Well, well, well. Seems like Trump’s trade wars are doing more than just giving us a headache. Global financial markets are stumbling, and Bitcoin is suddenly the hero nobody expected. Go figure.

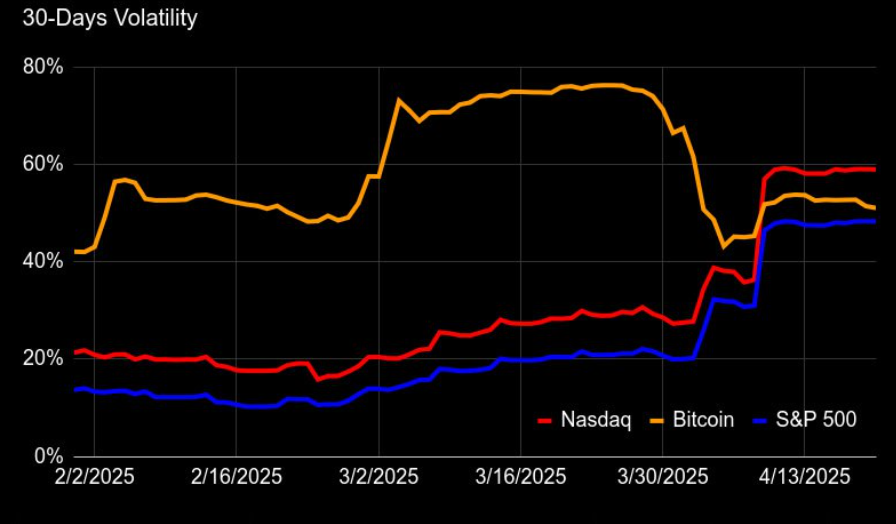

The crypto world has been on quite the ride recently, as traders scramble to make sense of a world where tariffs, Bitcoin, and equity markets are throwing punches at each other. Who knew that trade wars could mess with your digital wallet and your stock portfolio all at once? The volatility has been something to behold, especially as investors are left dizzy from the whiplash of these tariffs.

Is Bitcoin Really the Savior Here? Maybe. Probably. Let’s Talk About It.

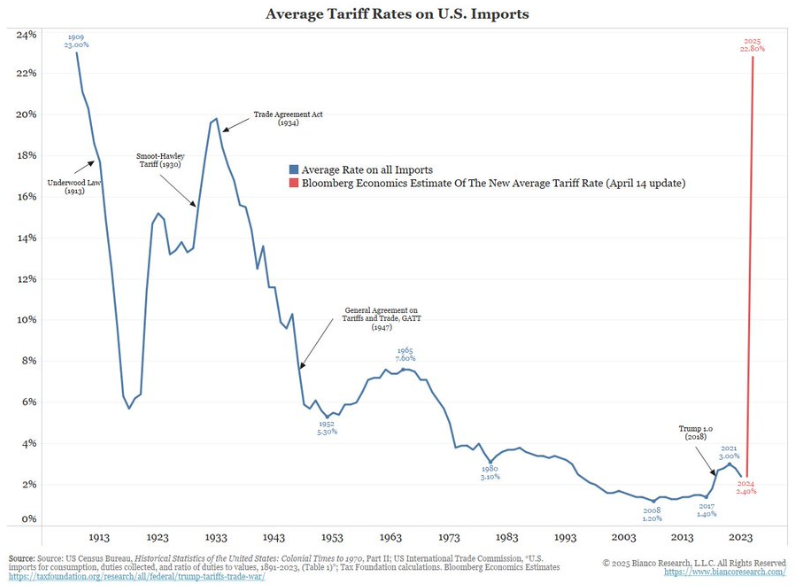

So, here’s the juicy part: Trump’s tariffs are making things spicy, and Bitcoin? Well, it’s been looking pretty strong. According to the brainy folks over at MV Global, US tariffs in 2025 have shot up to levels not seen since the Great Depression. And while that’s an absolute mess for equities (we’re talking more than $10 trillion in losses), Bitcoin? It’s like it saw the chaos, put on its best suit, and stepped into the limelight.

“The resulting capital flight is reshaping investment flows across asset classes,” MV Global said. Oh, you bet it is.

Despite the chaos, liquidity is creeping back into the market like a sneaky raccoon at a campsite. Analysts are getting giddy about the idea of a revaluation, with Bitcoin being at the center of it all. Because, why not? It’s not like equities are pulling their weight.

