- AAVE’s latest yield options now give fintech giants like Wise and Revolut a run for their money.

- The market’s been buzzing with excitement since the announcement, with buying activity soaring in the past 24 hours.

Outshining the Fintech Crowd

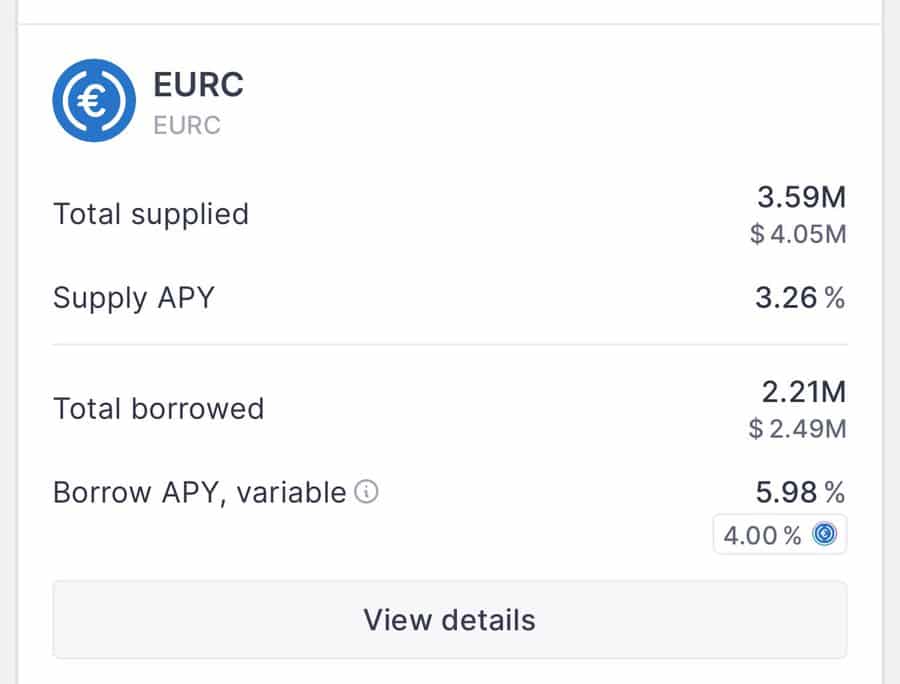

Now, let’s talk about the big revelation from Aave’s founder, Stani Kulechov. Apparently, Aave’s yield on EUR Coin has now surpassed the mighty fintech giants like Wise and Revolut, which—oh, the audacity—offer lower interest rates. Aave’s lenders can now pocket up to a respectable 3.28% APY, while Wise offers a humble 2.24% and Revolut a slightly better 2.59% (if you go for their Ultra plan). So much for that, right?

With such juicy returns, Aave’s starting to look like the go-to destination for anyone seeking to park their cash and earn something that doesn’t scream “I’m a bad idea.” Hello, yield-hungry crowd, Aave’s door is wide open!

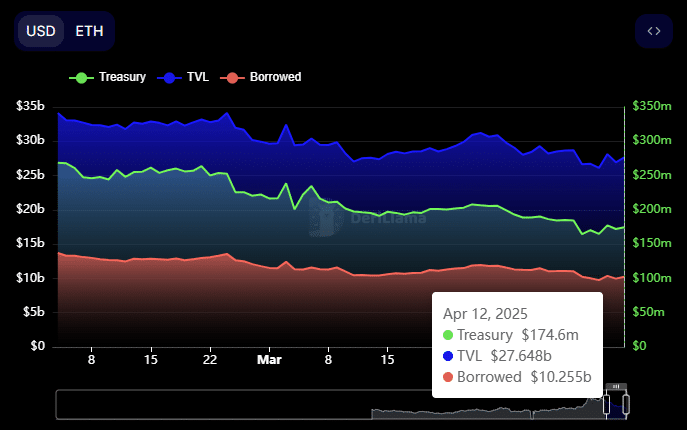

In fact, data from DeFiLlama is practically shouting, “Look at me!” The protocol has seen a serious uptick in liquidity, with borrowing hitting an impressive $10.255 billion. All signs point to growing user interest. Aave’s Total Value Locked (TVL) also rose to a cool $27.648 billion, signaling a firm vote of confidence from the market. Don’t call it a comeback—this is just the beginning.

All of this translates to one thing: more people are looking to take AAVE for a spin, and with any luck, this could push its value skyward. Or at least make those price charts look a little more interesting.

The Market’s Reaction: A Frenzy or Just a Fad?

In the grand tradition of crypto rallies, the market has been quick to react to Aave’s latest developments. It’s almost like the buyers have been waiting with bated breath for something positive to happen. And when they got the news, they didn’t hesitate—buying AAVE in droves. In fact, about $1 million worth of AAVE was snatched up from exchanges in the blink of an eye.

