The price of Cardano has experienced a bit of a dip over the past three days, as if the previous week’s surge needed a breather (after all, even digital coins need their rest). Last Sunday, ADA dropped to a modest $0.70, down from its glorious year-to-date high of $0.747. But hold on to your hats, dear readers, because we’re diving into the three *astounding* reasons why this coin could see a jaw-dropping 70% rise, potentially testing the lofty resistance level of $1.176. Brace yourselves.

Whales Are Buying (and No, We’re Not Talking About the Ocean)

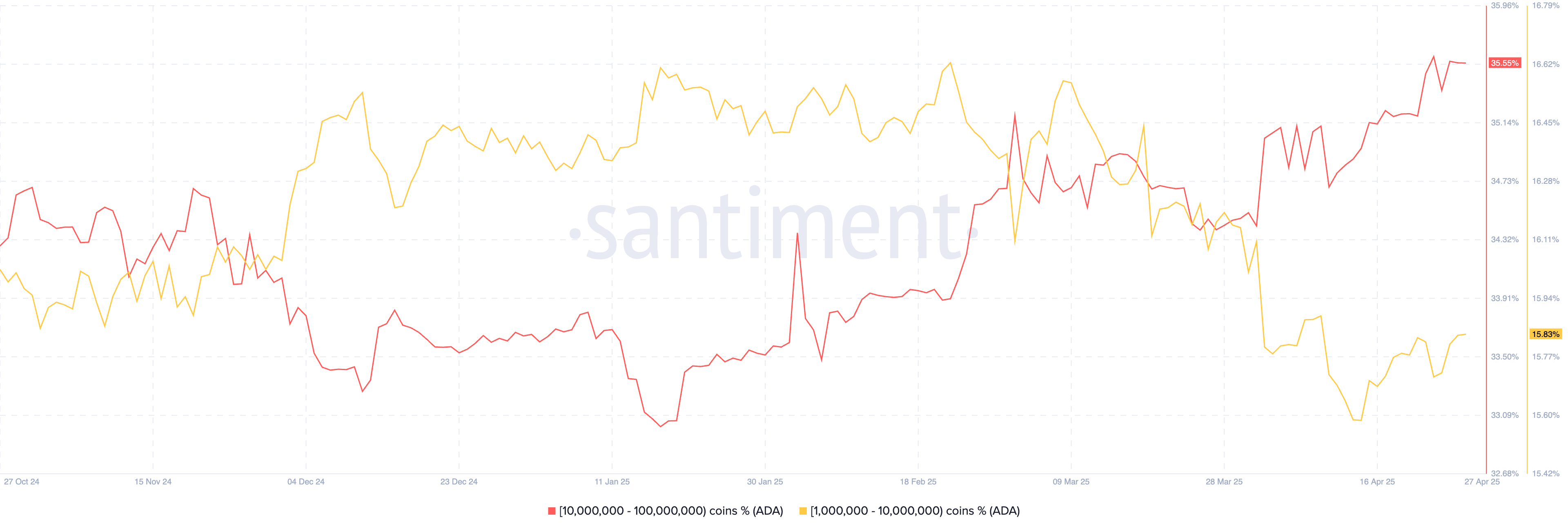

The first sign of impending greatness for Cardano? Well, it seems the whales—those elusive, deep-pocketed players—are starting to accumulate. And no, they’re not making a surprise appearance at SeaWorld. According to Santiment data, addresses holding between 10 million and 100 million ADA coins now control a solid 35.5% of all the circulating ADA. That’s up from a more modest 33% back in January. But wait, there’s more: holders of 1 million to 10 million ADA have jumped to 15.83%. Something smells fishy in the water… and it smells like *bullish* activity. Historically, when whales stockpile coins, it’s a sign that they’re expecting bigger things ahead. And when they dump? Well, let’s just say it’s not so festive.

The ETF Approval That Could Be a Game-Changer (and Possibly a Fantasy Novel)

Now, let’s talk about a golden ticket: the approval of a Cardano ETF. But it’s not just any ETF. Oh no. It’s the kind of ETF that could make Cardano price rise like your Aunt Judy after one too many glasses of wine at Thanksgiving. With the SEC’s new chair, Paul Atkins, at the helm, the odds of an ADA ETF getting the green light have soared to a staggering 55%. For context, that’s better than the odds of your favorite TV show getting renewed for another season.

But there’s more! The SEC is now reviewing over 70 crypto ETFs. Under Atkins’ watch, many of them are expected to get the nod. And here’s the kicker: tokens with staking features, such as Cardano, might get approved, giving investors the chance to earn returns from their ETFs, month after month. Imagine that kind of passive income rolling in like a paycheck you didn’t have to work for. Pure magic.

Charles Hoskinson, the co-founder of Cardano, has also been teasing something exciting for Bitcoin holders: a way to stake BTC on Cardano’s blockchain. How? By using sidechains like Midnight and Midgard. Midnight will allow Bitcoin to be represented on Cardano while keeping transaction privacy intact. It’s like keeping your secrets safe in a vault, but one that lets you earn interest. No more worrying about those centralized platforms that collapsed in 2022. This is the future, people!

Cardano’s Double-Bottom Formation: The Sequel We Didn’t Know We Needed

And then there’s the cherry on top of this bullish sundae: Cardano’s double-bottom formation at $0.510. I know, I know—technical analysis sounds like something out of a math class you tried to avoid, but stick with me. A double bottom is a classic bullish signal. It’s like the coin saying, “I’ve had enough of this downward spiral, thank you very much!” The neckline of this pattern sits at $1.176, the highest level Cardano has reached on May 3. Coincidence? I think not.

But wait—there’s more! Cardano is also sitting pretty at the 61.8% Fibonacci Retracement level, which, in layman’s terms, is known as the “golden ratio.” It’s basically the sweet spot for rebounds. Throw in a little bullish flag pattern (no, it’s not a new trend in fashion), and you’ve got a recipe for a potential breakout.

In conclusion, get ready. Cardano is primed for a 70% breakout, and it’s just a matter of time before bulls take charge and send the price soaring. And you, dear reader, will be sitting on the sidelines, sipping your coffee, watching it all unfold. Will you be part of the ride? Only time will tell. But one thing’s for sure—Cardano is not done yet.

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Whale of a Time! BTC Bags Billions!

- Crypto Riches or Fool’s Gold? 🤑

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Silver Rate Forecast

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

2025-04-27 16:03