Over the past five days, Bitcoin (BTC) has been moving within a narrow band, fluctuating between roughly $83,000 and $86,000. This price behavior indicates uncertainty, as both the market’s movement and technical indicators are showing signs of indecision.

As a researcher, I’ve noticed a downward trend in the number of whale wallets, which is concerning. However, on-chain data indicates that large investors are still showing significant interest in Bitcoin. On the technical analysis front, Bitcoin appears to be in a period of consolidation, with Equalized Moving Averages (EMA) showing weakness and Ichimoku readings providing mixed signals.

Bitcoin Whales Pull Back: Early Sign of Fading Confidence?

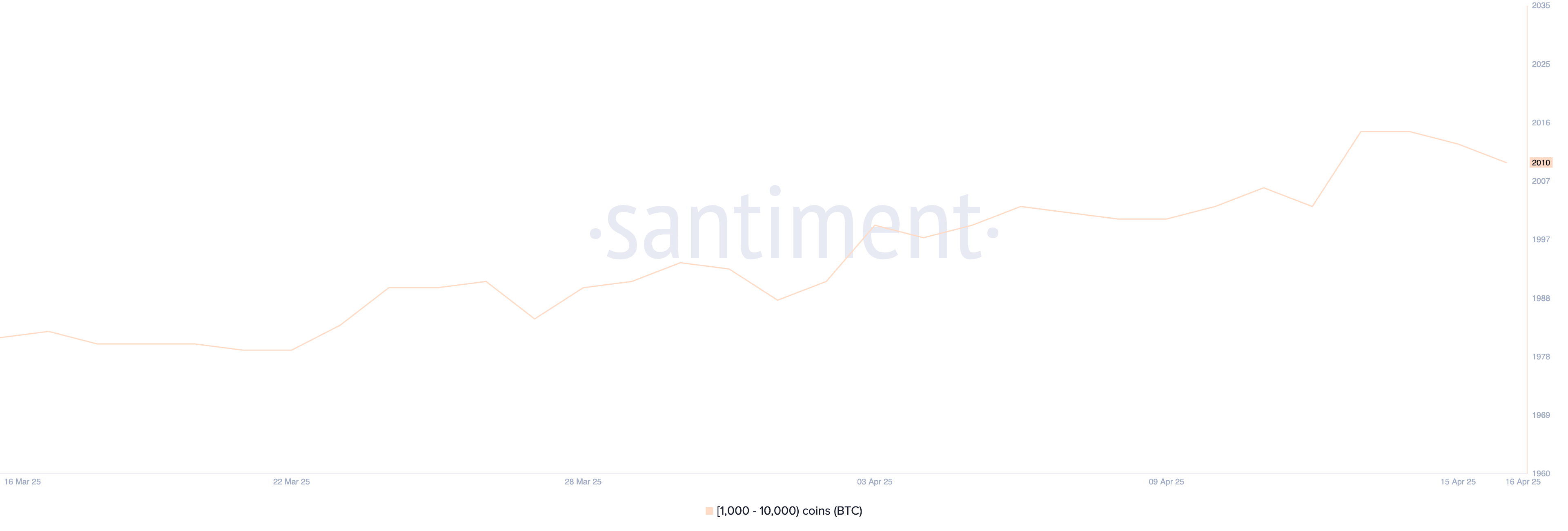

In the last few days, there’s been a slight decrease in the number of Bitcoin ‘whales’, which are wallets containing between 1,000 and 10,000 Bitcoins each. Specifically, as of April 14, we had 2,015 such whales, but by April 16, that figure dropped to 2,010.

After reaching its peak since May 2024, this retracement might indicate a possible change in attitude among significant investors, hinting at a potential shift in their sentiments.

Although a minor shift might appear insignificant, alterations in whale behavior frequently foreshadow larger market patterns. Therefore, it’s wise to keep an eye on even the tiniest adjustments.

The actions taken by whales, being major investors, are crucial indicators on the blockchain as they have the power to substantially impact market fluidity and potential price trends.

A rise in the number of whale wallets typically indicates that they are amassing and showing faith for the long term, whereas a decrease might imply strategic selling for profits or a shift towards more cautious investment strategies.

Lately, the drop following the highest point might suggest that certain big investors are reducing their involvement in the market due to increasing unpredictability. Should this trend persist, it could hint at a decline in strong institutional belief, which might temporarily impact Bitcoin’s cost.

