $2.40. Not too shabby! 🎭

Most of the action came from 106 micro contracts, each covering 2,500 XRP. Together, they contributed over $1 million in additional volume. It seems the big players are strutting into the market, while the smaller institutions are eager to join the dance. 💃

Despite the SEC’s attempts to delay its ruling on multiple crypto ETFs, including those tied to XRP and Solana [SOL], the momentum surrounding XRP investment vehicles continues to swell like a well-fed cat. 🐱

ETF Store President weighs in on the spot XRP ETF

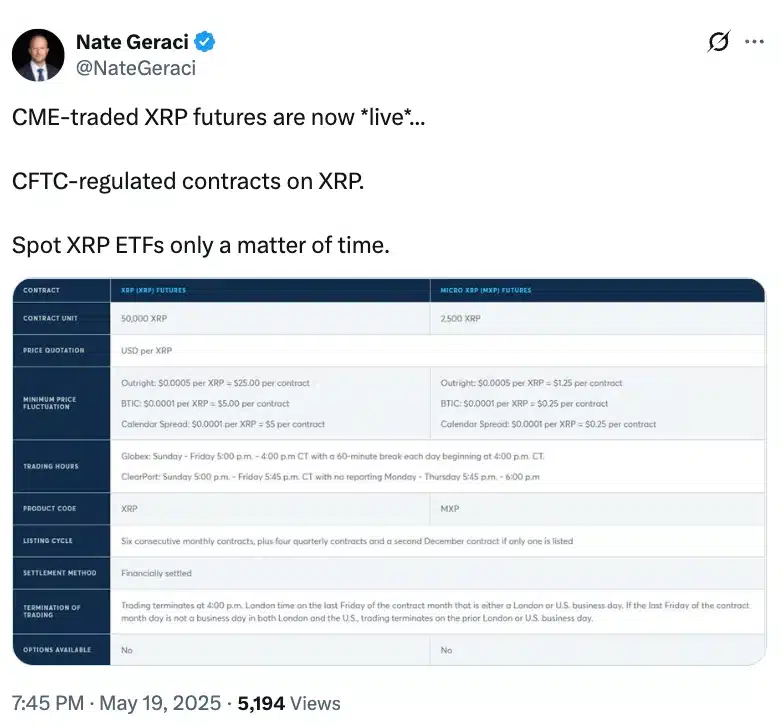

In a moment of clarity, the president of the ETF Store, Nate Geraci, recently proclaimed on X (formerly Twitter) that spot XRP ETFs are as inevitable as Monday following Sunday. Who could argue with such wisdom? 🧐

This underscores the importance of CME’s live, CFTC-regulated XRP Futures contracts. They’re like the sturdy lifeboats in this turbulent sea of finance! 🚢

In fact, sentiment on the decentralized prediction platform Polymarket remains as optimistic as a child on Christmas morning, with an 83% probability priced in for eventual approval. 🎄

However, with Franklin Templeton’s application now pushed to the 17th of June, the coming weeks may prove to be the dramatic climax in this ongoing saga of institutional access to XRP. Stay tuned! 📅

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- USD THB PREDICTION

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

- ZEC Surges 17%-Is $750 Just Around the Corner? 🚀💰

- Silver Rate Forecast

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

2025-05-21 02:22