Speaking of which, MV Global’s Global Economy Index just turned a corner, showing signs that things might be looking up soon. It’s a good omen, right? Or at least that’s what they’re hoping, as they predict a massive market shake-up, with Bitcoin possibly becoming the go-to option for those tired of the traditional game.

“Liquidity is quietly rebuilding across major economies. As the Global Economy Index turns upward, historical patterns suggest Bitcoin and equities may be on the cusp of a major revaluation,” they mentioned. Fingers crossed, right?

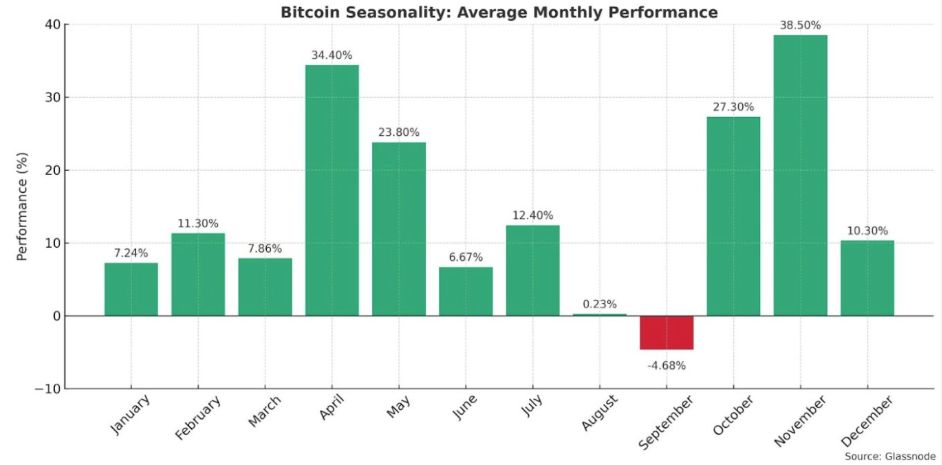

Bitcoin’s recent performance has been absolutely kicking the butt of traditional markets, so it’s not hard to see why people are starting to put more faith in it. With an average April return of over 34.4%, Bitcoin is looking a whole lot less like a “wild speculation” and more like a reliable asset in a crazy world.

Looks like we’re back to the good old days when people were running away from the dollar-centric system in favor of something decentralized and, you know, not tied to a billion different uncertainties. Amazing how history repeats itself, huh?

And Tomas Greif, the sharp mind behind Braiins Mining Ecosystem, has a point too. If you’ve been writing Bitcoin off as too volatile for your retirement fund, maybe it’s time for a rethink. He’s basically telling you, “Hey, your passive strategy might just be the thing that’s making you miss out on this wild ride.” Classic.

“If you previously thought Bitcoin was too volatile, you may want to re-evaluate your passive investment strategies for retirement,” Greif said. Ouch, but fair.

Mathew Sigel from VanEck sees the bigger picture, too. As the financial world continues to wobble like a toddler on roller skates, Bitcoin might just be the new “functional” hedge against whatever the heck is going on with US economic influence.

“Bitcoin is evolving from a speculative asset into a functional monetary tool—particularly in economies looking to bypass the dollar and reduce exposure to US-led financial systems,” Sigel wisely pointed out. We see you, Bitcoin.

Sigel’s right. Bitcoin is slowly but surely positioning itself as the underdog asset that everyone might need if things keep going south. Countries are distancing themselves from the good ol’ US dollar, and Bitcoin might just be the currency that steps into that gap. Russia’s even thinking about creating a Ruble-pegged stablecoin to take on the mighty US Dollar. Now that’s an international plot twist we didn’t see coming.

As stock markets continue their dramatic downfall and liquidity shifts like a tide, Bitcoin’s resilience is shaping up to be the new hedge for investors tired of living on the edge of geopolitical chaos. Hold on tight, folks. It’s going to be a bumpy ride. 🚀💸

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD RUB PREDICTION

- EUR UAH PREDICTION

- USD TRY PREDICTION

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Brent Oil Forecast

- BTC’s Ballet: A Symphony in Satoshis 🎻💰

- Dirham Dreams & Dollar Nightmares: When UAE Challenges Uncle Sam’s Crypto Throne

- Ripple CTO Raises Eyebrow, Crypto Twitter Faints: Is John Deaton’s X Account Besmirched?

2025-04-29 11:28