In the vast and unquiet realm of finance, men awaited with bated breath, often clutching their ledgers and their hopes, the promised dawn of the so-called “Pectra upgrade” upon which Ethereum, a digital estate rivaling any Tula nobility, was to embark. And lo, the software priests chanted, the scripts were set in motion—for all the solemnity, one might have mistaken it for a ritual anointing of a long-awaited czar. Yet, when the dust settled, the grand coronation seemed to have been met by a crowd of peasants who had far more pressing matters, like tending to potatoes. 🍠

May 7 arrived, heavy with anticipation; however, this anticipation was thinner than a serf’s broth in November. Ethereum’s price, far from displaying a victorious leap, stumbled with a humility Tolstoy himself might have assigned to a dashing young officer learning his first lessons on the battlefield. On that day, ETH opened at $1,849, but by the evening samovars were simmering, it sat sullen at $1,811—a disheartening 2% drop. Even now, as men write numbers in ledgers and gossip in backrooms, ETH lingers near $1,936: a gain less worthy of song than of a polite, obligatory clap at the end of a child’s piano recital. 🎹

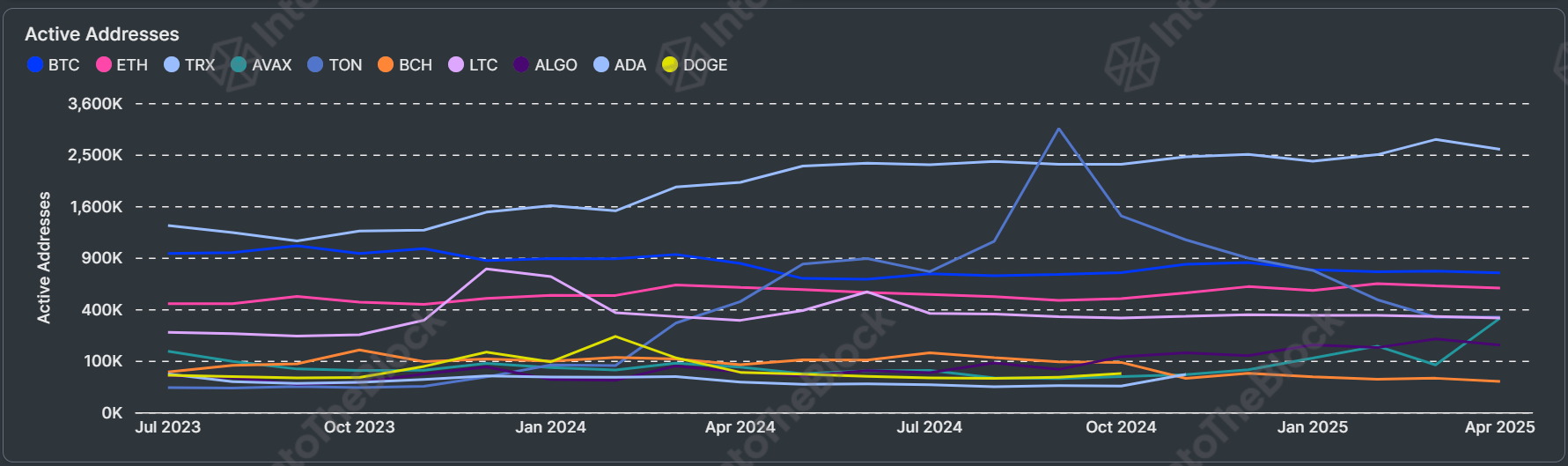

Whence this paralytic indifference? One does not need the wisdom of Pierre Bezukhov to see: the world’s trade winds are tempestuous, and tariff wars rage with the predictable pettiness of imperial court intrigue. Still, even this cannot erase the memory that Ethereum’s ailment is older than this year’s harvest. While rival houses—Tron, with its surging throng of 2.5K active addresses, and Ton, peaking at a splendid 3.6K, parade their vigor—Ethereum’s court remains fixed between 400,000 and 600,000 active addresses, much like a provincial noble never quite making it to Petersburg society.

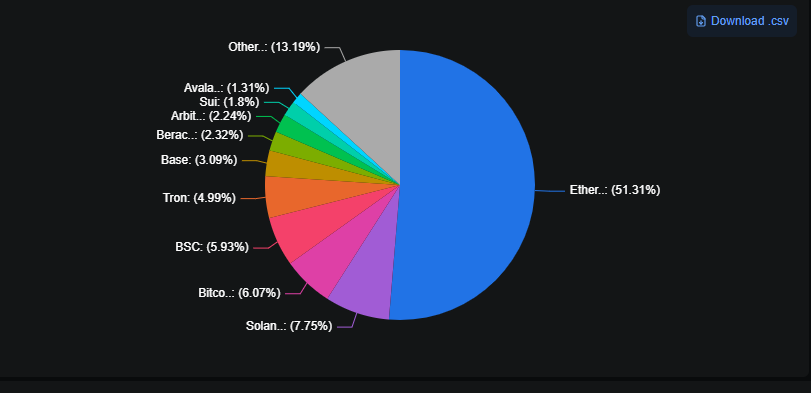

Yet, let no one say Ethereum lacks substance. Its coffers bulge with $52.6 billion in Total Value Locked, a sum that might finance a small war, or at least a proper ball at the Rostovs’. Institutional trust fortune smiles upon this blockchain, but it is the smallholder, the spirited retail investor, whose absence is as notable as an empty dance card at a Moscow gala.

Pectra, for all its noble intentions—lower blob fees, softer wallets—has not demolished the true walls bedeviling progress. The real villain of this story: the treacherous bridges required to ferry assets and data across Ethereum’s fractured Layer 2 principalities. Without uniting this fractured realm, mass adoption remains as elusive as the happiness Tolstoy’s characters awkwardly chase through three volumes of family drama. ⚔️

So, if ETH longs for a rally, it must offer not mere rumors of treasure locked in distant vaults, but the spectacle of joyous crowds—network adoption that swells like new conscripts flooding to the front. Until then, Ethereum’s price will continue to wander the steppe, waiting for the bridge to somewhere. Or at the very least, the bridge to user growth. 🏞️

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Gold Rate Forecast

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Whale of a Time! BTC Bags Billions!

- What the Heck? Cardano Predicts $500K Bitcoin & XRP Jumpstart! 🚀🤔

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- MSCI’s Exclusion Plan Sparks Crypto Chaos! 🚨📉

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

2025-05-08 13:55