Professor BorisVest, a man with the piercing gaze of an accountant at tax season, glances over his thick-rimmed glasses at a dizzying array of charts. Ethereum, the notorious troublemaker of digital finance, finds itself at a soiree of uncertainty. On one side, panicked retail investors perspire profusely, frantically hurling their ETH onto Binance, like superstitious peasants throwing salt behind their backs (only far less useful). Meanwhile, on the other, silent barons and enigmatic “whales” slink about in the moonlight, quietly stuffing their pockets full of ETH, presumably in anticipation of the next financial apocalypse—or at least a bull run.

The Eternal Tug-of-War (Now With Extra Confusion)

Ethereum, nearing the majestic and wholly arbitrary $2,000 threshold, finds itself the object of both optimism and dread. While certain market jesters claim the wind is shifting, on-chain data has all the clarity of spilled borscht on a bank statement. BorisVest, with all the glee of a doomsday prophet balancing his ledgers, remarks on Binance’s ETH signals as “mixed.” Short-term stats shriek “doom!” while the longer-term ones whisper, “have faith, you coward.”

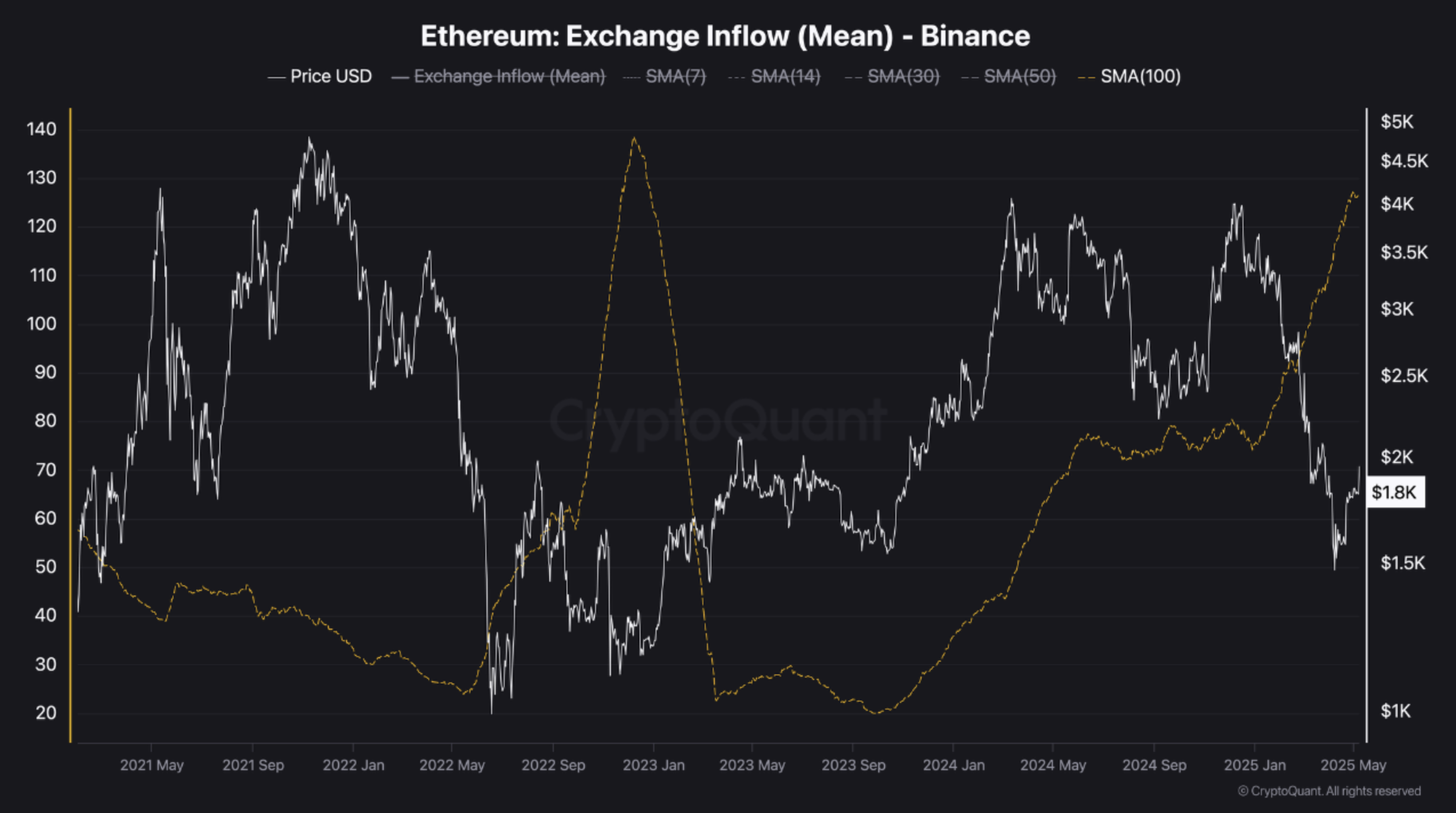

Since late 2024, mean inflows to exchanges have surged—picture retail traders stampeding toward a cliff, pockets bulging with ETH, much like in the memorable market carnage of 2022–2023 (an excellent time for toast and strong spirits).

Not to be left out, mean outflows have also risen since October 2023—though this is the domain of the great whales, those cryptic leviathans of the financial deep. While the masses shout “SELL!” the whales, never known for their punctuality or humility, quietly exclaim, “Buy the dip, and pass the vodka.” The result: a dance of dread and delight, or, as BorisVest puts it, a classic retail-panic-versus-whale-greed tableau.

