Well, folks, the White House has confirmed that a staggering 104% tariff against our friends in China will be unleashed at the stroke of midnight, and the crypto market is quaking in its boots! After a brief flirtation with $79,000, Bitcoin has taken a nosedive to $76,000, leaving a trail of $300 million in liquidations like a sad, soggy pancake on a Sunday morning.

But hold your horses! There’s a glimmer of hope as Bitcoin’s long positions have risen to a robust 54%. Tomorrow promises to be a day of reckoning; it might just bring chaos to the traditional finance folks, but our dear crypto might just weather this storm like a seasoned sailor in a squall. 🌪️

Trump’s Tariffs: A Crypto Catastrophe!

As the clock ticks down to tariff time, the markets are in a state of profound uncertainty, akin to a cat on a hot tin roof. Just yesterday, over $1 billion was liquidated from the crypto market, but today, a whiff of optimism about a potential deal has buoyed prices like a cork in a bathtub. 🛁

And lo and behold, the White House has confirmed that those 104% tariffs will indeed take effect at midnight, sending crypto prices tumbling once more:

Now, China is America’s largest trading partner, and these sweeping tariffs could wreak havoc on the markets. But crypto, bless its heart, has taken quite the beating. Publicly listed crypto companies are having a rough day at the office, with MicroStrategy’s MSTR taking a dive of over 11%. Talk about a rough patch!

Coinbase, Robinhood, and our beloved Bitcoin miners are all feeling the pinch, each approaching a 5% drop. It’s like watching a slow-motion train wreck. 🚂

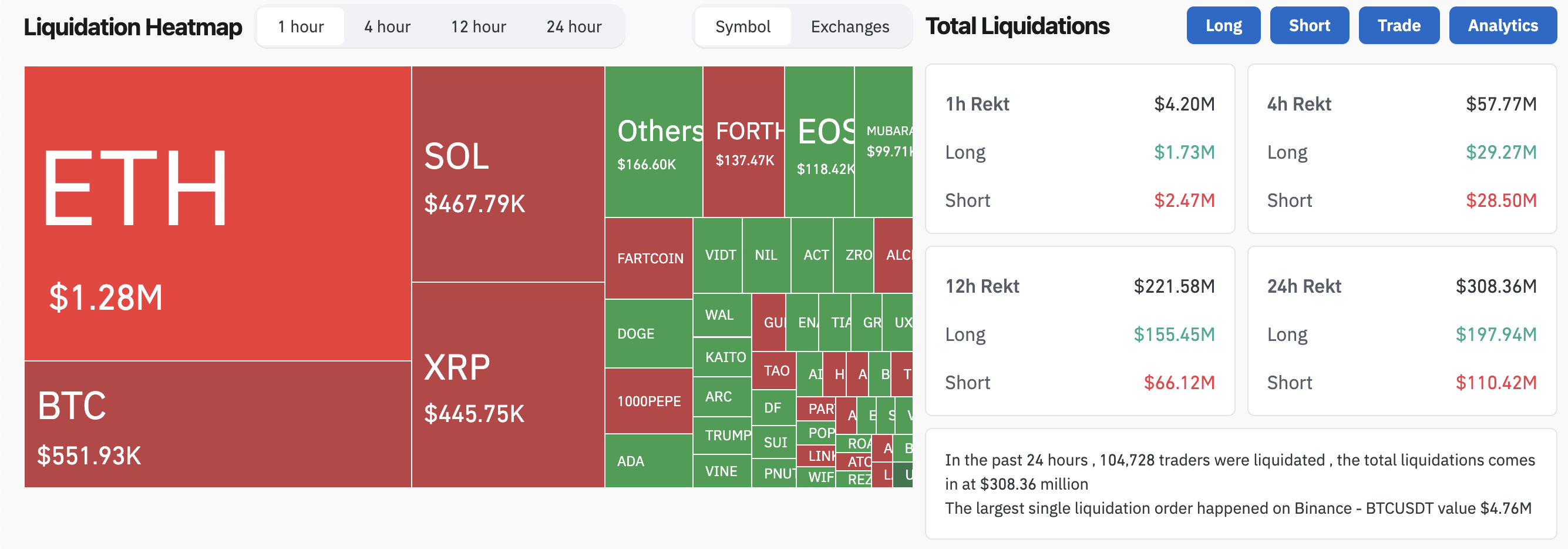

Now, Bitcoin finds itself in a precarious position. A recent report claimed it was one of the most tariff-proof assets in the crypto sector, but the winds of change may be blowing. Today, it dropped 2.6%, inching closer to the ominous $75,000 mark as over $300 million was liquidated. If it dips below that, we might just see a price rout that would make even the bravest trader shudder.

Bitcoin Long-Short Ratio: A Flicker of Hope!

As this morning’s price gains have shown, there’s still a flicker of optimism in the market. This could help all of crypto stand tall against the tariff threats, including our dear Bitcoin.

Its long positions have surged to 54%, indicating that most traders are betting on BTC to bounce back like a rubber ball. 🎾

Ultimately, tomorrow will be a pivotal day for tariffs, crypto, and the TradFi markets as a whole. It’s probably too late to hope that Trump will decide to play nice with China.

However, it remains to be seen whether the crypto market will continue to dance in step with the stock market after the tariffs go live, or if at-risk assets will reverse course and hedge against the looming inflation fears. Only time will tell, my friends! ⏳

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Whale of a Time! BTC Bags Billions!

- Crypto Riches or Fool’s Gold? 🤑

- Silver Rate Forecast

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

2025-04-09 01:42