Ah, the dawn of another day in the thrilling world of crypto. Welcome to your US Crypto News Morning Briefing—where the market’s wild antics are distilled into the most crucial, perhaps slightly absurd, developments.

Let’s start with something we all know: stablecoins are growing like a weed in a sunny garden. Yes, these charming little tokens pegged to the almighty dollar might be the harbingers of crypto’s adoption—at least according to some. But let’s not get ahead of ourselves, for Max Keiser, the Bitcoin sage, has thoughts. And they’re not entirely cheerful.

Crypto News of the Day: Stablecoins Might Just Push Bitcoin to $200K, Says Max Keiser

Crypto markets, in case you’ve been living under a rock, are enjoying a not-so-subtle uptick in institutional interest. A whopping $2 billion flooded into digital asset investment products just last week. Yes, that’s right—two billion! The very same market that’s notorious for moving with the grace of a drunk octopus.

Enter the Trump family’s World Liberty Financial (WLFI), making a grand entrance in the stablecoin sphere. Its USD1 stablecoin just crossed the $2 billion market cap. A modest number, really—if you’re not considering the trillion-dollar ambitions of the stablecoin sector. Tether, ever the overachiever, is already eyeing a second dollar-pegged stablecoin. One can only imagine the thinking behind this.

And as if to give us all an existential crisis, the US Treasury has taken a bold stance, predicting a $2 trillion market cap for stablecoins by 2028. Because, why not?

“Evolving market dynamics, structures, and incentives might just turbocharge stablecoins to that glorious $2 trillion mark by 2028,” the Treasury report ominously suggests.

But back to Max Keiser. According to him, these stablecoins are doing far more than just increasing adoption—they’re inflating the demand for the dollar. Apparently, it’s all part of a grand conspiracy to keep Bitcoin just under the $100,000 mark. The plot thickens.

And here’s where it gets a bit more sinister: stablecoin issuers are, according to Keiser, using their newfound dollar demand to amass Bitcoin at bargain prices. Clearly, their wallets are bulging while Bitcoin’s price stubbornly refuses to get any real traction.

Now, for a dash of alarmist rhetoric: Keiser believes these market dynamics could, ironically, undermine the very initiatives that are meant to boost Bitcoin’s stature—like the proposed US Strategic Bitcoin Reserve. As you do.

“Stablecoin issuers are the last bastion of dollar demand, as the looming threat of de-dollarization could leave the US economy staggering,” Keiser told BeInCrypto. A bit dramatic? Perhaps. But we all enjoy a good apocalyptic forecast, don’t we?

Keiser’s assertion? The stablecoin crew is slyly buying Bitcoin under $100,000 to distract Trump from stockpiling BTC for the strategic reserve. Genius, right?

US Dollar’s Slow, Miserable Decline Against Bitcoin

Now, let’s add a pinch of doomsday flair. Keiser, ever the optimist, predicts that when Bitcoin crosses $200,000, the panic-buying will go into overdrive. Governments and citizens alike, those who’ve been hoodwinked by stablecoin issuers, will be scrambling to get a piece of the action.

“Once Bitcoin crosses $200,000, the panic buying will be utterly ridiculous,” Keiser quipped, with a wink and a nod.

And just to top it all off, Keiser foresees a future where fiat currencies, from the Yen to the Euro, will devalue to nothing against the dollar and its stablecoin counterparts—before the dollar itself faces a miserable demise in comparison to Bitcoin.

“That’s how Bitcoin will hit $2,200,000 a coin in this cycle,” Keiser wrapped up, leaving us all in stunned silence.

For those of us in denial about the greatness of Bitcoin, Max Keiser has one final nugget of wisdom: Bitcoin’s price will soar to $2.2 million per coin. The catalyst? Institutional FOMO and the competition between 21 Capital and MicroStrategy, among others. Oh, the drama!

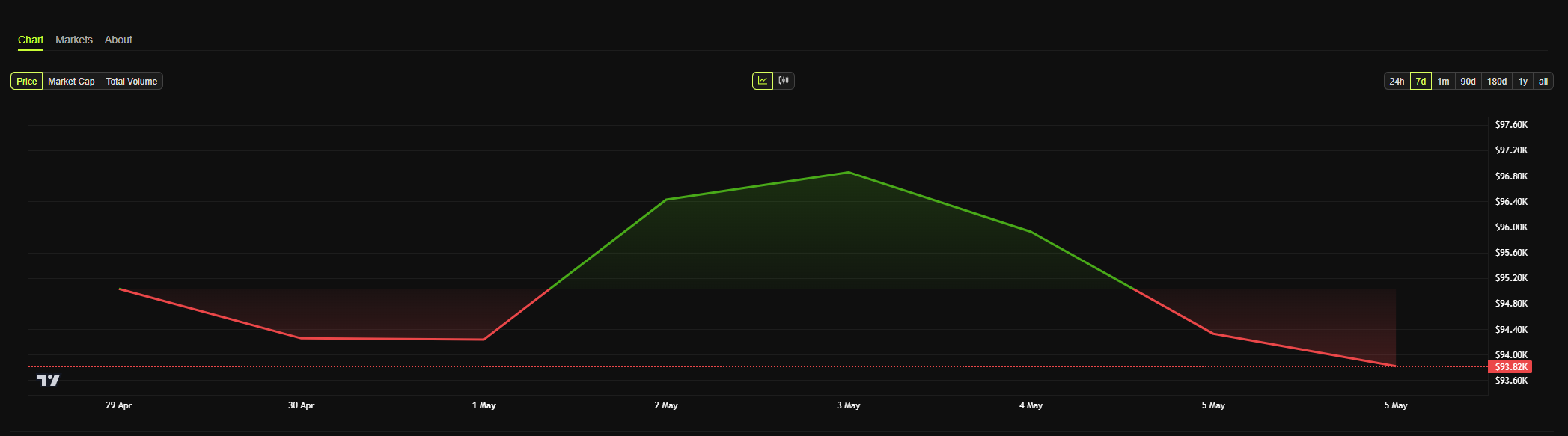

Chart of the Day

The stablecoin market cap is, as you might expect, growing like a teenager on protein shakes. It’s up nearly $40 billion in 2025 alone, rising from $203.372 billion to $242.977 billion. A truly heartwarming 19.47% increase in under five months. All hail the mighty stablecoin!

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | At the Close of May 2 | Pre-Market Overview |

| Strategy (MSTR) | $394.37 | $384.40 (-2.53%) |

| Coinbase Global (COIN) | $204.93 | $201.20 (-1.82%) |

| Galaxy Digital Holdings (GLXY.TO) | $26.84 | $29.95 (+11.60%) |

| MARA Holdings (MARA) | $14.48 | $14.11 (-2.56%) |

| Riot Platforms (RIOT) | $8.39 | $8.24 (-1.79%) |

| Core Scientific (CORZ) | $8.74 | $8.61 (-1.49%) |

Read More

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Gold Rate Forecast

- Binance’s CZ Predicts Bitcoin Will Go So High Even Molière Would Write a Satire

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- Bitcoin’s Last Stand: The Wild Ride Before the Big Move! 🚀💥

- Whale of a Time! BTC Bags Billions!

- Shocking! Dogecoin Poised for a 110% Leap—Is the Moon Too Tame?

2025-05-05 17:33