- Ethereum‘s Money Flow Index has taken a nosedive into the oversold abyss—hello, undervalued asset! 🙃

- Traders, beware! The bears are out in full force, and they’re not here for a tea party. 🐻☕

So, Ethereum [ETH] has been on a bit of a rollercoaster ride in 2025, and guess what? The bears are still holding the reins. 🎢

Word on the street is that a wallet, possibly linked to World Liberty Financial (because who doesn’t love a good conspiracy?), sold 5,471 ETH for a whopping $8.01 million at $1,465. Thanks, Arkham Intelligence, for the juicy gossip! 🕵️♀️

With the WLFI sale and the market price doing the limbo below the realized price, it’s safe to say the outlook for our beloved altcoin is looking a bit gloomy. ☁️

Oh, and ETH/BTC? It’s hit its lowest point since December 2019. Talk about a throwback! 📉

The next price target for Ethereum

After a thrilling rally in November, we plotted the Fibonacci retracement levels like we were in a math class. The 123.6% extension at $1,944 was the support in March, but now? It’s flipped to resistance faster than you can say “bear market.” 🐻

And that horizontal level at $1,550? It was supposed to be our knight in shining armor back in September and October 2023, but alas, it couldn’t stop the bear stampede. 🏇

The Money Flow Index is sitting at a cozy 11, indicating extreme selling pressure. A bullish divergence? Not in this economy! 💔

With prices below $1,550, recovery seems as likely as finding a unicorn. Instead, a retest of $1,550 might just be the perfect playground for short sellers. 🎠

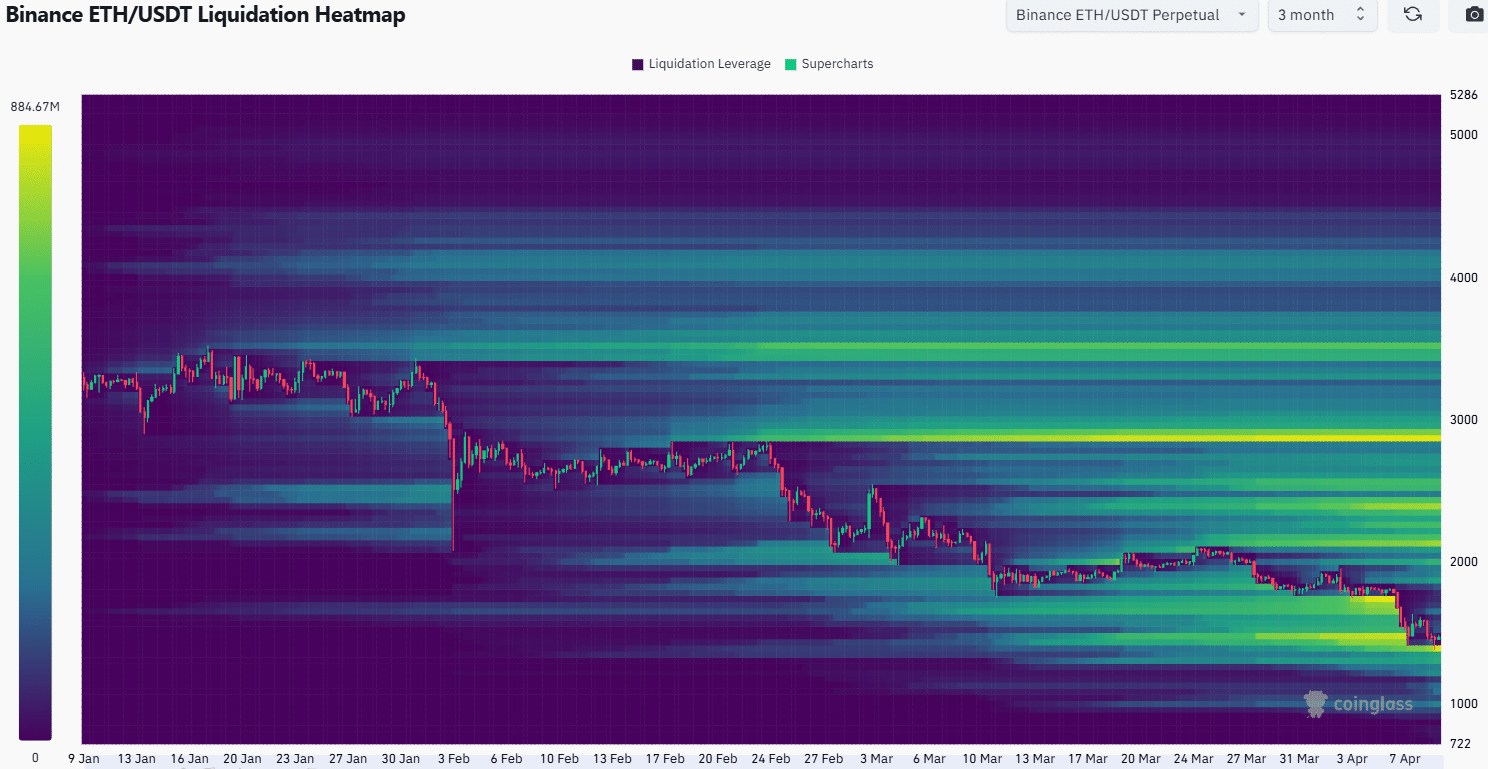

The 3-month Ethereum liquidation heatmap is revealing some short-term bullish targets at $1,510 and $1,640. Beyond that, we’ve got some magnetic zones at $1,860 and $2,000—because who doesn’t love a good magnet? 🧲

On the downside, $1,380 is looking like a significant liquidity pocket. It’s big, it’s close, and it’s probably the most likely short-term target. 🎯

Ethereum buyers, take a deep breath and hold your horses at $1,380. A price bounce is likely, but patience is key—like waiting for your favorite show to come back from hiatus. 📺

In summary, the long-term trend is still firmly in the bear camp. A minor recovery toward $1,640 might happen, but don’t hold your breath—those bears are still in charge! 🐻💼

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin Billionaire’s Bizarre Stock Scheme: Will It Collapse or Conquer? 🤔

- Coinbase’s Meme Coin Frenzy: A Tale of Farts and Fortunes 🚀💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Crypto Drama: Coinbase Ditches MOVE—Scandal, Swoon & a $100M Hangover 🍸

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Ethereum’s Wild Ride: Is It Just Getting Started? 🚀

2025-04-10 00:10