As a researcher, I found myself intrigued yesterday evening upon discovering that World Liberty Financial (WLFI) had invested $3 million in EOS tokens. This unexpected move sparked a wave of curiosity and speculation within the community. Interestingly, the price of EOS has since increased by approximately 9%, suggesting a positive impact from this acquisition.

Some have drawn parallels between the current event and World Liberty’s alleged ETH sale, which occurred when the price hit its lowest point over a three-month span. However, despite today’s transaction appearing peculiar, no proof of wrongdoing or insider trading has been presented as of yet.

Why Did WLFI Buy So Much EOS?

The Trump family is associated with numerous cryptocurrency ventures, but it’s the World Liberty Financial that has sparked significant political debate and controversy.

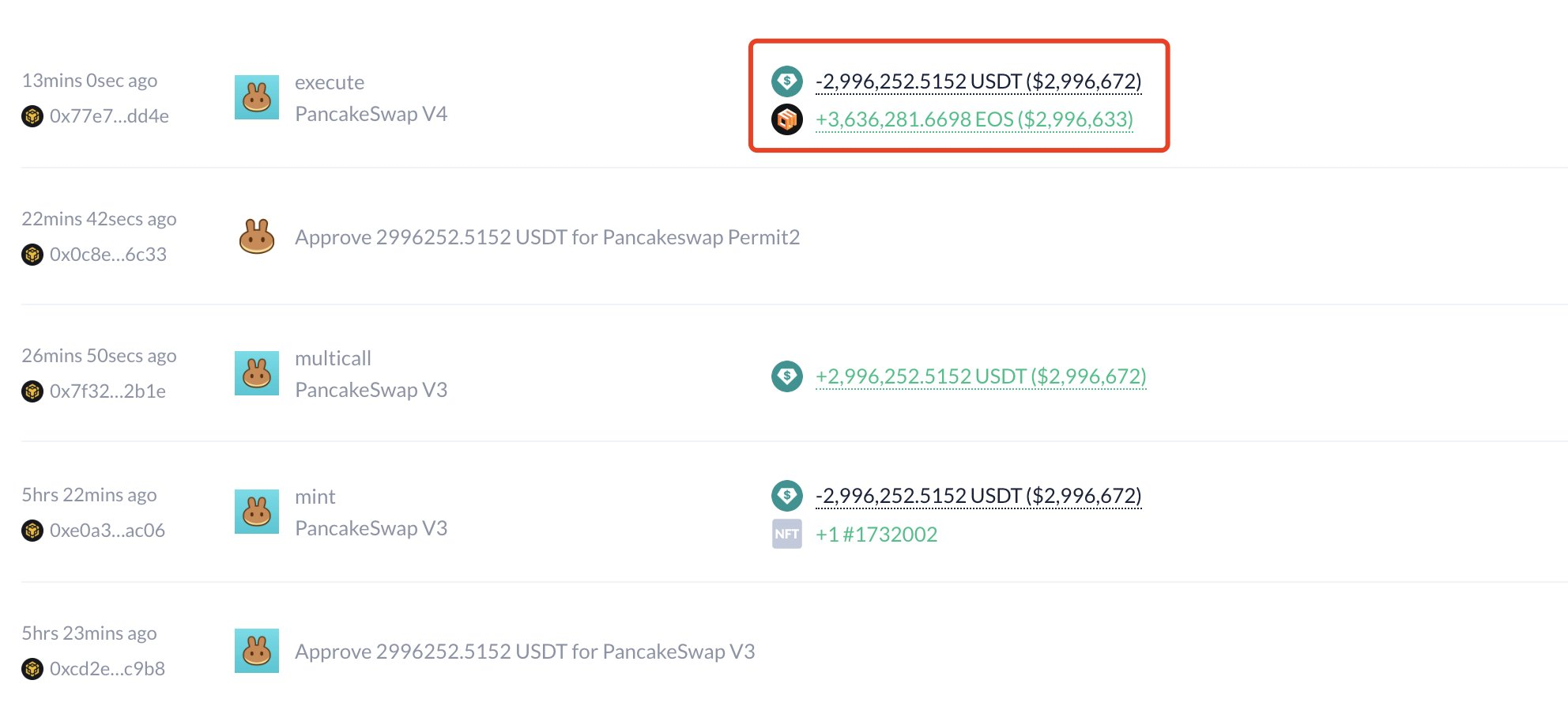

As an analyst, I’ve been tracking our firm’s investment portfolio, and it appears we made significant investments in various tokens. Regrettably, we encountered over $100 million in unrealized losses in March. However, a closer look at our transactions revealed an intriguing event: Lookonchain spotted WLFI’s substantial EOS acquisition, which ignited a small stir within the crypto community.

Initially, the community showed strong doubt and some even accused the project of being manipulated. However, it’s important to note that there are signs of life yet. For instance, EOS, a digital banking platform within the Web3 network, has recently reached a peak following its rebranding in March.

