Behold! Animoca Brands, that Hong Kong titan of all things Web3, whose value once soared like Icarus to the giddy heights of nearly $6 billion, now prepares to dash upon the New York stage, eager for the applause of Wall Street’s finicky audience.

The whispers in the wings suggest their dreams of Hong Kong or Middle Eastern listings have been sent packing—perhaps to the land of lost socks and broken SPACs.

Animoca Brands—Curtain Rises in New York! 🎭

In that most illustrious theatre, The Financial Times, Monsieur Yat Siu (co-founder and executive chair, with the gravitas of three powdered wigs no less) disclosed that Animoca, impatient as a suitor on Valentine’s, is racing toward a US IPO. “Soon!” he whispered—one can almost hear the orchestra tuning up.

His muse? The Trump administration’s love affair with digital assets! A “unique moment,” he swooned, to enter the grandest bazaar of capital on earth.

The Master Siu further confided that many clever stratagems for shareholding are afoot and, like a true thespian, insisted this grand performance cares not for mere market fickleness.

“Had the land of Uncle Sam not remonstrated with its regulators under the reign of Biden, we’d be dueling with some immense crypto monster. It’s the biggest marketplace—ought we not tread those boards? Carpe diem, I say! Wasting this would be a tragedy unfit even for Euripides!” poured forth Monsieur Siu to the scribes of The Financial Times.

A strategic volte-face, you say? Indeed! Animoca had been casting longing glances at stages in both Hong Kong and the Middle East for a debut by 2025. Now? America is the belle of the crypto ball.

To shun the Middle East—where crypto is embraced with the ardor of Parisian lovers—only for fairer prospects in the US? Quel dommage! But so spins Fortune’s wheel. Besides, Trump’s America is rolling out the crypto red carpet. (If only Congress had NFTs of those carpets!)

With Trump’s triumphant overture, crypto actors like Deribit—a colossus in the world of options—bolt across the pond. Gemini and Kraken prepare for their own IPO soirees, while Cathie Wood’s Ark Invest smugly saw this in her crystal ball.

A Spotty Past, Now with Extra Drama!

Animoca’s pas de deux with public markets has been, let’s say, spicy. Back in 2020, the staid Australian Stock Exchange booted them offstage, citing a script replete with governance woes and murky crypto holdings—drame, scandale!

Undeterred, Animoca donned a new mask, becoming a Web3 Medici with holdings in 540+ ventures: OpenSea’s NFT regatta, ConsenSys’s cryptographic cabaret, Kraken’s exchange—all starring roles. Now, Master Siu insists, a public listing is more about narrative than purse strings.

“We fancy ourselves the biggest non-bank in the crypto menagerie. Going public? Why, it’s to show there exists a crypto firm that isn’t simply mining digital tulips!” he declared, perhaps while flourishing a lace handkerchief.

Their accounts sing a cheerful tune: $97 million in EBITDA (unaudited, of course!) and $314 million revenue for 2024—the kind of leap that would make even Puck jealous. Last year? Only $34 million EBITDA. Oh là là, what a difference a year of blockchain mania makes!

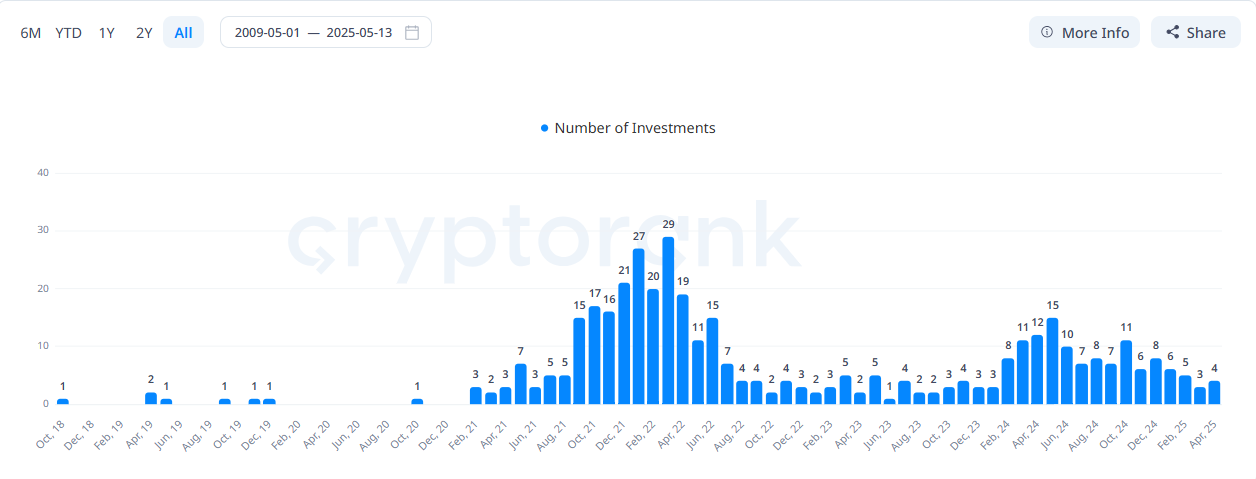

Animoca is sitting atop a dragon’s hoard: nearly $300 million in cash and stablecoins, $538 million in digital treasures. And according to the bards at Cryptorank.io, the company is investing in over 400 crypto tales—with returns fit for the king’s purse: a 1.93X average ROI. Not quite Midas, but respectable!

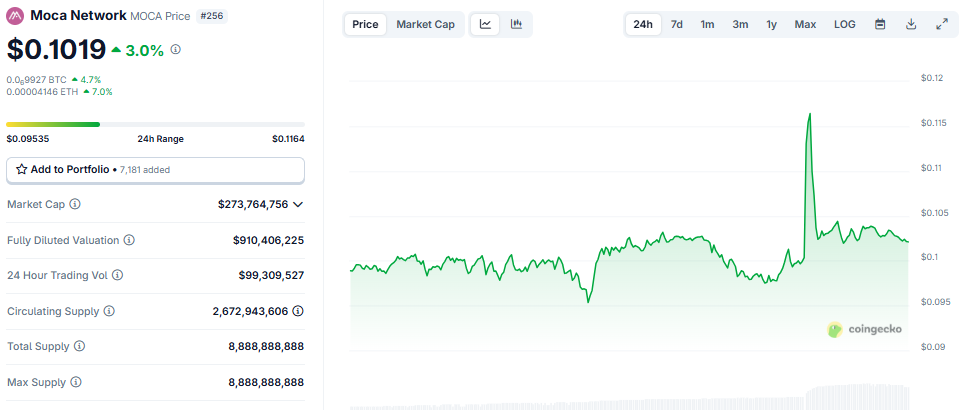

Recently, Animoca flung the spotlight upon Moca Coin, a new token and darling of the burgeoning Mocaverse, sending metaverse minstrels into a frenzy. 🎮✨

Should their IPO succeed, expect nothing less than a seismic shift—regulators and crypto jugglers alike scampering for position, as if chairs had just been yanked from under them by regulatory jesters.

As the curtain falls, MOCA token pirouettes up 3% (modest, but in theatre we clap for all acts), trading at a brisk $0.1019. So ends this tableau—for now. Stay tuned, for in this comedy of crypto errors, tomorrow’s script is never certain!

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Whale of a Time! BTC Bags Billions!

- Silver Rate Forecast

- Crypto Riches or Fool’s Gold? 🤑

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

2025-05-13 13:40