Bitcoin Stalls Near Ichimoku Pivot as Momentum Fades

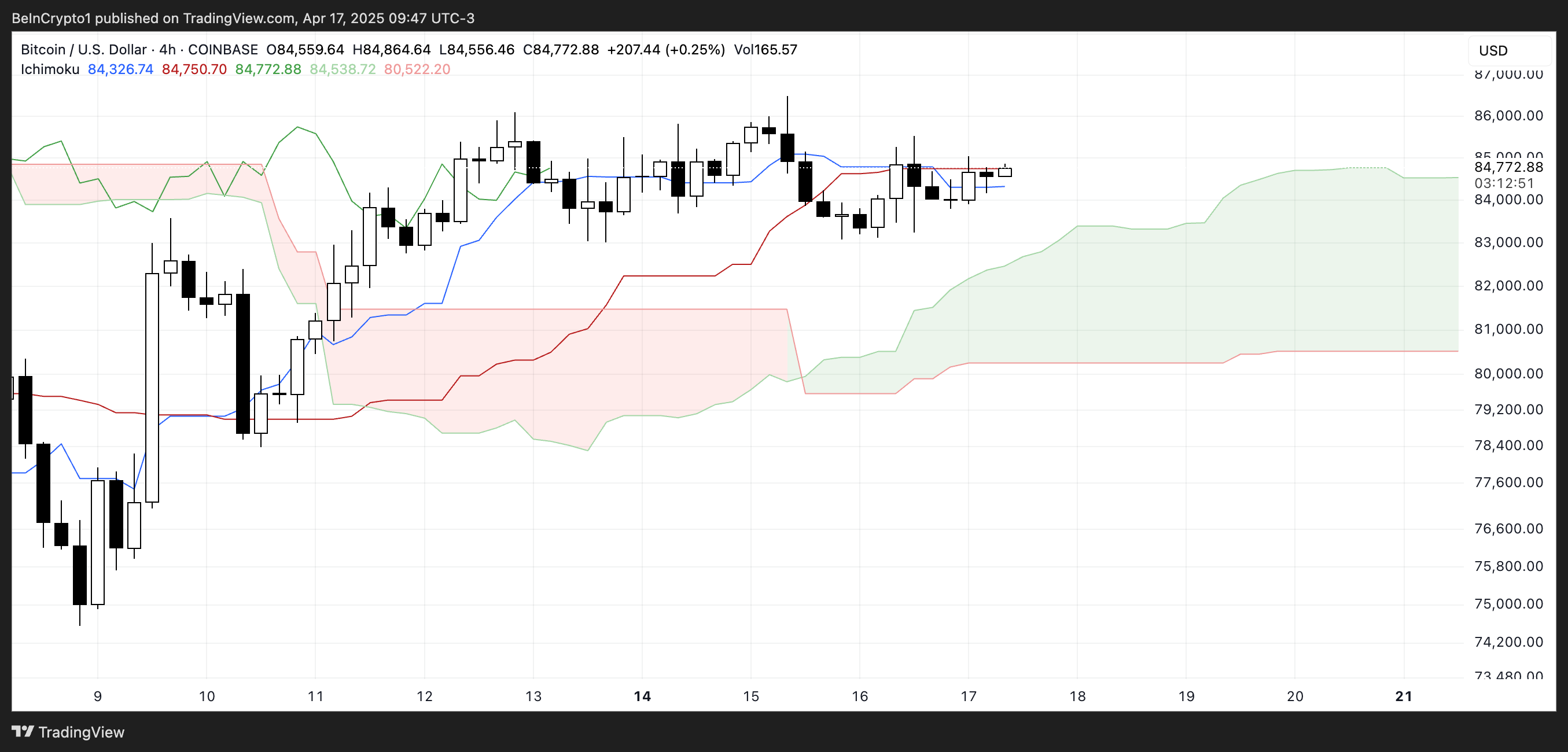

In simpler terms, when looking at the Ichimoku Cloud chart for Bitcoin, we’re seeing a phase where the price is holding steady. At the moment, the price is hovering close to the midpoint, represented by the blue Tenkan-sen and red Kijun-sen lines, which are currently sitting quite close together.

This arrangement seems to show no immediate directional movement, with both lines moving horizontally rather than up or down. Essentially, it appears that the market is in balance, with an equal number of buyers and sellers.

Upcoming clouds indicate a positive trend. The upper green boundary (Senkou Span A) surpasses the lower red boundary (Senkou Span B), however, the gap between these two boundaries is quite small.

This suggests that the bullish force isn’t particularly strong at present. Currently, the price is slightly above the cloud, indicating a potential positive development, yet there hasn’t been a definitive surge beyond the Tenkan-sen line and previous highs, which keeps the direction uncertain.

Chikou Span (lagging line) is overlapping with recent candles, reinforcing the sideways movement.

Generally speaking, Bitcoin seems to be stabilizing within a range that leans slightly toward optimism, though a more powerful surge is required to definitively establish an upward or downward trajectory.

Bitcoin Struggles for Direction as Key Levels Loom

In simpler terms, the moving average lines for Bitcoin right now aren’t showing any clear direction up or down, suggesting a lack of strong momentum. The trading activity seems to be indecisive, as both buyers (bulls) and sellers (bears) seem unsure about their next move.

As a crypto investor, I’ve noticed that the crucial support level sits around $83,583. If this level isn’t strong enough to withstand any potential selling pressure, we might see a steeper correction unfold. In such a scenario, my expectation is for the market to drop towards the next support at approximately $81,177.

As a crypto investor, I’m keeping a close eye on Bitcoin’s price movement. If it breaks below its current level, there’s a possibility that it might dip below the psychological $80,000 mark again. Should this happen, my attention would shift towards the potential downside target of around $79,890.

But if bulls are able to reclaim control, there’s a chance that Bitcoin might start heading towards recovery. The initial significant resistance is located at approximately $86,092; surpassing this barrier could indicate a resumption of positive price movement.

Moving forward, potential peak prices could reach approximately $88,804, with a stronger trend possibly pushing it to around $92,817.

The highest prices we might see would be about $88,804, and if things keep going well, maybe even $92,817.

Achieving this point could signify surpassing $90,000 for the first time since March 7, which may encourage new enthusiasm among individual and professional investors alike.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- Discover the Hidden Gems: Altcoins Under $1 That Could Make You Rich! 💰

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Brent Oil Forecast

- Crypto Drama: Sui’s Price Soars Like a Pigeon in a Storm! 🐦💸

- Uniswap Explodes: $1B TVL Surge – Buy or Bail? 🚀

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- SOL’s October Drama: ETFs, Upgrades, and $350 Dreams? 😱💸

2025-04-17 23:07