Ah, the eternal dance of Bitcoin — reminiscent of that flamboyant uncle who swears he’s finally settled down but secretly plans another raucous night. Today’s market vibes echo the wild ride up to nearly $73,000 in 2024 — could it be déjà vu, or simply Market’s Madcap Mambo? Buckle up, dearest readers, it’s a tale as old as blockchain.

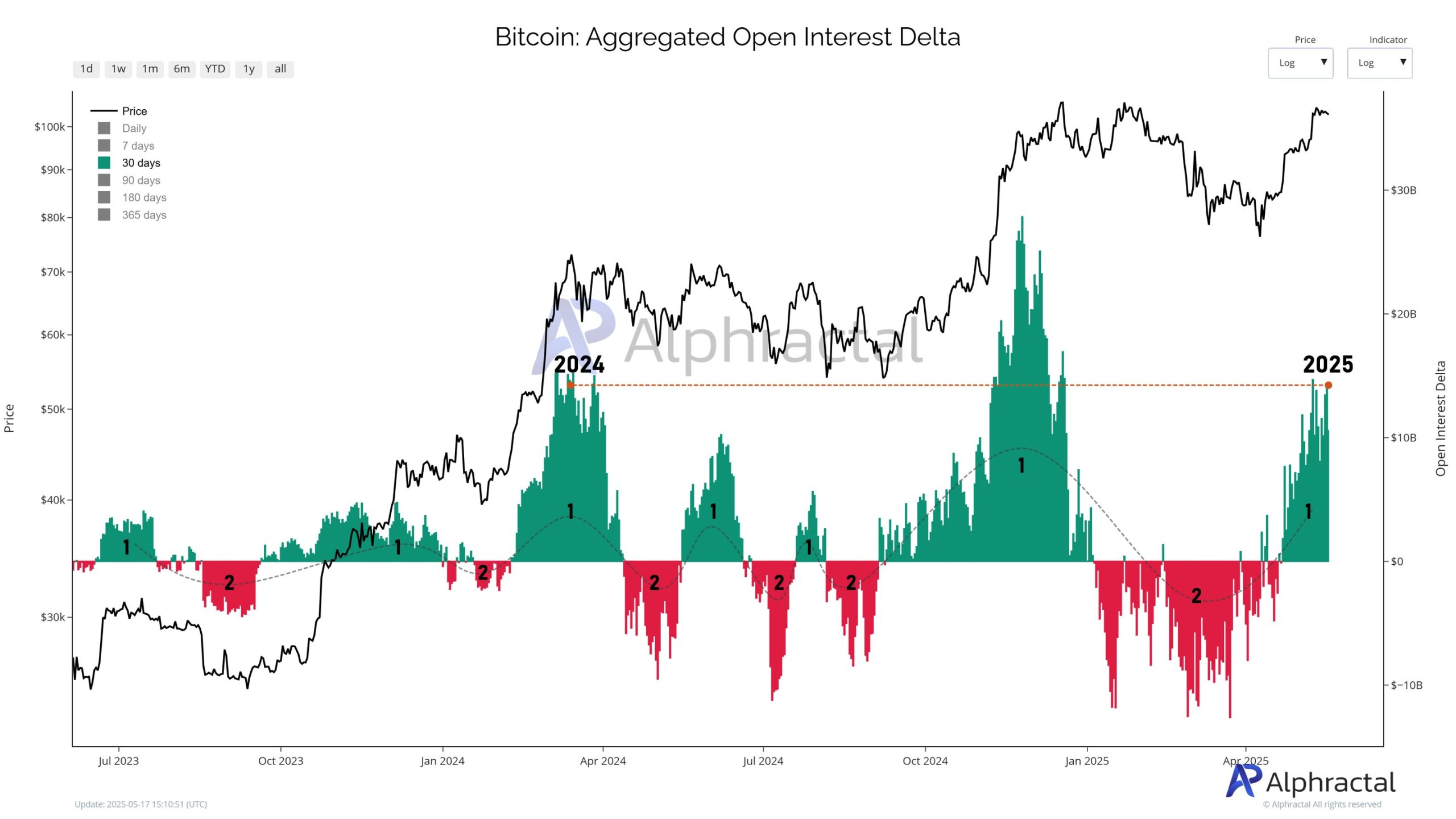

A Familiar Pattern in the Open Interest Delta

Lo and behold, the 30-day aggregated Open Interest Delta has giddily reached the same dizzy heights as during past explosive breakouts. Think of it as Bitcoin’s mood ring, revealing the net difference between bullish long lovers and bearish short skeptics. When charted, it shows a charming two-step waltz:

- Phase 1: A meteoric rise—like a show-off at a party—heralding serious accumulation.

