Bitcoin, that beacon of digital hope, has once again been thwarted by the infamous $85,000 ceiling this week. It’s like watching someone try to squeeze into their high school jeans—it just ain’t happening.

The true believers clutch their virtual wallets tighter as Bitcoin stubbornly refuses to rocket upward. Meanwhile, open interest is folding faster than my failed soufflés, and ETF investors are running for the exits, dragging a cool $170 million with them.

Bitcoin Spot ETF Outflows: The Great Escape

Spot Bitcoin ETFs have been the opposite of welcoming lately—with $171.1 million flying out the door on a single day, Wednesday, April 16, as if the market just smelled bad gas. Investors, who once sang Bitcoin’s praises from rooftops, are now giving it the side-eye, unsure if it’s going to take off or just crash and burn in a blaze of digital glory.

These exoduses from ETFs paint a picture of a market less “moon mission” and more “waiting for the bus that never comes.” The $85,000 mark is acting like a strict bouncer at a nightclub—and Bitcoin’s on the wrong side of the velvet rope.

Open Interest: The Wallflower at the Crypto Dance

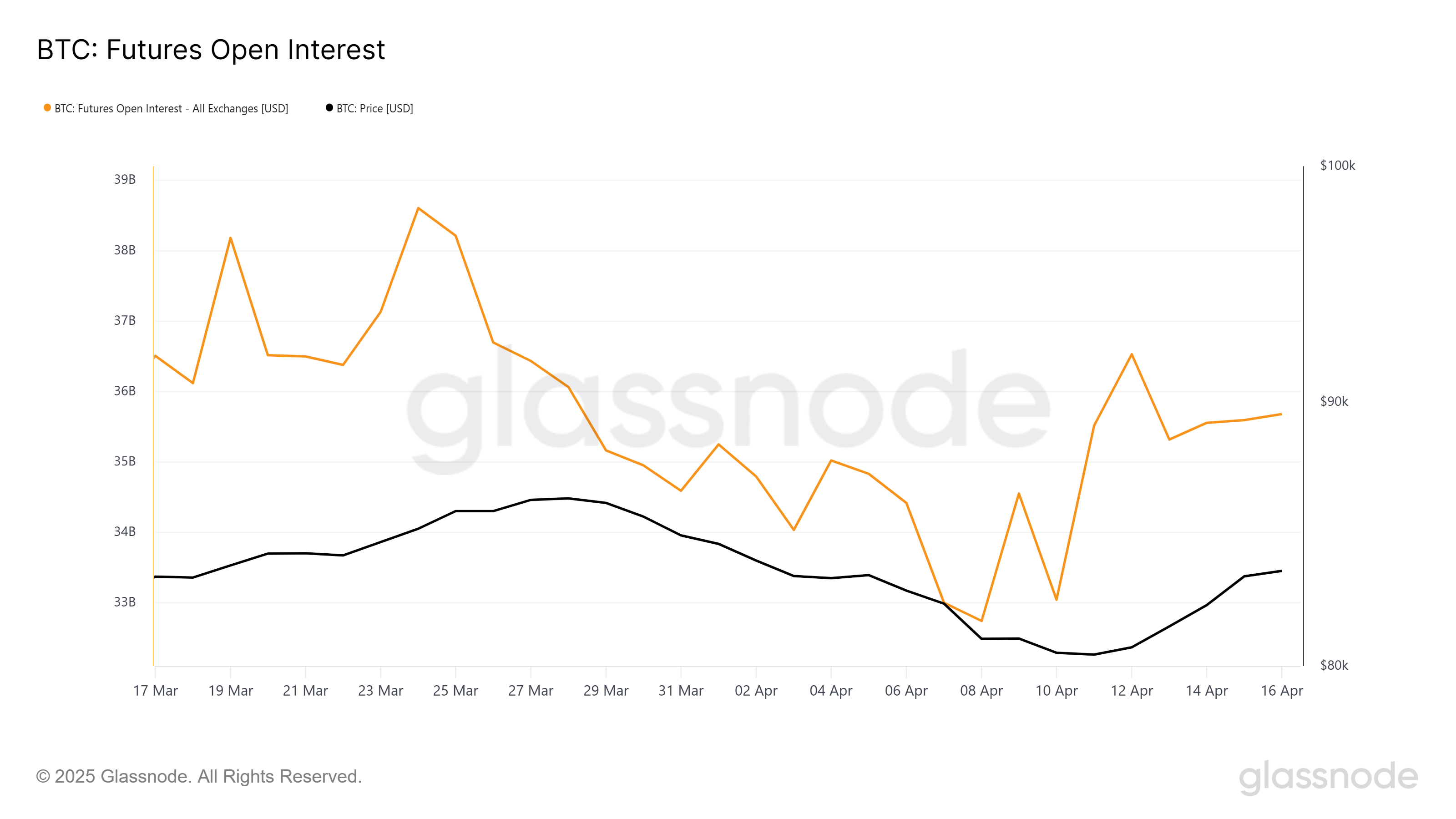

With open interest hanging around $36 billion, Bitcoin looks like that hesitant wallflower who just can’t figure out if they want to dance or call it a night. Early year optimism is now a distant memory, replaced by a collective shrug from traders who seem to have misplaced their enthusiasm somewhere between ‘pump’ and ‘dump.’

This awkward pause, with no one willing to commit, suggests Bitcoin is stuck on the crypto hamster wheel. Without renewed bets, it seems destined to hover, limp, or generally just linger like a guest who won’t quite leave the party.

Funding Rate: A Glimmer of Optimism or Just a Flash in the Pan?

After a gloomy stint in the red, Bitcoin’s funding rate has finally turned a cautious shade of positive. Think of it as the cryptocurrency equivalent of smiling politely at someone you don’t really want to talk to.

This pep talk might spark some confidence, but let’s not put the champagne on ice just yet. Positive funding rates are like flirting—they don’t guarantee you’re going home together, but hey, it’s a start.

Calls vs. Puts: The Battle of Hope and Despair

In a twist worthy of a daytime soap, call options are outnumbering puts—169,760 calls placed and counting. This means traders are betting on a bullish comeback, which sounds great until you remember Bitcoin has the stubbornness of a mule.

Will Bitcoin finally break the $85,000 glass ceiling? Or will its price remain stuck, like a bad plotline nobody asked for? Only time—and maybe a miracle—will tell. For now, let’s just enjoy the suspense and keep our fingers crossed (or better yet, our investments diversified).

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Unleashing the XRP Kraken: Will It Really Reach $15? 🤔🚀

- ZK Price: A Comedy of Errors 📉💰

2025-04-17 12:21