Ah, the grand spectacle of finance! The largest inflow, a veritable deluge, came from the illustrious BlackRock’s IBIT, which, in a fit of generosity, added around a staggering $81 million all by its lonesome. Bravo! 🎉

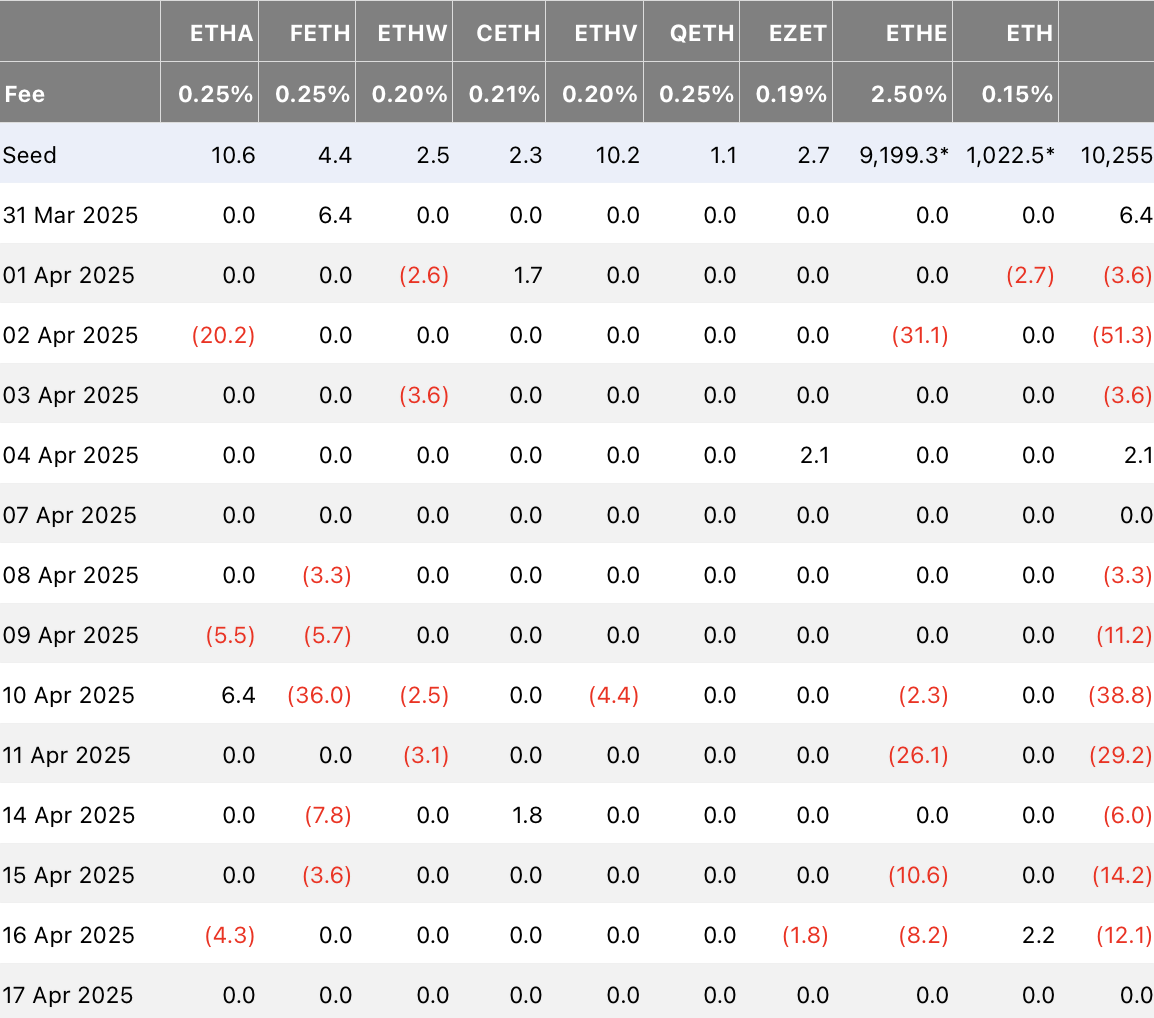

Yet, lo and behold, Ethereum, that once-celebrated second-largest crypto, now finds itself as popular as a forgotten sock in the laundry of institutional investors. What a twist of fate! 🧦

The contrast, dear reader, could not be more pronounced. The titans of finance—Fidelity, VanEck, and Grayscale—dance merrily around Bitcoin ETFs, while Ethereum languishes in a state of existential ennui, a mere spectator in this grand theater of wealth.

Even as the crypto market begins to bounce back like a rubber ball, ETH products remain as inert as a sloth on a Sunday afternoon. The message is as clear as a bell: Ethereum’s narrative, once a siren song, now fails to resonate with the discerning ears of investors—at least for the moment. 📉

Why ETH May Be Losing Institutional Appeal

Ethereum, that darling of the blockchain world, has long been lauded for its smart contract capabilities, yet this charm seems to have evaporated like morning mist. Alas, this appeal isn’t translating into ETF demand. Experts, those wise sages, suggest that without a compelling growth catalyst, ETH is losing ground to Bitcoin, which continues to reign supreme as the digital gold in the eyes of Wall Street. 🥇

Unless the winds of sentiment shift, Ethereum ETFs may find themselves trapped in this quagmire, struggling to break free—even if the broader market decides to don its bullish attire. 🐂

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD RUB PREDICTION

- EUR UAH PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- USD IDR PREDICTION

- Cardano’s ADA: $60M Whale Shopping Spree! Is $1 in Sight? 🐋💰

- Ethereum’s Great Dive: Shorts Party While Longs Cry Into Their Wallets

- Dogecoin Bulls Take Over: 54% of Traders Go Long as Whales Scoop Up 800 Million DOGE!

2025-04-18 17:10