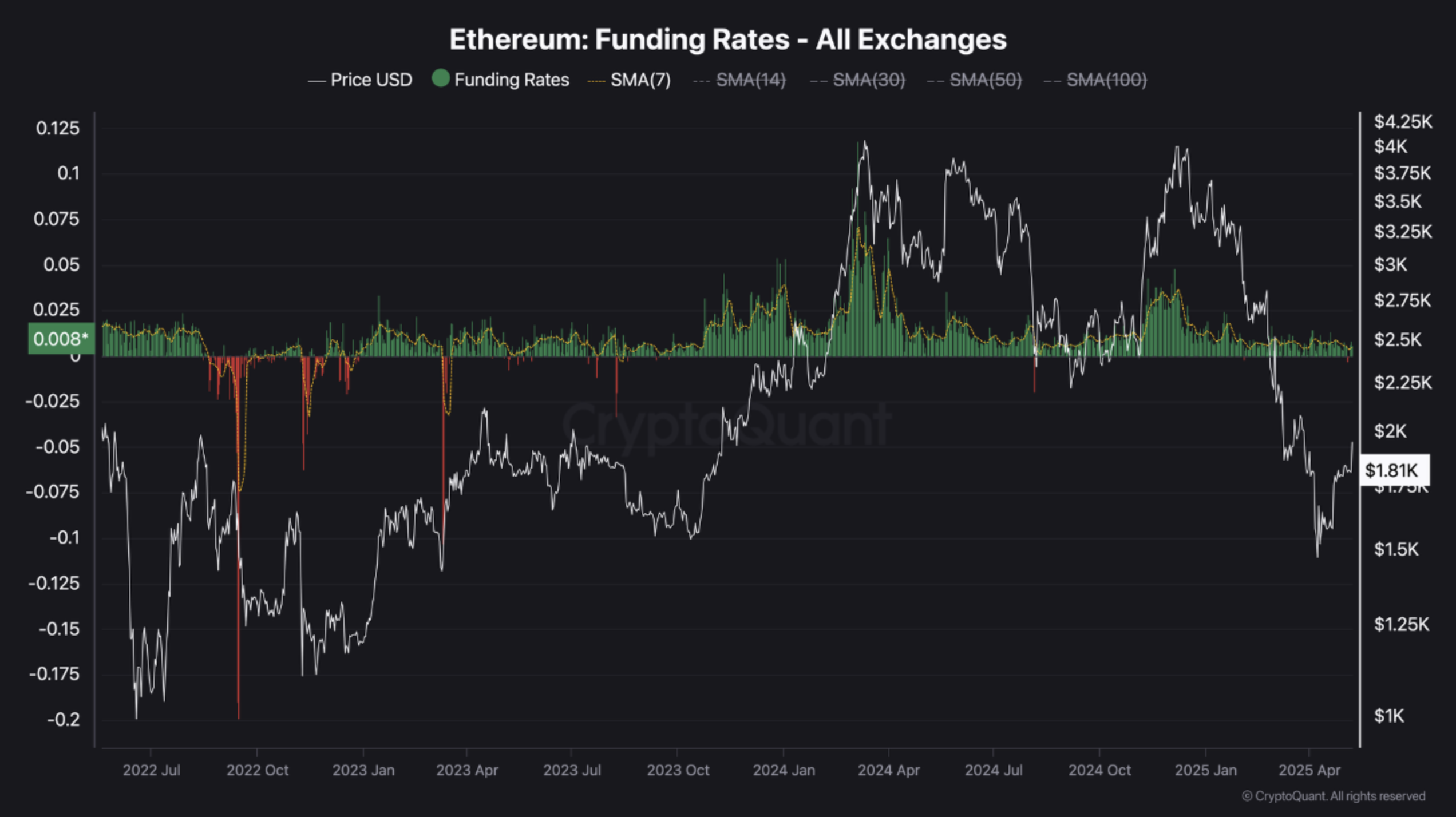

Let’s not forget funding rates, those curiously optimistic numbers that tend to swing from euphoria to despair faster than a Moscow weather forecast. During ETH’s jubilant climb to $4,000 in early 2025, funding became so positive even police dogs started sniffing for hidden assets. Result: a dramatic nosedive to $1,400 and a sobering lesson in leverage. Currently, all is eerily neutral—like a cat eyeing a room full of rocking chairs. If short interest rises, expect a glorious short squeeze; if not, expect more tea and cryptic tweets.

The taker buy/sell ratio, counted by diligent scribes and errant bots, saw epic selling pressure in late 2024 and early 2025 (everyone jumping ship before it even started sinking). But now the ratio steadies, as if sellers have sold their grandmothers and buyers are cautiously returning, peeking around doorframes.

The Wheel of Fortune Spins… Awkwardly

The facts: ETH is down a grand 34.3% in the past year—which, in crypto time, is basically the Renaissance, Plague, and Industrial Revolution all at once. Yet, sunbeams of hope peek through the technical clouds: golden crosses appear on charts (cue the Gregorian chanting), and rumors swirl that ETH has bottomed out for this infernal cycle.

