In the grand theatre of crypto, the mighty whales, those colossal custodians of bitcoin, now appear to have paused their relentless feasting—though they have not quite disappeared. The wise sages at Cryptoquant observe a market mired in a sea of cautious indecision, as if every player waits for some invisible hand to stir the waters.

Cryptoquant: The Great Accumulation Siesta

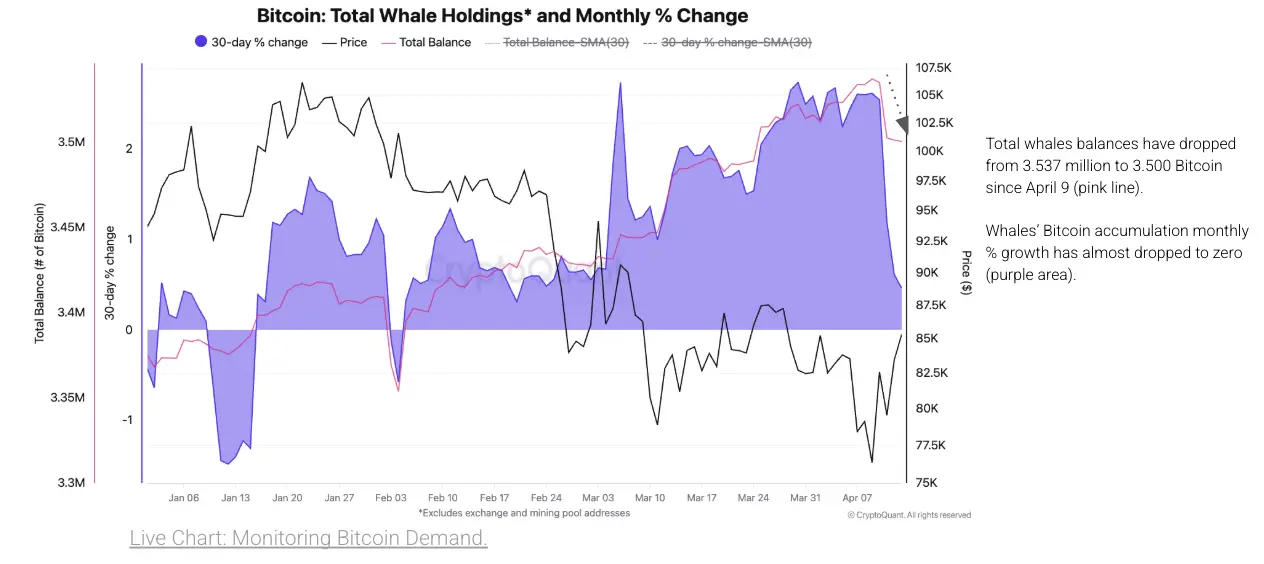

Once, in the halcyon days not so long ago, Cryptoquant noted a torrent of bitcoin—bold and brash, 800,000 BTC daily—cascading from the hoards of large holders. Now, that torrent dwindles to a mere trickle of 300,000 BTC, a retreat not from confidence but surrender. The great whales, facing the cruel sting of prices dipping beneath the fabled $80,000 mark, have been nursing their wounds, shrinking their treasure troves by some 30,000 BTC just this past week. One might almost imagine them muttering, “Better safe than sunk.”

Yet, just as a lazy river refuses to rush, so too has the monthly accumulation rate stalled at a paltry half a percent—the slowest languor since late February. From the bustling hub of Seoul, the Cryptoquant scribes highlight another drama: miners offloading 15,000 BTC at the brief summit of $74,000—arguably a nervous gesture revealing shrinking margins. Profitability has plummeted from a regal 53% down to a meek 33%, victims to the relentless tide of record hashrates and stingy transaction fees. Meanwhile, their Bull Score Index lingers near a somber 20, suggesting sentiment as dreary as a Russian winter, unwilling to rise except in fitful, fleeting moments.

Adding to the comedy (or tragedy) is the titanic tug of macro forces—the US and China locked in tariff skirmishes like two proud landowners squabbling over fences. This discord chills whale enthusiasm and mutes risk appetite, leaving accumulation a fragile, hesitant thing. Neither whales nor miners seem eager to dance toward a sustained bitcoin crescendo just yet.

Cryptoquant’s sages pronounce that until the accumulation flame rekindles and miners clutch their inventories tighter, bitcoin may wander its familiar circumference—rallies threatened by sudden surges of supply. While lower prices may stir whale interest like a faint beacon, only when the Bull Score breaches the hallowed threshold of 40 will we witness a true dawn of optimism. Till then, the cryptic saga continues, much like an epic Tolstoyan novel—long, intricate, and replete with sighs, pauses, and the occasional ironic grin. 🤨📉💸

Read More

- Gold Rate Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Brent Oil Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Crypto Riches or Fool’s Gold? 🤑

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Silver Rate Forecast

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

2025-04-17 02:58