Ah, beyond the mere dilettantes of Bitcoin and the pedestrian charms of Ethereum, and those stablecoins clinging desperately to the US Dollar like debutantes to their chaperones, a dazzling new carnival emerges: Real World Assets (RWAs) pirouetting upon the blockchain stage. Picture, if you will, owning a smidgen of gold, a slice of a stodgy old mansion, or even a whisper of a company—all distilled into gleaming digital tokens that pirouette across the internet with the speed of gossip at a ballroom.

This, dear reader, is the tantalizing promise of RWA tokenization. Projects embroider reality’s fabric and reweave it into shiny tokens living on blockchains named Ethereum, Polygon, or Base, because “charming” and “mundane” simply won’t do anymore. Take PAX Gold (PAXG): a token as faithful as a butler, each representing one troy ounce of physical gold secured somewhere deep and dark—likely with better protection than your secrets. ✨

Yet, amid this gleeful masquerade blooms a tragic conundrum: how to ensure the price of such a token waltzes in perfect step with the real-world value of its boudoir jewel—the actual gold? For gold’s price is dictated not in the crypto parlors but by colossal, mysterious global markets where gentlemen with cigars and questionable morals decide such fancies. Should the token’s price stray into the realms of fantasy, its dignity evaporates, and usefulness flees faster than scandal at a debutante ball.

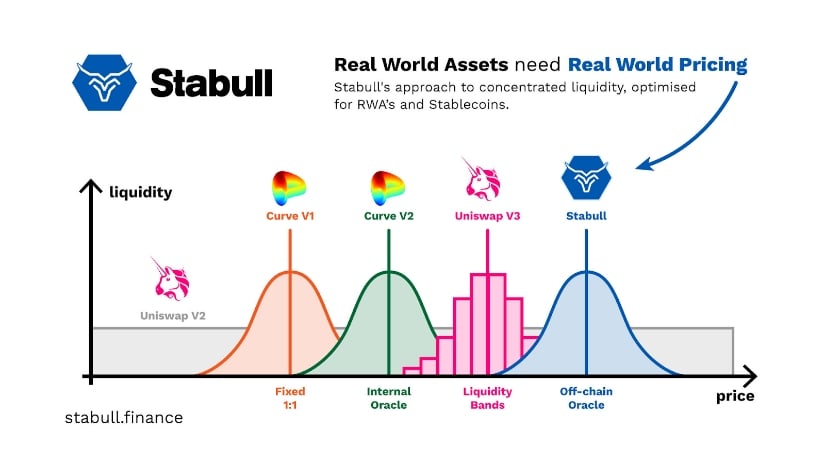

Enter Stabull Finance, a Decentralized Exchange with a mission more noble than most—to not only dignify stablecoins but also cradle tokenized commodities and RWAs with the tender care of a Victorian governess. Their secret weapon? Blockchain oracles—those curious creatures that fetch off-chain truths like a well-trained spaniel retrieving the morning papers. Let us delve into how Stabull’s oracles keep these precious tokens honestly priced, much like Charing Cross keeping London’s secrets.

The RWA Pricing Fiasco: When Real-World Gossip Matters

Unlike the theatrical spectacles of Bitcoin, whose prices are whipped up by crypto enthusiasts’ buying frenzies, RWAs such as gold—PAXG’s muse—derive their valuation from the real world’s intricate dance of supply, demand, and the occasional geopolitical brouhaha.

For PAXG to maintain its aristocratic poise on Stabull’s exchange floor, its price must shadow the ebbs and flows of the off-chain market with the faithfulness of a courtesan’s admirer. Otherwise, calamity looms:

- Loss of Credibility: Like a duchess caught at a carnival, the token loses its raison d’être when it does not mirror reality.

- Arbitrage Exploitation: Canny traders—those vultures in designer cloaks—could feast upon price disparities, turning liquidity pools inside out like an ill-fitting waistcoat.

- Reduced Utility: The token’s usefulness dwindles to that of a wilting corsage, scarcely suitable for hedging, investing, or posturing in polite conversation.

Henceforth, the need arises for a mechanism as steadfast as a butler’s loyalty to continuously funnel external price whispers into the blockchain’s unyielding embrace.

