Ah, yes, the ever-volatile crypto market. It seems to have decided it’s time for a bit of an existential crisis—where Bitcoin’s long-term holders are acting like the wise sages they are, while short-term holders are running like they just saw a bear on a bicycle.

The Long-Term Holders (LTHs)—bless their patient souls—are back to accumulating, much like a person who just can’t resist buying more books they’ll never read. Meanwhile, the Short-Term Holders (STHs), those thrill-seeking gamblers, seem to be heading for the exit, clutching their purses and mumbling something about ‘regret’ and ‘missed opportunities.’

The LTHs Return to the Fray, STHs Flee in Panic

In a recent report (which, of course, you didn’t read), the ever-enigmatic CryptoQuant analyst IT Tech—a name as mysterious as the market itself—pointed out that a sharp behavioral rift has emerged between Bitcoin’s LTHs and STHs. This, my friends, is a clear signal that we might be witnessing the early stages of a glorious re-accumulation phase. Isn’t that lovely?

According to IT Tech, the Net Position Change for LTHs has finally turned positive, marking the first time since the last local peak. Oh, how poetic! It’s like watching someone slowly return to their long-lost love after months of awkward, unresolved tension.

“This suggests that seasoned, conviction-driven participants are beginning to gather more Bitcoin, like collectors at a rare art auction. Their actions reflect strategic, cycle-aware positioning—nothing too grandiose, just a measured repositioning,” said the analyst, probably while sipping on some overpriced coffee.

And on the other side of the battlefield, we have the STHs—those poor souls who’ve held their Bitcoin for less than 155 days. They’re selling into the weakness like it’s a fire sale at the local flea market. It’s a capitulation, plain and simple. The price troubles have scared them away. They’re out, and their faces are as pale as if they’d just learned their favorite band had broken up.

IT Tech believes this dichotomy is the beginning of something beautiful—an early sign of re-accumulation. How poetic it is when chaos and order dance together in a market so unpredictable, it’s almost like watching a train wreck with a side of popcorn.

“If long-term holders continue to increase their positions, while short-term holders are flushed out like a pile of dirty laundry, we might just have a solid foundation for future price recovery. Sure, the short-term volatility will be a headache, but hey, that’s the fun part, right?” the analyst quipped, probably smiling to themselves.