Yet, what’s this? The ever-optimistic machine learning oracle from CoinCodex predicts another possible tumble, with ETH falling to a wallet-emptying $1,500. Meanwhile, the price sits at a devil-may-care $1,966, up a bouncing 7.8% in 24 hours—as if to taunt both prophets and gamblers alike.

So, Ethereum remains caught between the clumsy panic of retail hordes and the inscrutable cunning of whales. Will it soar? Will it sink? In this circus, only one thing is guaranteed: you’ll get another thrilling episode tomorrow… with extra charts and fewer answers. 🎪💸

Read More

- Gold Rate Forecast

- USD HUF PREDICTION

- Brent Oil Forecast

- Crypto Clash: Bitcoin, Ethereum, or Solana – Who’s the September Superstar? 🌟

- Crypto Chaos: Will the White House’s New Report Save the Day? 🤔💰

- Bitcoin’s Price Madness: A Comedy of Bulls and Bears 🎭💰

- Traders Rush Back to XRP: The Silent Storm Brewing in the Crypto World! 😱🚀

- When Will the Long Traders Finally Give Up? 🤔

- Ethereum’s Fee Fiasco: When Blockchains Play Hard to Get! 🤡

- Mysterious Moves: Crypto Titans’ Bold Bet or Folly? 🤔

2025-05-09 11:36