Hold on to your wallets, folks! Experts say stablecoins are skyrocketing in popularity, and guess what? They’re doing more transactions than Visa! Bitwise says 2024’s volumes are through the roof, but DWF Labs’ Andrei Grachev warns of “redemption pressure.” Sounds like trouble, huh? 🤷♂️

Stablecoins Beat Visa at Their Own Game

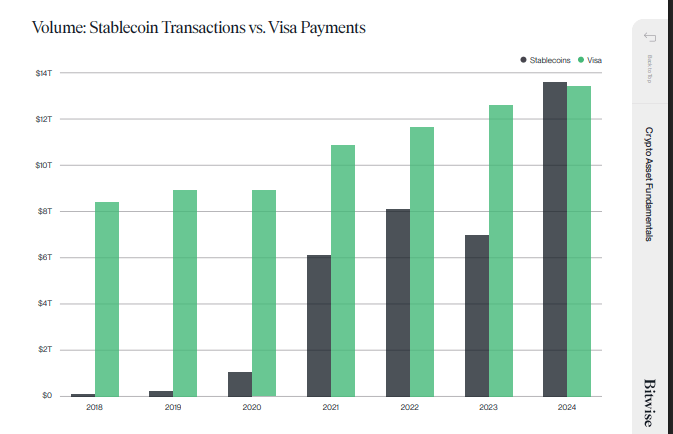

Let’s talk numbers! Stablecoins are on fire 🔥. According to some so-called “experts” (I mean, who are these guys, really?), stablecoins are now handling more transactions than Visa! In 2024, stablecoin transaction volumes surpassed that of Visa, and if that doesn’t make you sit up straight, then you’re probably still using a fax machine. 🤔

So why are people falling head over heels for stablecoins? It’s simple: they’re fast, they’re cheap, and they work 24/7. Unlike the old-school SWIFT system that moves slower than your grandma on a Sunday morning, stablecoins are zipping money around the globe faster than a speeding bullet 🦸♂️. And no, they don’t come with hidden fees that feel like a punch in the wallet.

In the world of decentralized finance (DeFi, for those who haven’t caught up yet), stablecoins are the hero we never knew we needed. They help with everything from lending to trading without the chaos of traditional financial systems. So, yeah, they’re kind of a big deal now. 🤑

But wait, there’s more! Or… maybe not. Andrei Grachev, the guy over at DWF Labs who’s apparently looking out for the “big picture,” thinks we should be cautious. He’s worried about “redemption pressure.” Translation: if people panic and try to cash out all at once, we might see a little bit of a crash. Imagine a crowd trying to escape a burning building, and you’ll get the picture. 🏃♀️💥

“If users start jumping ship because they’re worried about a depeg, things could get ugly,” Grachev warns. And we’re talking *ugly*. Like, an 80’s hair metal band ugly. 🤘

Oh, and did I mention reserve management? If a stablecoin doesn’t have solid reserves, it’s basically a house of cards. One gust of wind, and poof, it all comes crumbling down. 🙈

So how do we fix this? Grachev suggests some high-tech solutions—like real-time proof-of-reserves. Basically, showing your work, like you did in math class. You know, to make sure you’re not making it up as you go along. Also, transparency is key. If your reserves look like they’re from an off-the-grid island with no oversight, that’s a red flag. 🏴☠️

According to the Bitwise report, stablecoin transactions hit $14 trillion last year, up from $7 trillion in 2023. Just to put that into perspective, in 2020, stablecoins were barely a blip on the radar compared to Visa. It took less than five years to close that gap. Talk about rapid growth! 🏃💨

Can Big Banks and Stablecoins Play Nice?

Now, let’s get into the big question: Will traditional financial institutions adopt stablecoins? Petr Kozyakov, the co-founder of Mercuryo, has some thoughts on this. He’s wondering whether the new stablecoins will follow the lead of USDT and USDC, or if they’ll be locked up tighter than Fort Knox. 🔐

“Will these ‘TradFi’ stablecoins operate on public, permissionless blockchains, or will they be stuck in private, permissioned blockchains?” Kozyakov asks. Translation: Are we going to let the people have some freedom, or will it be the same old boring control game? 🧐

Meanwhile, Mike Blake-Crawford from World Mobile Group seems to think that banks will lean toward permissioned blockchains. But, spoiler alert: this might cause some serious problems in places like Pakistan and Zanzibar. Banks want the stablecoin perks without the decentralization that makes them so powerful. Talk about trying to have your cake and eat it too! 🎂

But here’s the kicker—while the U.S. and the EU are still trying to figure out the rules for stablecoins, everyone’s watching closely. Stability, my friends, is coming. (And yes, it’s about time!)

Blake-Crawford summed it up perfectly: “The STABLE Act could be a game-changer for American operations. People want the same convenience we see in Africa—no red tape, just clear rules to keep everyone safe.”

Oh, and there’s more legal drama on the horizon. As the global financial regulators get their act together, we’re all wondering how stablecoins will evolve. The BIS and IMF are probably already cooking up something big. 😎

Grachev believes the future of stablecoins boils down to a key issue: how do we balance privacy with compliance? How do we make sure you can still go about your business without a bunch of nosy regulators sticking their noses in? 🍿

So there you have it, folks. Stablecoins are taking over, but it’s not all sunshine and rainbows. Hold onto your hats, because it’s going to be one wild ride! 🚀

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- Crypto Riches or Fool’s Gold? 🤑

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Brent Oil Forecast

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

2025-04-27 08:58