Bitcoin Gains Momentum, and So Does Our Interest

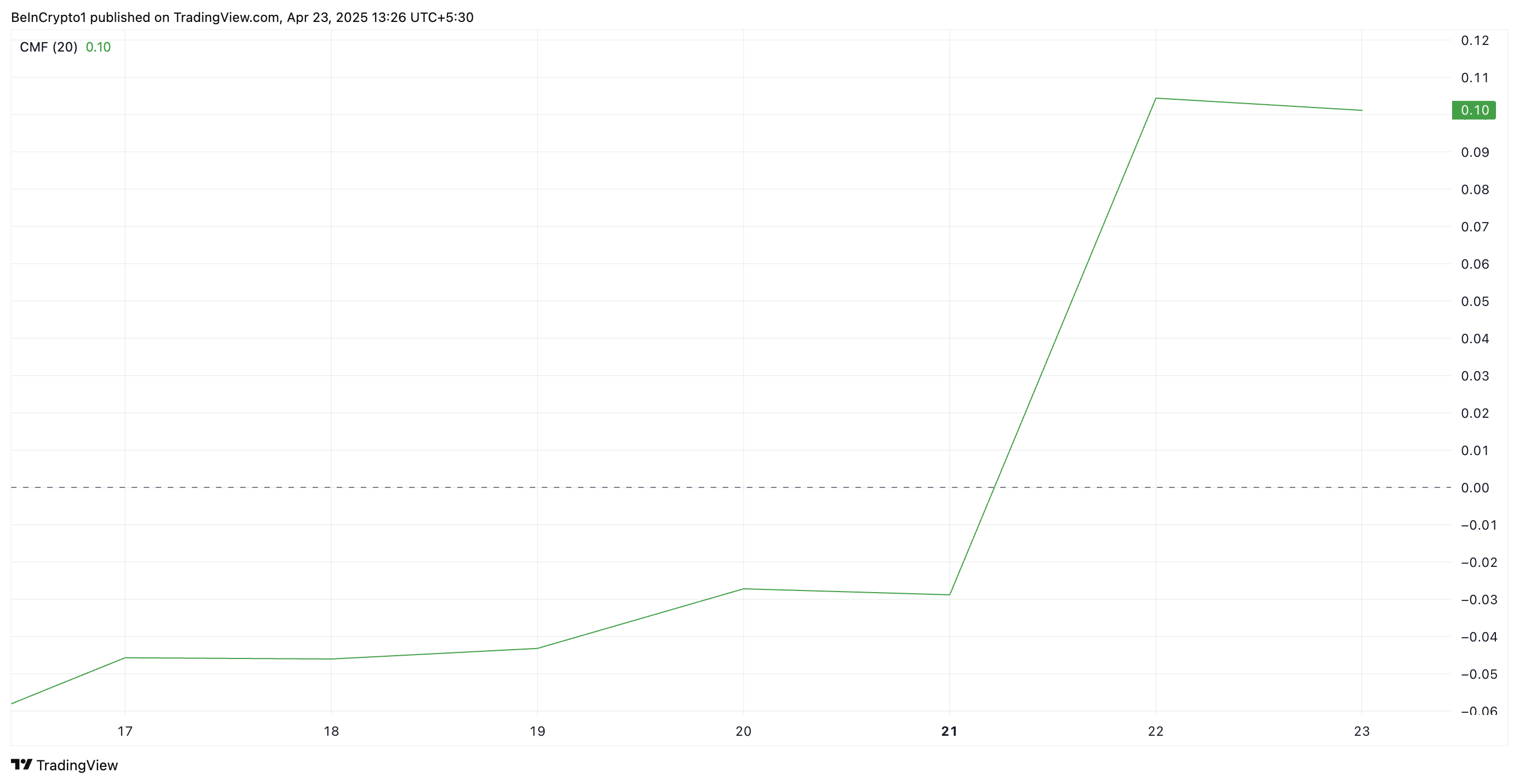

On the daily chart, BTC’s positive Chaikin Money Flow (CMF) is strutting around like it owns the place, signaling that demand is surging, and there’s cash flowing in like water during a monsoon. This, my dear friends, reinforces the tantalizing possibility of a bullish breakout—just as we all predicted… or hoped for, really.

As of now, the CMF reading stands at 0.10. This magical number means that buying pressure is in full force, and sell-offs are about as rare as a unicorn in a coffee shop. Buckle up, folks, the price could keep climbing—unless, of course, the market decides to throw a tantrum.

Moreover, the Aroon Up Line is currently sitting at 100%, which basically translates to ‘we’re in a super strong uptrend’—or as I like to call it, ‘the Bitcoin bull run that everyone has been waiting for.’

The Aroon Indicator tracks price movements with the grace of a seasoned ballet dancer. When the Aroon Up line hits 100, you know that upward momentum is as strong as a caffeine addict at 3 AM.

But don’t get too comfortable, my fellow market enthusiasts. We’re not out of the woods yet. If traders decide to cash in their winnings, the dream of soaring to the heavens might be dashed faster than a New Year’s resolution.

BTC Bulls Dream of New Heights

Bitcoin is comfortably nestled above the crucial support level of $91,851, like a cat in a sunbeam. If the bullish momentum holds, the price could climb to $95,971. Oh, the sweet, sweet smell of potential gains.

But, alas, should traders decide to take profits like a kid grabbing the last cookie, the price might fall back to the $91,851 support. If that breaks, well… let’s not even think about it. We could be looking at a potential dip to $87,730, and that would not be as fun as it sounds.

Read More

- Gold Rate Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Brent Oil Forecast

- XRP: The Calm Before the Storm?

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- Silver Rate Forecast

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- You Won’t Believe Why Bitcoin Just Smashed $99K – And What’s Next! 🚀💰

2025-04-23 13:43