In the midst of swirling market chaos and looming recession fears, public companies like Strategy and Metaplanet are boldly diving deeper into the Bitcoin waters. Strategy alone splurged a hefty $285 million on BTC, while Metaplanet didn’t shy away, spending a more modest $26.3 million.

What makes Metaplanet’s recent antics stand out, you ask? Well, let’s just say Japan’s 30-year treasury yields are soaring, and typically, in such uncertain times, companies would sprint away from the dollar. But nope—Metaplanet is out here making Bitcoin moves like it’s business as usual. A bold strategy, indeed!

Strategy and Metaplanet: Not Just ‘Buying the Dip,’ But Staking Their Claim

Now, let’s take a look at Strategy (formerly known as MicroStrategy) — a titan of Bitcoin holdings. If you’re wondering about the recent chaos, it’s due to constant swings between massive BTC buys and abrupt pauses, making the whole situation feel like a soap opera for crypto nerds.

But here we are, with Strategy’s Chair, Michael Saylor, dropping the mic with an announcement about a new $285 million Bitcoin buy:

“Strategy has acquired 3,459 BTC for ~$285.8 million at ~$82,618 per bitcoin and has achieved BTC Yield of 11.4% YTD 2025. As of 4/13/2025, Strategy holds 531,644 BTC acquired for ~$35.92 billion at ~$67,556 per bitcoin,” Saylor proudly proclaimed on social media.

The chaos? Oh, that’s all because of recession fears causing Bitcoin’s price to flip-flop like a pancake. When BTC was down, speculation ran wild, with folks wondering if MicroStrategy would sell off its precious assets. But now that Bitcoin is on the up-and-up, Saylor and co. are back at it.

But wait! Strategy isn’t the only one on this Bitcoin-buying spree. Enter Metaplanet, a Japanese firm that, despite the economic turbulence, is loading up on BTC like there’s no tomorrow. Just two days before Strategy made its grand purchase, Metaplanet’s CEO Simon Gerovich dropped a similar bombshell:

“Metaplanet has acquired 319 BTC for ~$26.3 million at ~$82,549 per bitcoin and has achieved BTC Yield of 108.3% YTD 2025. As of 4/14/2025, we hold 4525 BTC acquired for ~$386.3 million at ~$85,366 per bitcoin,” Gerovich declared.

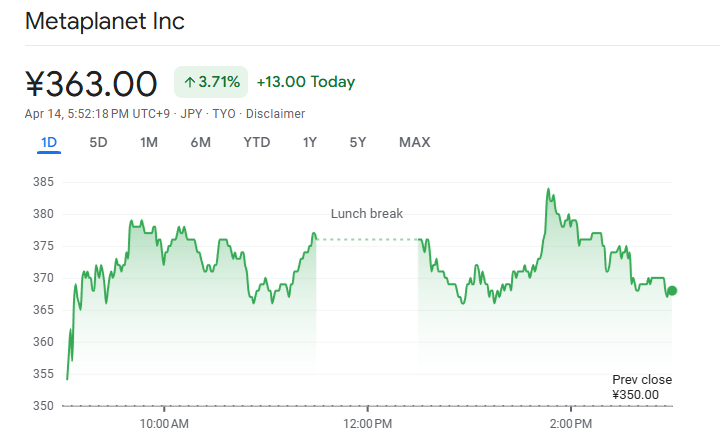

Here’s the kicker: Metaplanet’s bullish move flies in the face of traditional financial wisdom. After all, Japan’s bond yields are soaring, signaling a market riddled with risk aversion. But nope! Metaplanet is forging ahead with its Bitcoin obsession, and guess what? Their stock shot up by 3% today. Go figure!

In conclusion, corporate giants like Strategy and Metaplanet aren’t hitting the brakes on their Bitcoin acquisitions anytime soon. Despite the market rollercoaster, these companies seem to think Bitcoin either has the potential to soar or will remain a rock-solid store of value. Either way, their bold public bets are certainly shaking up the market.

So, when these big players go full throttle, it sends a message across the crypto world that, hey, maybe BTC isn’t such a bad idea after all. 🤑

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- USD THB PREDICTION

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

2025-04-14 19:42