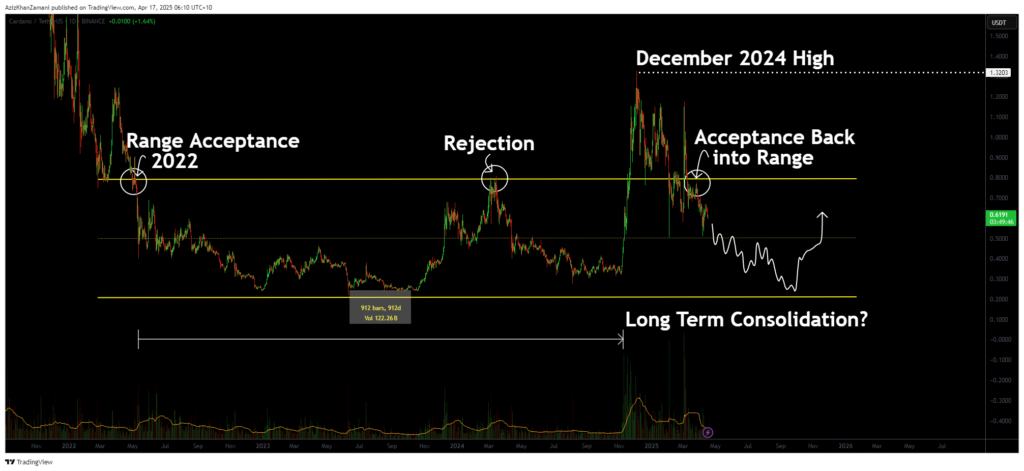

As a researcher studying the cryptocurrency market, I’ve noticed that Cardano (ADA) has recently re-entered a significant multi-year trading range it last exited in late 2024. After an initial breakout lacking substantial volume strength, the asset has failed to maintain its elevated levels, indicating potential weakness. This return to the established trading range could significantly influence Cardano’s future price movement over medium to long terms for traders to consider.

Key points covered

- ADA has closed multiple candles back within a multi-year trading range, signaling true acceptance

- The 2024 breakout lacked volume confirmation, indicating a potential climactic top

- A move towards the lower support region is increasingly likely as ADA seeks true market value

For approximately three years, from 2022 onwards, ADA’s trading remained within a specific bandwidth. But in December 2024, ADA made a significant move beyond this range for the first time, reaching a new peak. However, this breakout seemed incomplete as it lacked the substantial volume needed to support it. An immediate drop in trading activity following the breakout hints at decreasing energy, indicating a potential climax rather than a continuous bullish run.

The price of ADA has dropped below its range’s high and ended several candles under it, suggesting it is moving back into the range. This development, from a structural perspective, indicates that ADA might be heading back toward its value zone, possibly towards the lower end of its long-term range.

The volume profile supports this notion. The rise to December’s highs didn’t reflect consistent buyer interest. Instead, the volume dropped significantly, suggesting that the breakout could have been driven by speculation rather than strong conviction. In such instances, the price frequently retraces to equilibrium levels to reconsider fair market value.

What to expect in the coming price action

As I, the researcher, observe Cardano (ADA) now residing within its long-term price range once more, it seems plausible that a gradual descent towards the lower support zone could be on the horizon. It is advisable for traders to practice patience, refraining from impulsive trades until there’s either a clear trend reversal or a test of the lower boundary. The potential for optimal gains might present itself when ADA shows signs of consolidation and forming a distinct structure near the bottom end of this historical price range.

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Crypto Riches or Fool’s Gold? 🤑

- Silver Rate Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

2025-04-17 00:50