In an unceremonious twist of fate, the crypto investment sphere experienced an exodus of $795 million last week alone, culminating in a staggering total of $7.2 billion withdrawn since February. Bitcoin led this dismal parade, while altcoins like XRP and Ondo casually flaunted their meager gains, like a kid with a participation trophy.

Digital Asset Exodus: $7.2 Billion Vanished as XRP Plays Rebel

The realm of digital assets bore witness to yet another grim week, burdened by an outflow of $795 million as the specters of global economic anxiety and tariff apprehensions haunted investors like a relentless ghost.💀

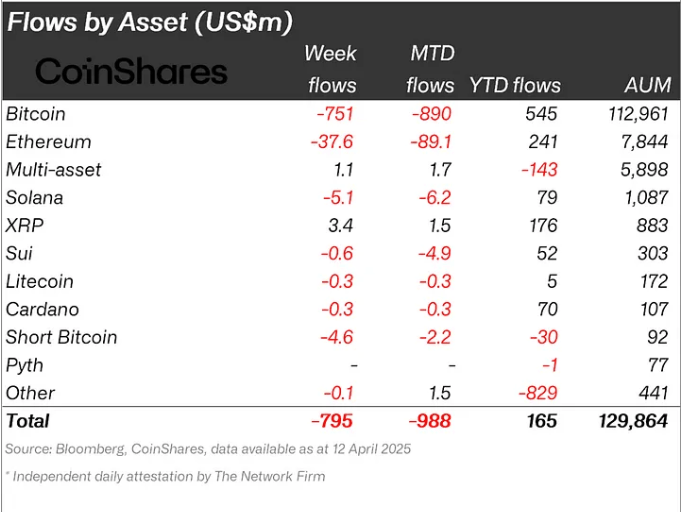

As detailed in Coinshares’ latest weekly report, this marks a trifecta of weeks clad in negativity, stripping away nearly all year-to-date gains to a mere $165 million — a disheartening detail indeed.

Once again, Bitcoin bore the brunt, wearing the crown of loss with $751 million in outflows. All the while, it clings to a shocking $545 million in net inflows for 2025, a glimmer of hope in a sea of despair. Ethereum followed in its footsteps with $37.6 million swept away, while Solana, Aave, and Sui joined the decline, like comrades falling in a battle gone awry.

Curiously, even the short-selling of Bitcoin didn’t escape the carnage, witnessing $4.6 million in redemptions, which suggests that uncertainties loom larger than clear directional convictions, as if investors are wandering the desert without a compass. 🏜️

Yet, not all tokens felt the sting of loss. In an unexpected twist of fate, XRP swam against the current, drawing in $3.5 million in inflows, prompting some to chuckle at the irony. Interestingly, smaller victories were celebrated by Ondo ($460k), Algorand ($250k), and Avalanche ($250k). 🥳

In a bizarre conclusion to this gloomy saga, a slight market rebound occurred late in the week, sparked by President Trump’s delightful game of tariff reversals, nudging total crypto assets under management back up to $130 billion — an 8% uplift from recent lows. Whether this flicker of hope signifies a change in sentiment remains an open question, tantalizingly hanging in the air like the last slice of pizza at a party.

Read More

- Gold Rate Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- XRP: The Calm Before the Storm?

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Riches or Fool’s Gold? 🤑

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

2025-04-15 00:57