- Phase 2: A graceful decline, typically due to traders liquidating or their profits evaporating faster than a cucumber sandwich at a garden party.

This cyclical mambo suggests a rhythm of hype-building and crashing down — largely orchestrated by the institutional tightrope walkers who love to keep us guessing.

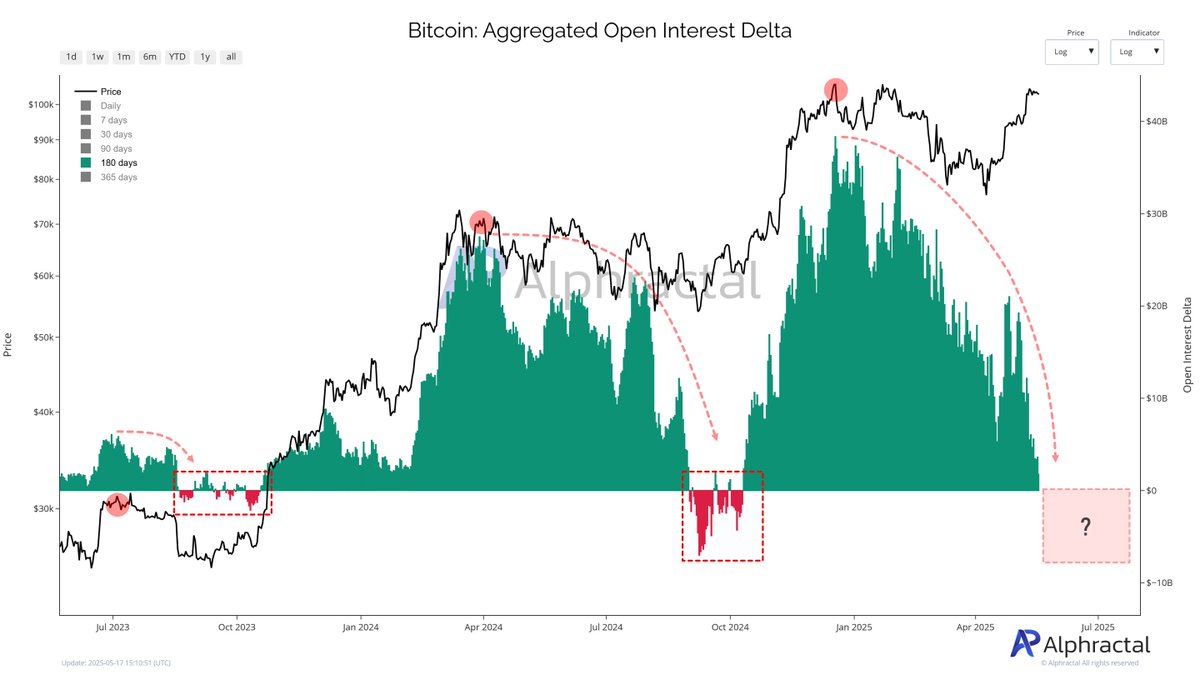

The 180-Day Delta: A Closer Look Under the Bed?

Longer-term, the 180-day Open Interest Delta offers a rather more compelling soap opera:

- Bruises and scars often line the charts when this metric plummets — generally indicating overzealous longs getting laid low by liquidations.

- When the Delta sinks into negative territory, it signals a potential market bottom or a strategic quiet before the storm, much like an overstressed tea kettle just about to whistle.

Currently, the 180-day Delta teeters ominously on the edge of negativity — hinting at possible chaos or, at the very least, another dainty period of consolidation. The suspense is unbearable!

Whale Watching: The Fractal Fish in the Ocean

It appears that in 2025, the open interest growth isn’t quite living up to the fireworks of 2023–2024. Yet, intriguingly, the cycles seem to recur every October — like clockwork, or perhaps a whale’s annual habit of bursting into the open like a flamboyant diva. A fractal pattern, or just a coincidence? You decide, dear reader.

Final Word: The Crystal Ball of Crypto

“Monitoring Open Interest on major exchanges is the surest way to gauge whether the whales are feeling frisky or simply sunbathing,” muses the wise Alphractal, probably while sipping a martini. 🍸

With all signs pointing to either a breakout spectacle or a prolonged siesta, one thing’s certain: Open Interest remains the most reliable gossip for predicting Bitcoin’s next shenanigans. Stay tuned, stay sarcastic, and remember — in crypto, nothing is certain but the fun.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Brent Oil Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Silver Rate Forecast

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- USD GEL PREDICTION

2025-05-18 01:02