Bitcoin (BTC), that enigmatic digital chimera, has surged 9% in the past week, flirting shamelessly with the $88,000 mark. Momentum indicators like the DMI and Ichimoku Cloud are flashing green like a traffic light on steroids, signaling that buyers are firmly in the driver’s seat. 🚦

If this upward trajectory persists, BTC might soon test resistances near $88,000, with $90,000 as its next conquest. But, as always, the specter of Trump’s trade tariffs looms like a dark cloud over this digital carnival, threatening to rain on the parade and send BTC tumbling back to the $81,000 support zone. 🌧️

Bitcoin DMI: Buyers Flexing Their Muscles

Bitcoin’s DMI chart is a sight to behold, with the ADX climbing to 29.54 from 24.07 in a single day. This surge suggests that the current move is gaining momentum, pushing the ADX tantalizingly close to the 30 threshold—a number that traders treat like the Holy Grail of trend confirmation. 📈

While the ADX doesn’t indicate direction on its own, when paired with directional indicators, it’s like a compass pointing to the prevailing force in the market. The +DI is holding steady at 23.47, while the -DI has plummeted to 9.45, signaling that bearish pressure is as weak as a wet paper towel. 🐻➡️📉

This widening gap between bullish and bearish momentum is a clear sign that buyers are in control. If the ADX continues its ascent above 30, it could validate a new bullish phase for BTC, much to the delight of crypto enthusiasts everywhere. 🎉

