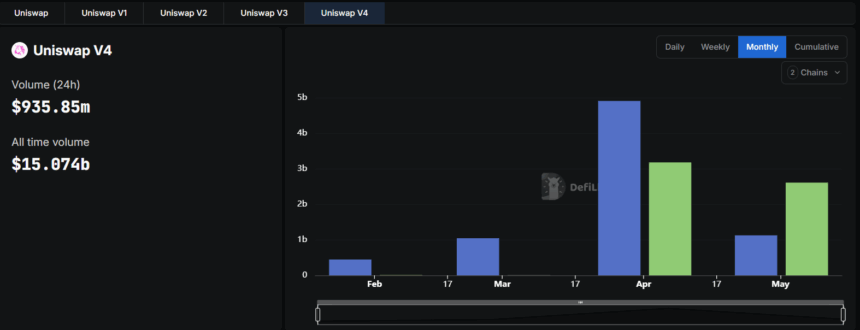

My dear reader, the world of decentralized finance (DeFi) has been turned on its head. The humble Unichain, a mere upstart Layer-2 from Uniswap, has gallantly surpassed the mighty Ethereum in Uniswap v4 transaction volume. Indeed, one would not have predicted such a meteoric rise when Unichain debuted its mainnet just in February 2025. But, as ever, the world spins unpredictably, much like a dance at a ball. 💃

As of May 2025, Unichain now commands an astonishing 75% of Uniswap v4’s market share, whilst poor Ethereum, once the indisputable leader, has fallen below 20%. How the mighty have fallen! 😲 According to DeFillama, this shift is quite the spectacle indeed.

What has driven Unichain’s meteoric ascension, you may ask? Well, it appears that Unichain’s infrastructure is optimized for speed and low cost, boasting one-second block times and gas fees that are a mere fraction—up to 95% lower—than those of Ethereum’s Layer-1. Quite a bargain for the common trader, if I do say so myself! These marvellous features, coupled with an incentive campaign in April that was as generous as it was strategic, have led liquidity providers and traders alike to flock to Unichain, pushing its total value locked (TVL) to a princely sum of over $250 million. 🏦

And then, dear reader, there is the trading volume. Since May 1, Unichain has racked up $2.613 billion in trading volume, a rise of 56% from Ethereum’s own $1.128 billion. A surge that would leave even the most seasoned financier astonished. But let us not be too surprised—after all, who could have predicted such a swift ascent? 🚀

Such is Unichain’s allure for those DeFi enthusiasts who crave speed and lower transaction fees. With Uniswap v4, complete with customizable hooks and improved liquidity pools, now running natively on Unichain, its efficiency is amplified to no small degree. As for Ethereum, though it still reigns supreme for Uniswap v3, this transition hints at a new era—one in which Unichain may very well play a dominant role. The game is afoot! 🕵️♀️

What of Ethereum’s long-term prospects, you ask? Fear not, for it remains an immovable titan in DeFi, with a staggering $59.65 billion in TVL. But let us not forget—no empire lasts forever. 🌍

Read More

- Gold Rate Forecast

- XRP: The Calm Before the Storm?

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- Doge Doomed?! 😱🐳

- Traders Rush Back to XRP: The Silent Storm Brewing in the Crypto World! 😱🚀

- Silver Rate Forecast

2025-05-09 17:07