It’s quite unexpected that WLFI would invest heavily in EOS given its peak performance years appear to be long gone. Notably, the token’s value was supported by a stable floor price between $2 and $4 throughout 2020 and 2021, excluding major surges. In stark contrast, it has spent most of the last year trading below half a dollar.

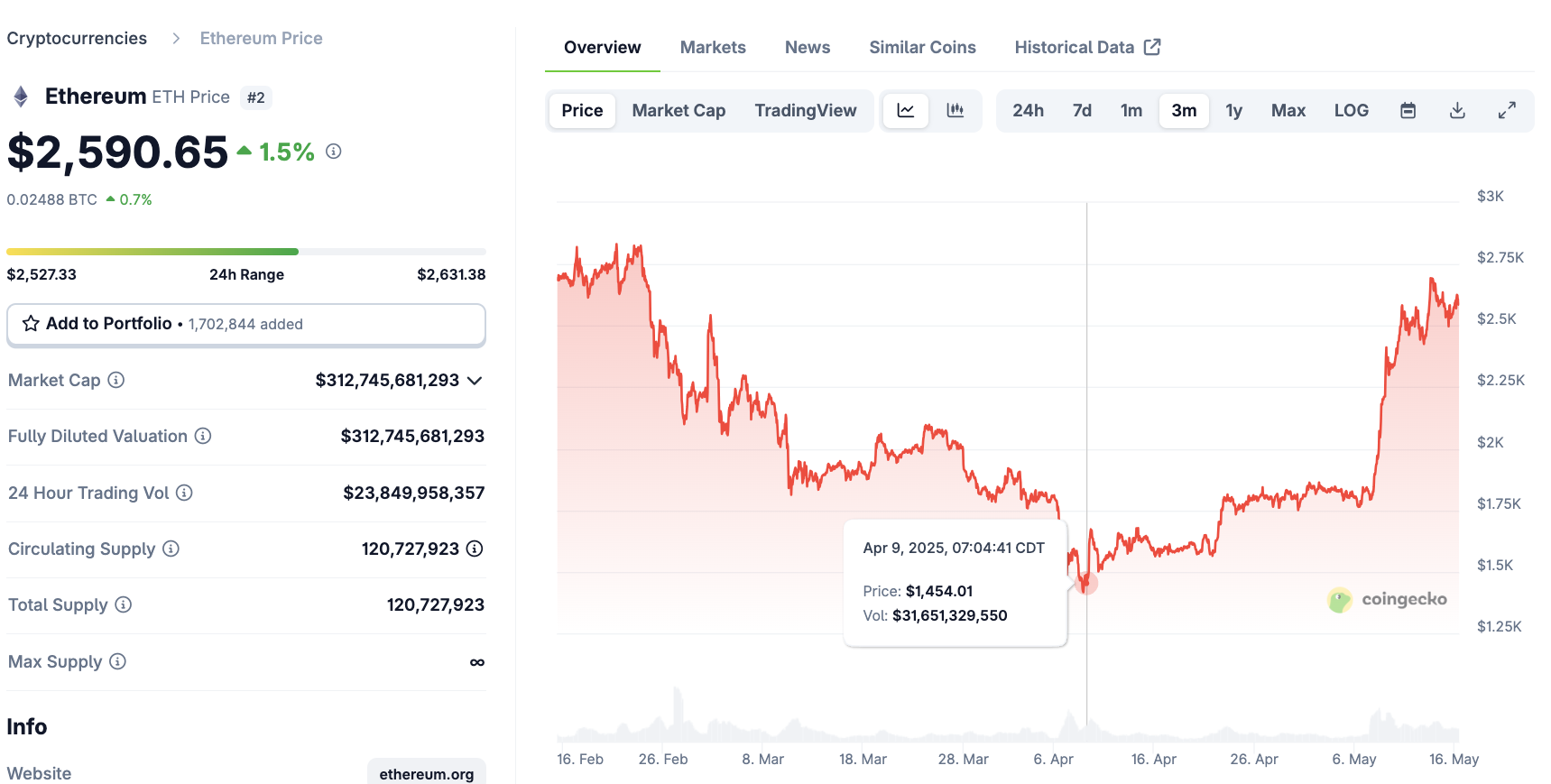

Some analysts have linked World Liberty Financial Investment’s EOS investments to a recent issue involving Ethereum. In the beginning of this year, World Liberty purchased substantial amounts of Ethereum tokens for approximately $3,259 each.

A few months ago, the records on the blockchain indicated that it sold off a significant portion of its holdings when the price was around $1,465, resulting in a loss exceeding $125 million.

Regarding the allegation, WLFI firmly rejected the claim that they sold ETH. Interestingly enough, Ethereum saw an uptick shortly following this incident, and the supposed transactions transpired right at the lowest point in its price over the past three months.

After World Liberty Financial Inc.’s acquisition, the EOS stock saw a surge of over 9%. However, it’s unclear what precisely is happening in this situation. Although World Liberty Financial’s business activities often stir up controversy, as of now, there’s no definitive proof of any wrongdoing.

The community will surely keep an eye on this story for further developments.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Whale of a Time! BTC Bags Billions!

2025-05-16 20:26