In an unprecedented twist of fate, nearly 100 exahash per second (EH/s) of Bitcoin hashrate has vanished from the network in the past week. This mass exodus seems to have been triggered by the not-so-charming rise in difficulty to a staggering 123.23 trillion on April 19. Apparently, miners aren’t fans of challenging their brains out at the moment.

Will the Big Retarget on May 4 Save Bitcoin from Its Hashrate Fiasco?

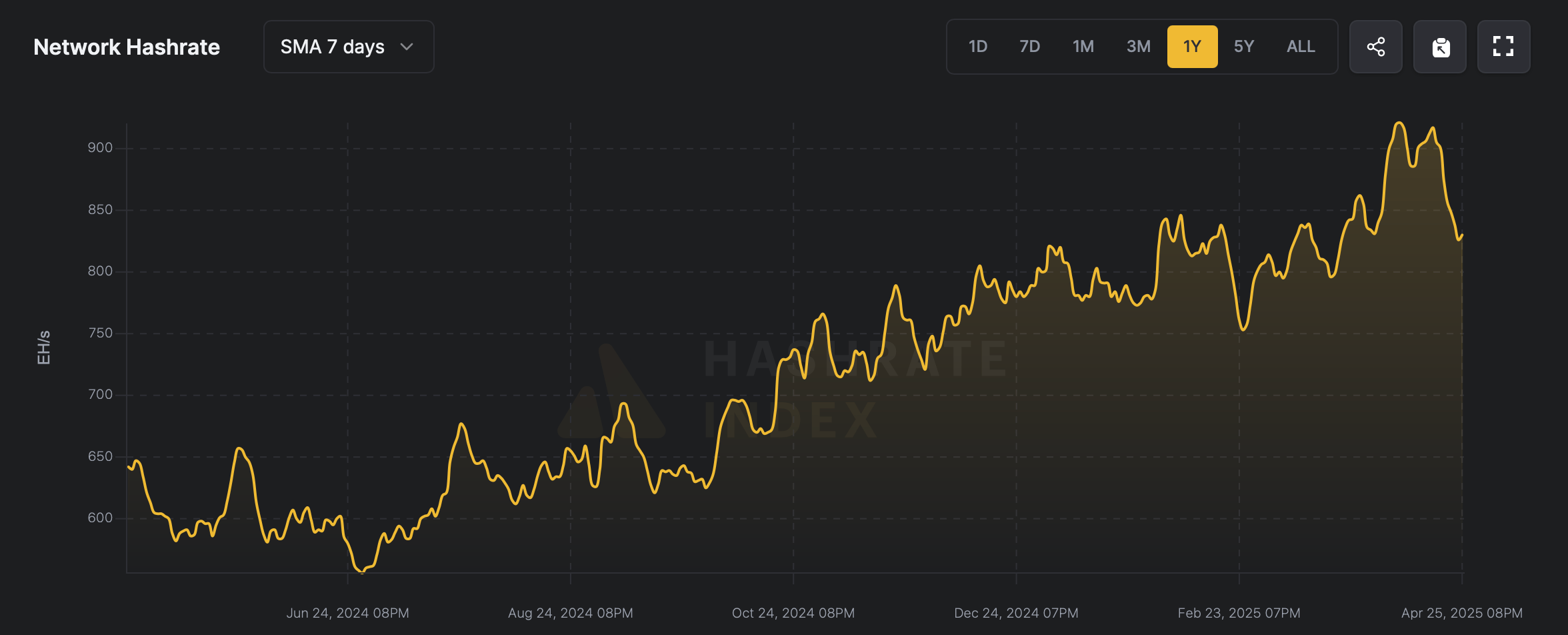

According to data from hashrateindex.com, a stunning 91 EH/s packed its bags and left the Bitcoin network after April 17, 2025, when the network was operating at a leisurely 917 EH/s. At its peak, just nine days earlier on April 8, it hit an all-time high of 926 EH/s, as measured by the seven-day simple moving average. But after April 17, it’s been a downhill slide, like watching your favorite TV show get canceled mid-season.

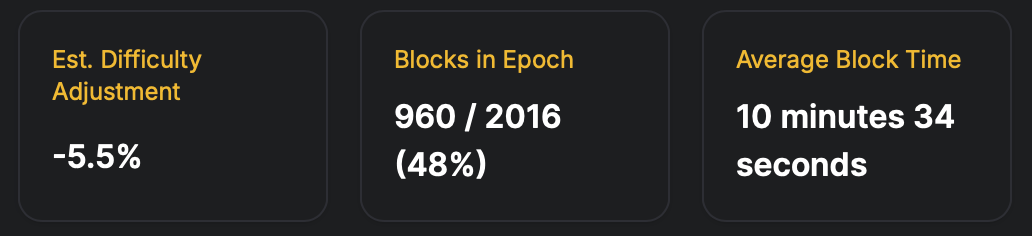

Most of this dramatic departure coincided with a sudden 1.42% difficulty spike on April 19. This particular adjustment made things harder than a crossword puzzle on hard mode, sending difficulty to 123.23 trillion and marking the fourth consecutive increase in the saga of increasing complexity. This, of course, led to slower block times, now averaging 10 minutes and 34 seconds. For context, this is well beyond the typical 10-minute target, which is like missing the deadline for a paper you haven’t even started yet.

Now, normally, slower block times are a signal for a possible difficulty reduction, and it seems that the May 4 difficulty retarget could see a 5.5% drop. This may provide a much-needed breather for the remaining miners who are hanging on like the last few people left at a party after it’s already over. Meanwhile, miners have gotten a bit of a silver lining in the form of a hashprice increase. On April 19, the hashprice was $44.06 per PH/s; today it’s up to $48.70, a jump of 10.53%. That’s a nice bonus, like finding extra fries at the bottom of the bag.

Bitcoin’s recent dip in hashrate is a testament to the network’s self-correcting nature. As difficulty rises, miners skedaddle, and block times slow down. Yet, the hashprice increase is a sign that the remaining miners are not only surviving but thriving—competing like it’s the world’s most awkward game of musical chairs. With the difficulty retarget around the corner, the network is set to find its equilibrium once again, easing the burden on miners and potentially giving them a bit of a break this cycle.

Read More

- Gold Rate Forecast

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- Silver Rate Forecast

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Brent Oil Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Satoshi Nakamoto Statue Invades NYSE: Wall Street’s New Boy Toy 🏛️💻

- Discover the Hidden Gems: Altcoins Under $1 That Could Make You Rich! 💰

- ETH PREDICTION. ETH cryptocurrency

- Block, OpenAI, and Anthropic: The Unholy Tech Alliance!

2025-04-26 19:02