- SOL, like a melodramatic actor, shed over half its value in Q1, leaving investors clutching their pearls.

- Institutions are now eyeing SOL like it’s the last slice of pizza at a party. But will it be enough? 🍕

Solana [SOL] recently dipped below $100 for the first time in over a year, as if it were trying to audition for a tragic role in a Tolstoy novel. The prevailing macro uncertainty played its part, like a villain in a Russian winter.

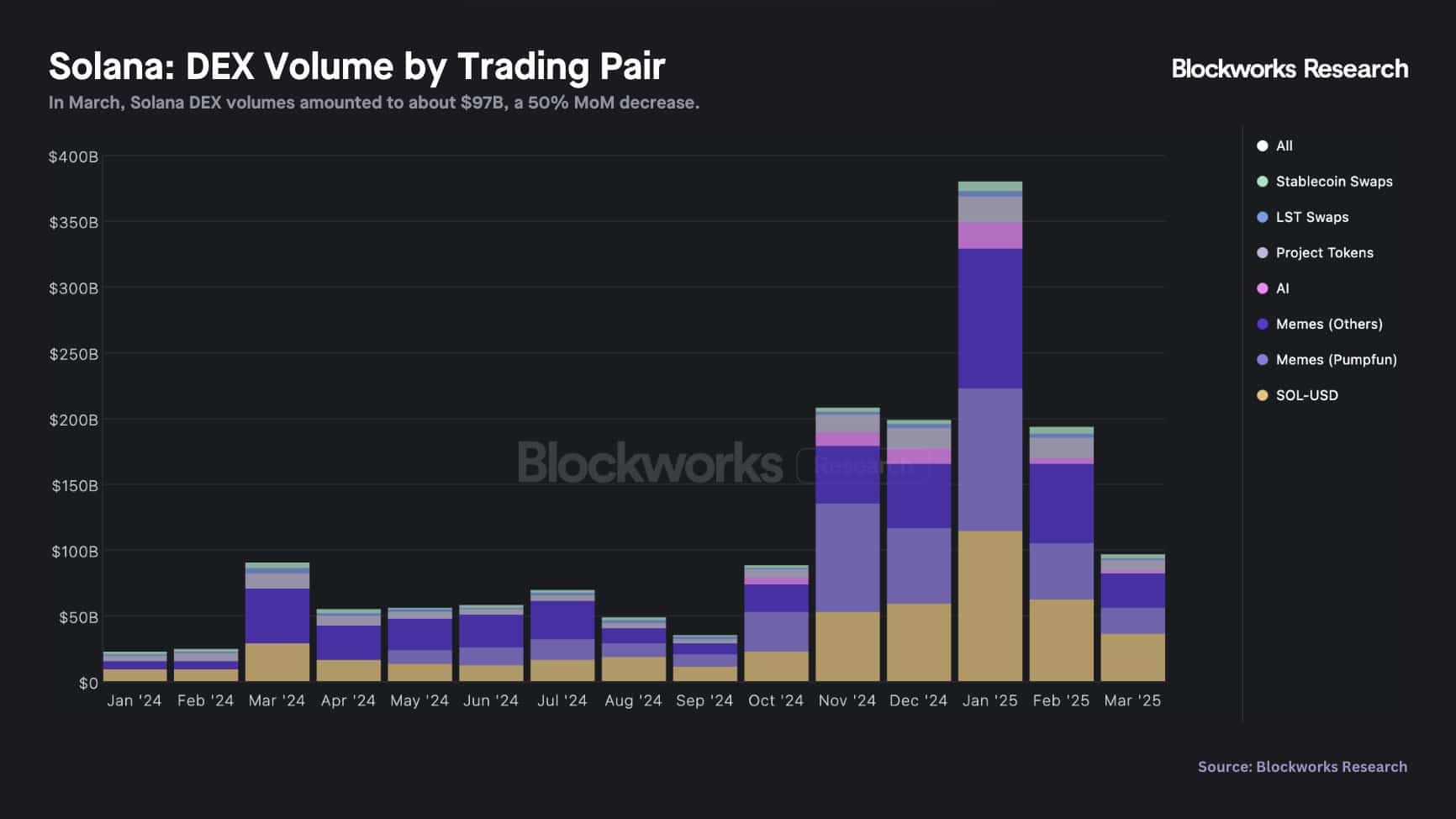

Adding to the drama, Solana’s DEX volumes took a nosedive, plummeting by 50% in March to $97 billion from $193 billion in February. It’s as if the decentralized exchanges decided to take a long, contemplative walk in the snow. ❄️

Even the memecoin segment, Solana’s top DEX volume contributor, saw a dramatic drop from $60 billion to $26 billion over the past two months. It seems the memecoin craze has cooled off faster than a samovar in Siberia. 🥶

As a result, SOL’s price tumbled 53% from $240 to $100 over the same period, leaving investors wondering if they’ve stumbled into a financial version of “War and Peace.”

Institutions to the Rescue? 🦸♂️

However, not all is lost. Marginal buyers have been aping Strategy’s Bitcoin play, such as SOL Strategies, as if they’ve discovered a secret recipe for borscht.

Janover, a real estate platform, recently announced plans to acquire Solana validators and create a SOL treasury strategy. The firm’s JNVR stock skyrocketed by +800% after the announcement, as if it had been injected with a dose of Russian vodka. 🍸

SOL Strategies, for its part, had over 3M SOL (nearly $400M) staked across its validators. The firm’s March report revealed that it bought 24k SOL and held 267k SOL, as if it were hoarding gold in a Tolstoyan estate. 🏰

Such institutional demand could potentially boost SOL’s value in the long term. However, in the short term, the altcoin remains at the mercy of the broader market sentiment, much like a character in a Tolstoy novel is at the mercy of fate.

On the Options market, traders were pessimistic about SOL crossing $150 in the first half of April. Only 10% of traders expect the altcoin to hit $150 by the end of the month, as if they’ve resigned themselves to a long, cold winter. 🌨️

From a technical chart perspective, SOL seemed to be defending the slopping trendline support. However, the daily chart RSI was yet to tap the oversold territory—a sign that sellers could still drag it lower, much like a sled down a snowy hill. 🛷

As such, SOL could rebound from its press time levels. However, a further decline to $80 can’t be overruled, as if the market were preparing for a dramatic twist in the final act. 🎭

Read More

- Brace Yourself: Bitcoin’s Social Media FOMO Warning! 😱💥

- Elon Musk’s Bitcoin Love Affair: Is It True Love or Just a Fling? 💔💰

- Bitcoin’s $1.5 Billion ETF Inflows: A New All-Time High or Just Another Mirage? 🤔

- Schools Shut Down?! 🤯 Crypto-Fueled Chaos!

- EU Crypto Chaos: CoinShares Gets MiCA License, Sparks Regulatory Frenzy! 🚀

- Steinbeck’s Take on Crypto ETFs: Ether Shines While Bitcoin Takes a Nap 😴

- Gold Rate Forecast

- Crypto Frenzy: Metaplanet’s Billion-Dollar Bitcoin Feat! 🚀

- Dogecoin Whales Are Back: Is the Moon Mission Reloading? 🚀🐶

- Why Is Ripple Quietly Taking Over the World? 🤔 The Untold Story of XRPL’s Chaotic Rise to Fame

2025-04-09 11:06