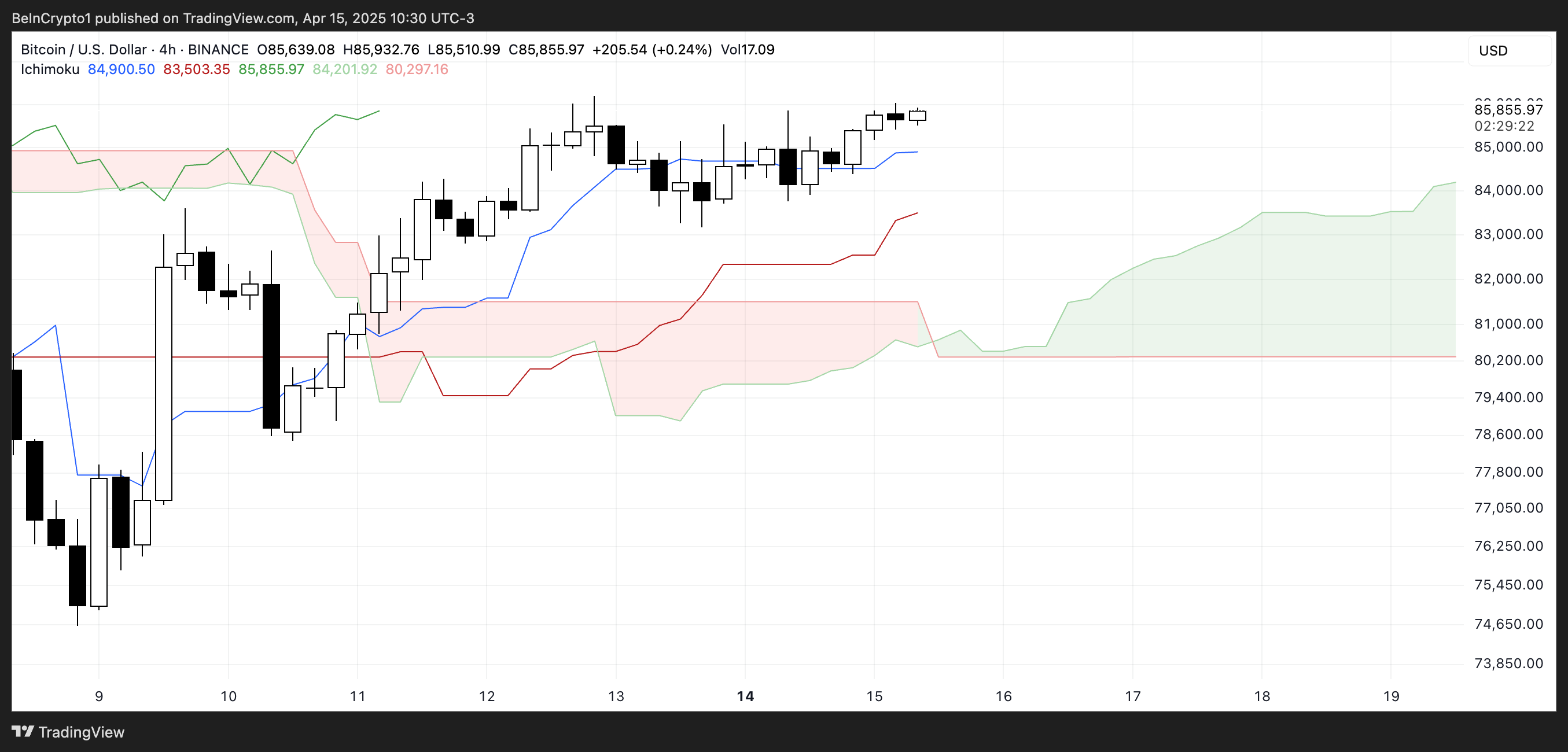

BTC Ichimoku Cloud: A Bullish Oasis

Bitcoin’s Ichimoku Cloud chart is a veritable oasis of bullishness, with the price holding firmly above both the Tenkan-sen (blue line) and Kijun-sen (red line). This positioning suggests that both short-term and medium-term momentum are firmly in favor of buyers. 🐂

The flat Kijun-sen could act as a strong support area, while the rising Tenkan-sen shows that buyers are still active on smaller timeframes. The Kumo (cloud) is green and steadily rising, reinforcing a positive outlook for the coming sessions. 🌈

The price is well above the cloud, indicating that the trend is not just bullish but firmly established. There’s also a clear gap between the current candle and the cloud, suggesting that the market has room to retrace without shifting the overall structure. As long as the price stays above the Kijun-sen and the cloud remains green, the bullish trend remains technically intact. 🛡️

Will Bitcoin Break Above $90,000? The Million-Dollar Question

If Bitcoin maintains its current momentum, it could soon challenge the resistance at $88,839, with $90,000 as a psychological milestone. Should the uptrend remain strong, further targets lie at $92,920 and potentially $98,484, marking a continuation of the bullish structure. 🚀

However, crypto analyst and Coin Bureau founder Nic Puckrin warns that this momentum could be as fleeting as a politician’s promise. He notes that renewed uncertainty around Trump’s trade tariffs might weigh on BTC:

“The caveat here is that all this positive momentum could disappear in a puff of smoke if there’s any backpedalling on tariffs or an unexpected shock announcement – which we all know is always a possibility. In fact, we continue to have constant back-and-forth on tariffs: exemptions on electronics turned out to be temporary, the details of when tariffs will come in are lacking, and so on,” Puckrin told BeInCrypto.

He also defends that the $81,000 support could be tested again:

“This, perhaps, explains why Bitcoin is, once again, in a “wait and see” pattern, with low liquidations at under $200 million pointing to uncertainty in the market. If we don’t see any external shocks, $88,000-$90,000 is the next range to watch, with liquidity pool clusters at this level suggesting we will see an uptick of volatility here. However, a short-term correction to re-test support at $81,000 would be healthy and, as long as BTC remains above this threshold, would even point to a sustainable price recovery,”

Overall, it looks like the current macroeconomic factors are priced in. Yet, the market is cautious about sudden surprises, as Trump’s recent tariffs went beyond any conventional economic trend and disrupted almost every global financial market. 🌍💥

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD RUB PREDICTION

- EUR UAH PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- NFT Crash Comedy: Markets Bounce Back in Hilarious Tantrum! 📉😂💸

- Crypto Drama: Sui’s Price Soars Like a Pigeon in a Storm! 🐦💸

- Shiba Whales Throwing Cash? 🐳💰

- New ETF: Bitcoin and Gold Tango to Save Your Wallet from Currency Woes!

2025-04-15 22:38