In a plot twist that not even the Easter Bunny could have predicted (and frankly, wasn’t invited), Bitcoin (BTC) decided to throw a 13,520% long-to-short liquidation imbalance party over the last four hours. Imagine $9.62 million in longs getting steamrolled while shorts casually sipped tea and lost a mere $71,000, which is like bringing a water pistol to a flamethrower fight. All this drama unfolded as BTC somersaulted down to the mystical $83,800 mark before sheepishly bouncing back to a slightly less embarrassing $84,453.

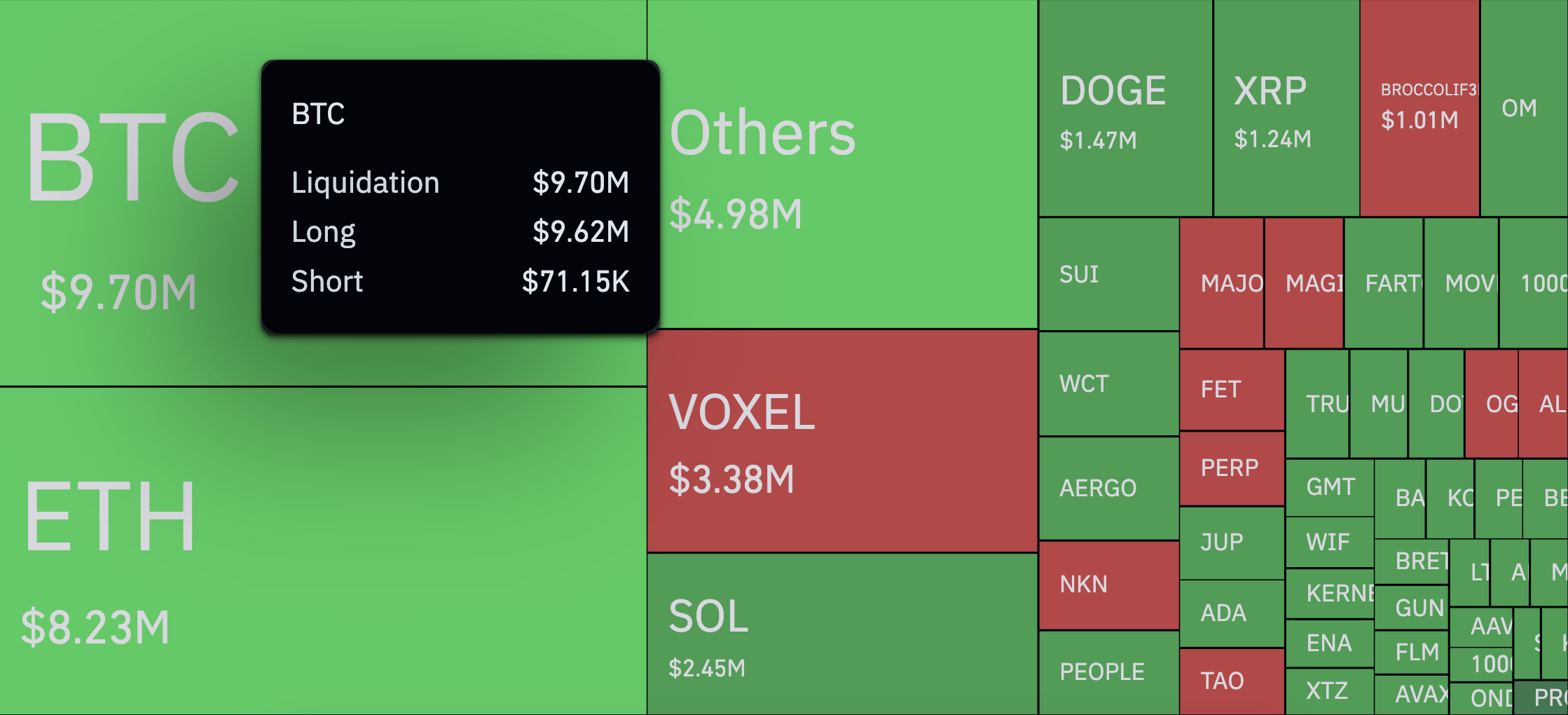

The market’s reaction? A collective “WTF?” that led to a grand total of $35.35 million in liquidations during the same period — with longs taking 83.6% of the financial whacks. It was like watching a very ironic soap opera, except real money was involved.

BTC fancied itself center stage, hogging $9.7 million of the drama, while ETH tried to stay relevant with $8.2 million, and SOL quietly limped in with $2.45 million wiped from its leveraged dreams.

To put it mildly, the scale of this imbalance was less “small hiccup” and more “apocalypse for leveraged longs.” Long liquidations happen in swift market tumbles, sure, but having over 130 times more longs liquidated than shorts looks like someone forgot to read the risk memo heading into the weekend. The rollercoaster didn’t stop there; a staggering $165.1 million got vaporized over 24 hours, ruining the dreams of 119,000 hopeful traders who apparently thought the weekend would bring chocolate and profit.

Spotlight on the most flamboyant casualty: a jaw-dropping $5.95 million BTC/USDC position on Binance, because why not go big or go home—except it was more like go bankrupt and cry on the internet, according to the oracle known as CoinGlass.

Take a glance at Bitcoin’s price chart and you’ll see the market acted like a caffeinated kangaroo—bouncing around briefly near $85,400 before diving to $83,800 in what looks like a “hold my beer” moment. The quick rebound hints at some temporary overselling chaos, but for the long players who went all-in, the damage was as real as a hangover the next morning.

So, what’s the moral of this Easter Sunday fable? Traders arrived expecting a basket of upward returns and instead got a slap in the face courtesy of groupthink and overexposure. When everyone zigs, sometimes all it takes is a tiny zag to send the whole market tumbling down like a house of cards… or a pile of Bitcoin futures contracts. 🥚💥💸

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- USD THB PREDICTION

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

- Silver Rate Forecast

- You Won’t Believe How $3B in Real Estate Is Now Just Tokens. Mind-Blowing, Right?

2025-04-20 17:34