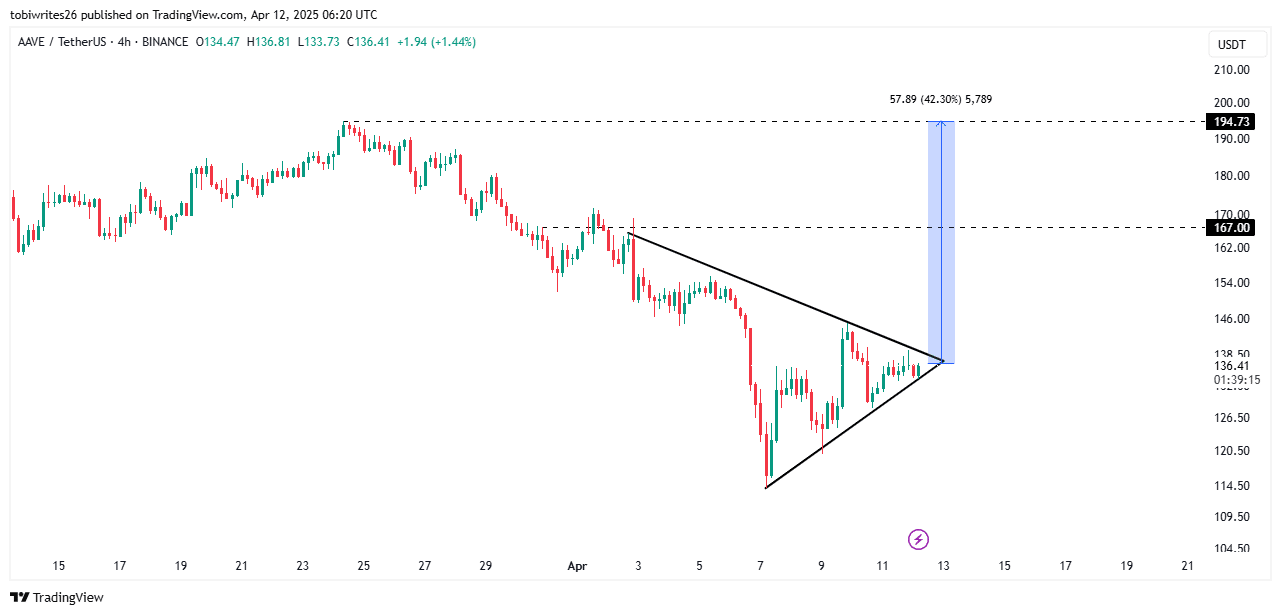

But hold your horses! If this enthusiasm continues, we could see AAVE take a 42% leap, pushing it to a glorious $194. A rally like that is, of course, entirely dependent on whether the market momentum stays strong enough to break through its resistance lines. After all, it’s not a real rally unless you’re breaking something, right?

Right now, AAVE’s in a symmetrical triangle pattern, which—get this—might just be the most polite bullish pattern ever. A breakout could send the altcoin on a wild ride to $167 in the short-term, and then, hold onto your hats, $194 in the long run. But beware, if momentum dips, it could all just fizzle out like the end of a bad soap opera.

For now, AAVE’s patiently waiting, consolidating like a good little token, soaking up all those buys while the market holds its breath. Will the big breakout happen? Only time will tell—preferably sooner rather than later!

The Adoption Surge: Aave’s Native Stablecoin GHO is on Fire 🔥

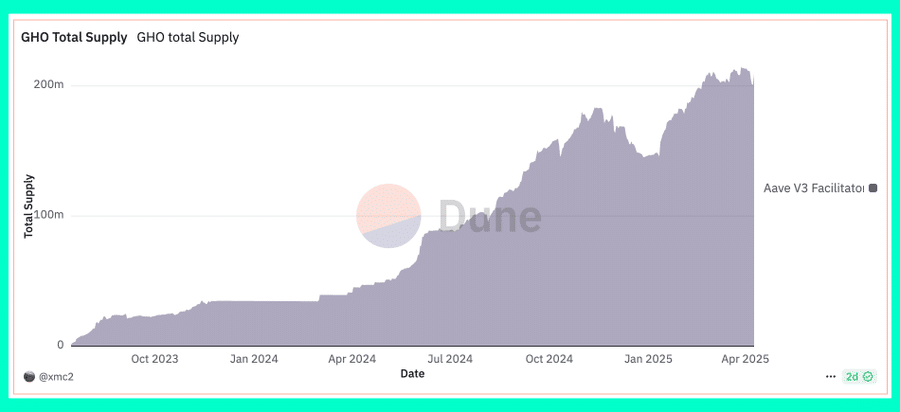

If you thought the good news was over, think again! Aave’s stablecoin GHO is absolutely exploding in adoption, surging 442% over the past year alone. It’s almost as if people really like the idea of stablecoins that work. Go figure!

This increase in GHO supply signals a growing demand for Aave’s offerings and, by extension, a possible spike in AAVE’s value. As GHO becomes more widely used, Aave’s ecosystem gets stronger—and so does its token. Who doesn’t love a win-win?

In conclusion, with the market sentiment remaining bullish, AAVE is looking like a solid bet for hitting its short-term target of $167. But then again, it could surprise everyone and hit $194. Nothing in crypto is ever truly predictable, right? Just hold on and enjoy the ride.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- ETH PREDICTION. ETH cryptocurrency

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- Silver Rate Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- 🚀 Worldcoin: $1.50 or Bust? Analysts Predict Crypto Chaos! 🌌

2025-04-13 06:19