In the grand theater of cryptocurrency, Ethereum has recently strutted onto the stage with an air of bravado, breaking through resistance levels like a juggler at a circus. As the market pitchforks its way to dominance, Bitcoin seems to wink mischievously from its lofty perch above $85,000, leaving Ethereum to scrabble for scraps and accolades. Yet, as ephemeral as a ghost at a midnight soirée, Ethereum dances near a descending resistance line, kissing bullish momentum like a long-lost lover. But hold your applause! Whispers of dropping whale interest threaten to spoil the night.

Ethereum’s Whale-Watching Tour: Abandon Ship? 🐳

With a twirl and a flourish, Ethereum has seen its buying interest swell with a heart-pounding 6% price increase over the past week. Alas, dear comrades, the drama of the numbers unfolds as approximately $82.8 million worth of trading positions in Ethereum face the guillotine, with buyers losing about $43.5 million, while sellers clink champagne glasses with a mere loss of $39.2 million. Talk about a party gone wrong!

Just last week, our friend ETH dove to the depths not seen since March 2023, but fear not! A lull in tariffs wafted through the air like incense, allowing some minor recovery. However, investor confidence remains as shaky as a tightrope walker on a windy day. The ghosts of Glassnode reveal that wallets holding at least $1 million worth of ETH are dwindling, their numbers now at their lowest since January. The wealthy are evidently on an unannounced vacation—good luck fitting these high rollers back at the table!

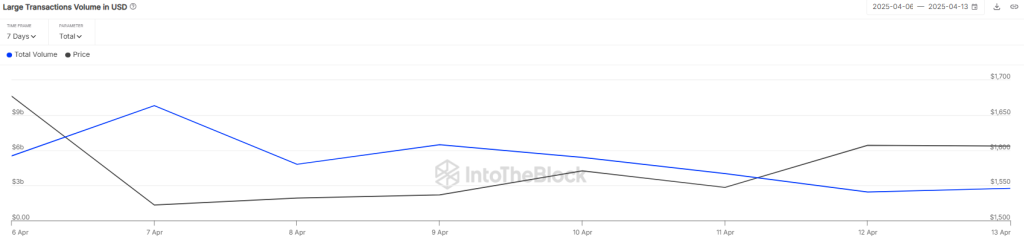

To add a pinch of salt to this already spicy stew, IntoTheBlock reports a worrying decline in large Ethereum transactions. Whale activity has plummeted from an impressive $9.81 billion to a paltry $2.75 billion. It seems those wealthy aquatic creatures are swimming somewhere else these days. On April 14, one notable whale sauntered over to the Kraken exchange, moving 20,000 ETH (a casual $32.4 million) like a seasoned card shark preparing to cash out.

In an unexpected twist, an early investor from Ethereum’s 2015 ICO is playing the role of the hapless villain, selling their treasure like there’s no tomorrow. On April 13, this financial trickster unleashed 632 ETH, worth around $1 million. Bravo, dear whale!

Meanwhile, the ambiance of market sentiment is mixed—like a smoothie made of grapes and pickles—and Ethereum’s open interest has dipped by 1.16%, landing around $17.91 billion. This veiled decrease might just put the brakes on Ethereum’s ambitious recovery, conjuring the idea of a short-term pullback. Oh, the drama of it all! 🍷

ETH Price: The Crystal Ball Says…

Our gallant Ether has made a valiant rebound from the critical $1,500 level, as sellers play a losing game to push him lower. Buyers, those hopeful souls, have gathered around, determined to keep ETH above a descending resistance line and feed the bullish momentum like eager crows. Currently, ETH is frolicking around $1,640, boasting more than 2% gains in the last 24 hours. Prosperity knocks, but will it enter? 🥳

With the moving averages pointing toward the heavens and the RSI basking in positive vibes, our buyers hold the upper hand. If they can maintain their grip above that elusive descending resistance line, a meteoric rise towards the revered $2,000 level might soon follow—if only the fates allow.

On the flip side, if our villainous sellers muster their strength, they’ll need to drag the price below the EMA20 trend line. Such dark magic could send Ether tumbling toward $1,384—a vital support level. Should that breach occur, one could only brace for a shift in momentum—into the forbidding realm of the bears. Clearly, this roller coaster ride is not for the faint-hearted.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- Bitcoin’s Wild Ride: Is It a Rally or Just a Bunch of Greedy Investors? 🤔💰

- XRP: The Calm Before the Storm?

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

2025-04-14 22:52