The Oracles: Blockchain’s Very Own Mystics

Blockchains, alas, are hermits by default—closed systems refusing to peek beyond their digital cloisters. Here is where oracles prance in, dressed as messengers with credentials far more persuasive than your average gossip columnist. They trawl the external markets, summon prices from lofty commodity exchanges, and present this intelligence to smart contracts with impeccable discretion.

Stabull specifically courts the oracle grandeur of Chainlink, which does not merely nod sagely but actively fetches, corroborates, and faithfully transmits the gold price (XAU/USD) onto Ethereum or Polygon chains, ensuring that the blockchain’s brain is not bereft of worldly wisdom.

Stabull’s Oracle-Powered Ballet: The AMM That Dances to Real Prices

Knowing the price is but the prelude; the true enchantment lies in Stabull’s AMM—a “4th generation” Automated Market Maker that could give any automatons a run for their money.

The old-school AMMs, like flustered debutantes, depend solely on token ratios in their pools, which can wax and wane wildly. Buy a mountain of PAXG, and the pool price pirouettes upward, uncaring of gold’s actual ballroom number, until sharp arbitrageurs sweep in to restore decorum—often too late and inadequately.

Stabull, however, is no wallflower. It proactively inveigles the oracle price as its grand marshal:

- Liquidity in a Corset: Most liquidity clusters tightly around the oracle’s announced price (say $2400/oz), rather than sprawling lazily across the range like a lazy aristocrat at tea.

- Hybrid Invariant Curve: A charmingly subtle mathematical formula ensures prices change ever so gently near the oracle’s proclamation, reducing the nasty jolt of slippage that besmirches amateurish traders’ dreams.

- Oracle-Driven Pirouettes: The moment Chainlink whispers a new price, Stabull’s smart contracts recalibrate, elegantly repositioning the liquidity to the updated target—no need for frantic arbitrage footwork.

Imagine a cosmic scale, where the oracle nudges the pointer to the actual weight, and the AMM faithfully balances its tokens to that ideal without the usual drama. 🎩

A delightful comparison: The gold’s real-world ballroom number vs the PAXG’s dance on UniSwap Polygon—sometimes they synchronize; often they flirt with chaos.

Why Stabull’s Oracle Waltz Matters for RWA Trading

To those who fancy dabbling in tokenized assets, Stabull offers a venue resplendent with virtues:

- Price Accuracy: Traders may sip their digital tea assured that PAXG trades near the true gold price—a rarity in these capricious times.

- Minimal Slippage: Because liquidity lounges close to the oracle’s decree, trades slip by smoothly, unlike the usual market thud.

- Reduced Impermanent Loss: LPs find their risks tamed, for their token pairs dance obediently to the real-world tune—not some volatile frenzy.

- Capital Efficiency: Capital is neither squandered nor slothfully spread but tightly focused where it murmurs most profitably.

- Reliable Arbitrage Hooks: When tiny discrepancies emerge, savvy arbitrageurs waltz in for quick, riskless profits, restoring grace and order.

Stabull In Action: A Gold-Backed Soiree

On the splendid Polygon stage, one may connect their wallet and transform dull USDC tokens into sparkling PAX gold—priced meticulously by Chainlink’s oracle. Swap back? Naturally, with the same poised elegance, less the modest 0.05% tip for the house. With more commodity partners courting Stabull, the future resembles a glittering ball of endless possibility.

The Grand Vision: Stabull as RWA’s Trusty Butler

The tokenization of Real World Assets portends the next grand odyssey of finance—transforming dusty ledgers into vibrant digital treasures. Yet, such dreams crumble without dependable pricing—a task Stabull embraces with aplomb. By entwining trusted oracles into its very heart, it ensures the blockchain ball is never led astray by fanciful illusions.

Others may list RWAs, but Stabull’s oracle-guided AMM waltz ensures the dance remains dignified, the prices just, and the players happy. For what is a token, if not a promise—and what civilized society tolerates broken promises? Stabull’s oracle-powered precision ensures the tokenized gold you trade is no mere fantasy but a glittering reality. And that, dear interlocutor, is how the blockchain learned to trust its own shadows. 🥂

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- USD THB PREDICTION

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

- Silver Rate Forecast

- You Won’t Believe How $3B in Real Estate Is Now Just Tokens. Mind-Blowing, Right?

2025-04-16 23:18