The grand political sleight-of-hand – a change as unexpected as a wizard in a laundromat – sweeps in amid a gust of deregulatory wind. It seems President Donald Trump now prefers his digital markets to sparkle like a street fair in Ankh-Morpork, brimming with brilliant ideas rather than bogged down by that old, dreary “regulation by prosecution.” 🧙♂️💥

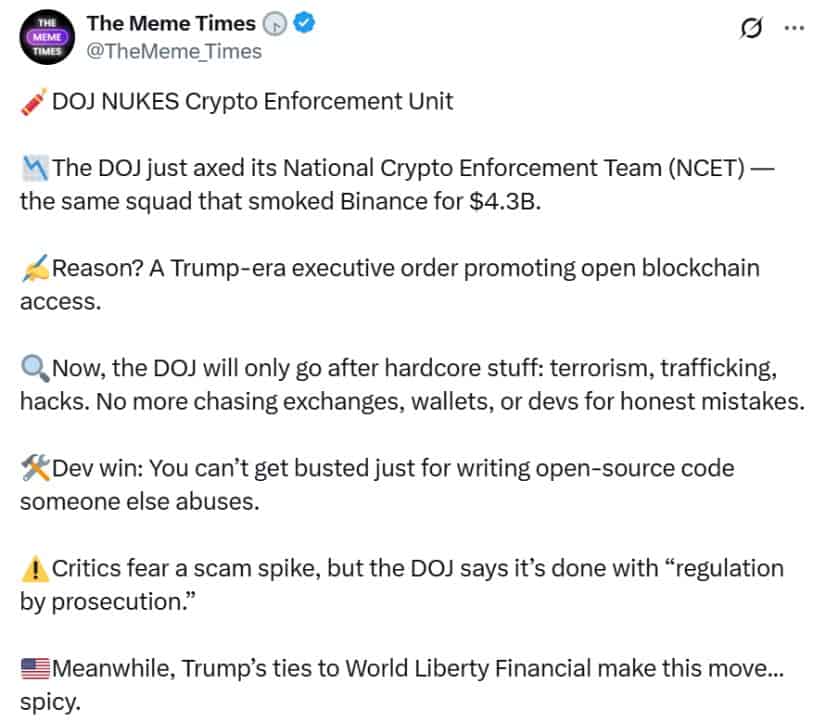

Justice Department Refocuses Priorities

In a memo that looked as if it were scribbled during a particularly hectic cup of tea, Deputy Attorney General Todd Blanche announced that the notorious NCET was disappearing faster than a city watchman on a hot day. Formed in 2022 to chase down crypto miscreants involved in dubious digital dealings, the team now vanishes like an overenthusiastic street magician’s prop.

Blanche declared that the DOJ will now swap its detective cap for a more imposing helmet – one suited to dealing with truly outrageous villains, whether they’re financing terror or trafficking supernatural narcotics. Sometimes, you’ve simply got to let the really rotten apples rot. 😏

In a missive as cutting as a wizard’s lightning bolt, he reminded everyone, “The Department of Justice is not the keeper of digital sorcery. The previous regime turned it into a wild carnival of regulation by prosecution – ill-conceived and executed like a novice’s magic trick.”

Embracing a Pro-Crypto Framework

This curious pivot sprang forth on January 23, during President Trump’s triumphant third day back on stage – a day filled with executive orders as plentiful as trolls in the sewers. His decree, insisting on the need for legal clarity as precious as alchemical gold, painted the cryptocurrency realm as the beating heart of modern wizardry. “We shall banish the regulatory hexes on digital assets,” Trump proclaimed, promising to crown the U.S. the crypto capital of the planet. 👑

The administration’s switcheroo stirred the cauldrons in both finance and tech. Crypto devotees cheered like they’d just discovered a secret stash of gold, while the skeptics grumbled that loosening oversight might let the goblins and pixies run amok.

National Cryptocurrency Enforcement Team Dissolved

The now-vanished NCET had once been as relentless as a golem in a good mood, chasing down miscreants accused of digital wizardry like money laundering and other shady shenanigans. Paired with cyber sorcerers from the FBI realms and U.S. Attorney’s Offices across the nation, they were the crypto equivalent of a knight’s errand.

The memo announced that any investigations not aligned with this fresh vision would be dropped quicker than a clumsy apprentice’s spell. Now, crypto firms need not fear getting entangled in regulations unless they deliberately step into the realm of outright mischief.

Industry Applauds Shift Away from ‘Regulation by Prosecution’

The champions of the crypto world and even a few sensible advisors filled parchment after parchment with applause. They ridiculed the old approach that treated builders like heretics, insisting that one should not be locked away simply for inventing marvelous contraptions. 😎

“It delights us to see the DOJ focusing on real rogues rather than punishing the ingenious builders of our financial future,” quipped Amanda Tuminelli of the DeFi Education Fund, while Katie Biber reminded us that laws should mean exactly what they say – not what a prosecutor wishes they did.

Trump’s Broader Crypto Vision

Trump’s affection for crypto extends further than a dwarf’s love for shiny jewels. Earlier this year, he waved an executive order like a seasoned conjurer, establishing a Strategic Bitcoin Reserve that suggested digital assets might someday be the coin of the realm in Uncle Sam’s grand castle.

He even unleashed his own token, $TRUMP, which, much like an over-ambitious spell, soared to valuations rivaling legendary treasures – if only for a brief, glittering moment. Controversial, yet captivating, it sent the market into a tizzy that would make any sorcerer proud.

Meanwhile, the normally stodgy SEC and FDIC began to dabble in crypto matters. The SEC, in a rare act of backpedaling, untangled several enforcement cases, while the FDIC now permits banks to frolic in crypto arenas—provided they respect the sacred scrolls of risk management.

A New Era for U.S. Crypto Regulation?

Not everyone is ready to join the revelry. Critics moaned that relaxing the rules might turn the system into an open playground for money launderers, sanction evaders, and other unsightly villains – a notion as unsettling as a prank by the Unseen University’s faculty of magic. 😈

One somber scholar even suggested that dangerous competitors might use cryptocurrencies to launder wealth and dodge sanctions, a thought as chilling as a troll’s laugh at midnight. Yet, the administration remains convinced that proper crypto regulation is best left to calm and calculated financial alchemists, not wild-eyed prosecutors.

Going forward, the DOJ plans to play only a cameo role, stepping in solely for the most spectacular cases of investor fraud, colossal exchange hacks, and the occasional instance of digital asset deviousness.

Final Thoughts

So, with a flourish worthy of the grandest tale told by candlelight, the disappearance of the National Cryptocurrency Enforcement Team has put a new spin on U.S. crypto policy. As the administration toasts to blockchain brilliance, the impossible task of balancing economic wizardry with real-world safety remains a spectacle as riveting as any discworld escapade. ⚖️✨

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Discover the Hidden Gems: Altcoins Under $1 That Could Make You Rich! 💰

- Brent Oil Forecast

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- ETH PREDICTION. ETH cryptocurrency

- XRP’s Quest for $3: A Tale of Volume and Vexation 🏛️💰

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

2025-04-09 16:46