Somewhere between the mystical forests of market optimism and the shadowy steppes of caution, the humble retail investor has vanished again. So says the learned scribes at CryptoQuant, tallying their blockchain grains of sand. Oh, how the mighty crypto peasants—those souls exchanging between $0 and $10,000—now stand at the sidelines, wringing their hands, while Bitcoin ascends toward a price even Pierre Bezukhov would consider fit for inheriting.

What the Chart Whispers, Like a Discontented Cousin

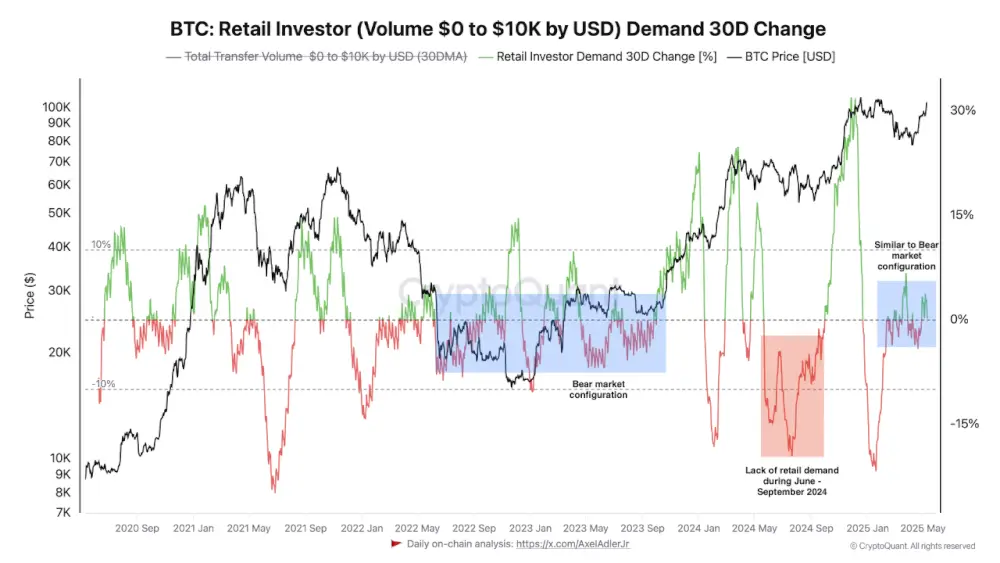

Upon the bartered scroll (that is, a chart), one beholds the trembling trajectory of BTC’s price, now soaring over $103K, like a roulette wheel in a Moscow ball. Yet, retail demand—those green and red bars—remains as still as Levin in contemplation. Eyebrows arch higher than Bitcoin itself; where is the old peasant crowd, shoveling in their savings? Have they traded their memes for Dostoyevsky novels?

- Between the summers of June and September, the retail crowd was as present as a czar in a peasant’s hut. Bargains beckoned, yet hands remained stuffed in pockets—perhaps seeking breadcrumbs, not Bitcoin.

- Now, retail growth is listless, as if cursed by the ghosts of the 2022–23 bear market. Memories of old wounds linger; the herd hesitates, fearing a wolf hidden among lambs.

- Traditionally, retail arrives après le bal—late to the party, having heard distant laughter and finally deciding it’s worth a peek. By then, the wine is gone and only the bill remains 💸.

Analysts Call This “Lagging Behavior”—We Call It a Long Nap 😴

CryptoQuant, peering down their pince-nez, asserts that present retail caution is but an echo of bear markets past. Despite bullish winds and stronger fundamentals (whatever those are this week), the people’s courage hides beneath winter blankets. Who can blame them? When last they ran to the market’s embrace, many returned scorched, if not bald.

“The current setup resembles what we observed during the previous bear market, with a sort of lagging behavior that reflects confusion and a lack of confidence among retail investors,” bemoans CryptoQuant. Or perhaps retail simply heard dinner was ready and left the casino.

The Onions of the Market (And What This Means)

While titanic institutions scoop up Bitcoin, the retail crowd watches from the window, torn between FOMO and remembering grandmama’s warnings. This curious silence could mean:

- Bitcoin still has room for wild adventures. The peasants march in only after the parade has clogged the streets.

- The current rally is piloted by “smart money,” not by the karaoke enthusiasts of the investing world.

- Once the retail masses hear of “easy riches” and dust off their apps, the party might kick into overdrive—or collapse beneath the weight of its own exuberance. 🥳🚨

And so Bitcoin rides toward new peaks, leaving its noisiest admirers behind, for now. Is this the hush of financial maturity, or merely the eye of a coming storm? Only the next chapter, probably written in all caps on Twitter, shall reveal the truth.

Read More

- Gold Rate Forecast

- USD HUF PREDICTION

- Mysterious Moves: Crypto Titans’ Bold Bet or Folly? 🤔

- Bitcoin’s Price Madness: A Comedy of Bulls and Bears 🎭💰

- Crypto Chaos: Will the White House’s New Report Save the Day? 🤔💰

- Steinbeck’s Take on Upexi’s Solana Gold Rush 🏭💰

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- PLUME: 60% Down?! 😱

- Traders Rush Back to XRP: The Silent Storm Brewing in the Crypto World! 😱🚀

2025-05-10 22:16