Right, so apparently Bitcoin has decided to go full Bridget Jones’s knickers and become vintage, darling. At least, that’s what CryptoQuant’s CEO (who probably has a much tidier spreadsheet than my sock drawer) insists. According to him, Michael Saylor and his merry band of MSTRs have been hoarding Bitcoin like exes collect emotional baggage—rapidly and with zero plans of letting go.😳

He took to X (which, yes, is what we’re calling Twitter now, and no, I’m not OK with it), informing his 422,200 loyal followers—roughly the population of a mid-size city or the number of bras I’ve lost to the laundry abyss—that Saylor’s squad is scarfing up BTC much faster than miners can spit it out. Move over miners, you’ve been replaced by a corporate Pac-Man.🪙👾

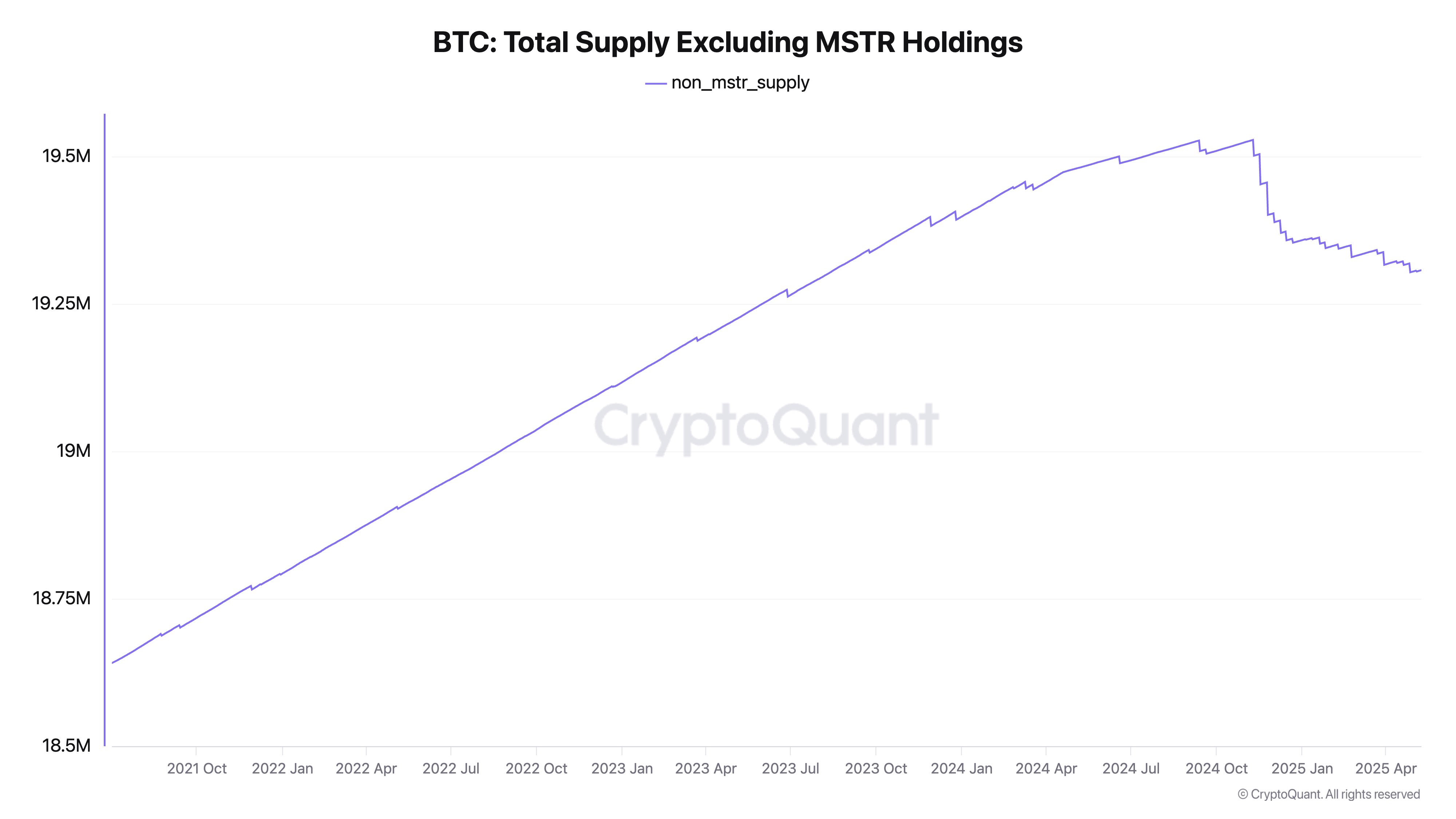

And, according to CryptoQuant’s data—presumably run through whatever magical Excel wizardry is trendy in crypto these days—if you take out the coins gobbled by Saylor’s MSTR, the actual supply of Bitcoin for the rest of us has been swirling down the drain since late last year. Just brilliant.

“Bitcoin is deflationary.

Strategy is buying BTC faster than it’s mined. Their 555,000 BTC is illiquid with no plans to sell. MSTR’s holdings alone mean a -2.23% annual deflation rate – likely higher with other stable institutional holders.”

According to a website called BitcoinTreasuries.net—because of course there’s a website for that—Strategy is now sitting on 555,450 BTC, roughly $58 billion. (Imagine all the shoes.) This is about 2.645% of all Bitcoin in existence, which, for the record, is more than I ever managed on my maths GCSE.

More plot twists than an Austen subplot: Ju—the CEO in question—recently U-turned faster than me dodging an awkward office party, saying the Bitcoin bull market isn’t over after all. Turns out there are now so many whales, ETFs, and assorted moneyed creatures splashing about, even the forecasters have gone cross-eyed.

With a straight digital face, he explained that these days, actual pressure to sell Bitcoin has calmed down, thanks to “massive inflows” from spot ETFs. (I’ll have what they’re having.)

“In the past, the Bitcoin market was pretty simple. The main players were old whales, miners, and new retail investors, basically passing the bag to each other. When retail liquidity dried up and old whales started cashing out, it was relatively easy to predict the cycle peak. It was like a game of musical chairs – everyone tried to cash out at once, and those who didn’t ended up stuck with their holdings.

But now, the Bitcoin market has become much more diverse. ETFs, MicroStrategy (MSTR), institutional investors, and even government agencies are considering buying and selling Bitcoin. In the past, profit-taking cycles were triggered when whales cashed out at the peak, leading to a chain reaction of sell-offs and a price drop.”

Latest price check: Bitcoin is sitting pretty at $114,112. If only my swipe-right matches held value the way BTC does. Honestly, where’s my fortune?

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Gold Rate Forecast

- Binance’s CZ Predicts Bitcoin Will Go So High Even Molière Would Write a Satire

- What the Heck? Cardano Predicts $500K Bitcoin & XRP Jumpstart! 🚀🤔

- Bitcoin’s Last Stand: The Wild Ride Before the Big Move! 🚀💥

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- MSCI’s Exclusion Plan Sparks Crypto Chaos! 🚨📉

2025-05-12 12:31