Ah, the inevitable rise of Bitcoin—a force so unpredictable, even the mighty gold quivers in its shadow. Fidelity’s latest analysis paints a picture of what can only be described as the moment the world has been waiting for: the digital currency’s potential to leap over gold and claim its throne as the dominant store of value.

Fidelity Hints at Bitcoin Stealing the Crown from Gold—And It’s About Time!

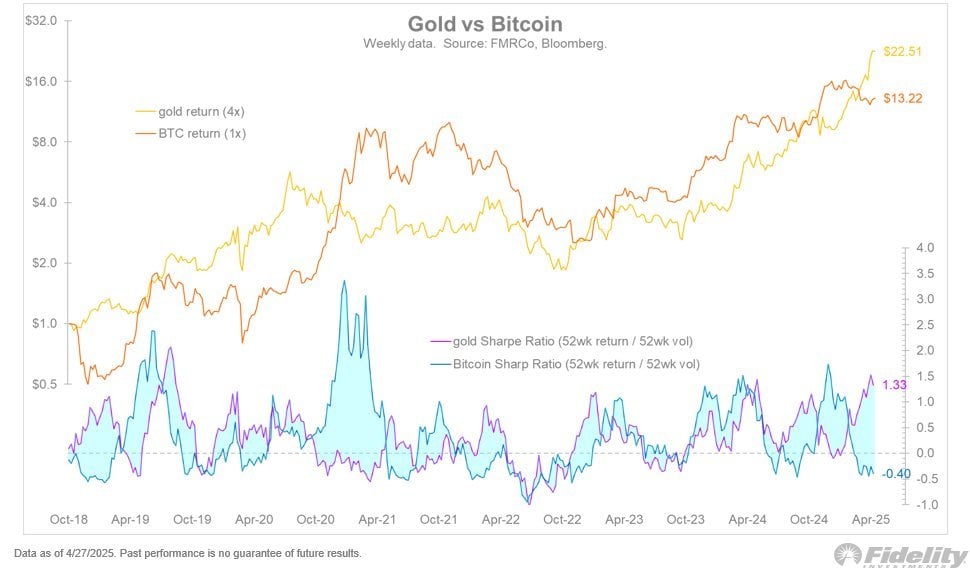

In a moment that almost feels like a prophecy, Jurrien Timmer, Fidelity’s illustrious director of global macro, took to social media on April 27 to unveil his thoughts on the great battle between Bitcoin and gold. With the fervor of a philosopher, he presented data from Fidelity Management & Research Company (FMR Co) and Bloomberg, analyzing the Sharpe Ratios—the sacred indicator that measures return adjusted for risk. The numbers suggested, of course, that we are witnessing a shift of cosmic proportions.

“Isn’t it funny?” Timmer mused, “Gold and Bitcoin, once sworn enemies, now seem to be engaging in a delicate dance of rivalry, like two fencers at the peak of their game. As the chart below shows, they’ve been trading blows lately—measured by their Sharpe Ratios.” He added:

Well, from what I see, it might just be Bitcoin’s turn to grab the baton from the old, tired gold. Its Sharpe Ratio is a thrilling -0.40, while gold sits comfortably at 1.33. It seems a passing of the torch is imminent.

And here comes the chart to deliver the knockout punch: gold’s return of $22.51 recently overshadowed Bitcoin’s modest $13.22, but let’s not forget that gold’s performance was scaled by a 4x multiplier, thanks to its snooze-worthy stability compared to Bitcoin’s wild rollercoaster ride.

In a twist that will no doubt leave traditional investors clutching their pearls, Timmer encouraged a strategy that would make the likes of old-school gold hoarders tremble: Why choose between gold and Bitcoin when you can embrace them both? “Both can play on the same team,” he suggested, revealing his preferred portfolio mix—four parts gold to one part Bitcoin. It’s a little like pairing a steady, reliable old horse with a fiery, unpredictable stallion.

When you compare the historic price of Bitcoin to gold on a 1:1 basis, Bitcoin is the undisputed champ. But if you scale it to 1:4, the two assets are practically twins—well, if one twin was a whirlwind of volatility and the other was a trusty old bank vault.

Timmer then ventured into the psychological depths of Bitcoin, acknowledging its Dr. Jekyll & Mr. Hyde personality. “Bitcoin’s unpredictability? Oh, that’s just part of its charm,” he said, as if describing a rogue character in a Dostoevskian novel. “It thrives when the money supply (M2) and equities are growing—gives you that exhilarating mix of speculation and security.” On the other hand, gold remains as steady and reliable as ever—almost to the point of being boring. But hey, steady wins the race, right? Well, in Bitcoin’s case, it’s the one breaking all the rules.

With a wink and a nod, Timmer acknowledged Bitcoin’s place in the modern financial ecosystem, calling it “a modern-day invention aspiring to be hard money in an easy money era.” It’s the rebel you can’t quite ignore, and maybe—just maybe—it’s the future.

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Whale of a Time! BTC Bags Billions!

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Brent Oil Forecast

- Crypto Riches or Fool’s Gold? 🤑

2025-05-04 05:57