- Stellar, rather like a recalcitrant butler, attempted to don $0.3 as resistance – only to be unceremoniously shown the door over the past ten days 😏

- The dress rehearsal at the $0.2 demand zone hinted at a modest bullish jig, though prudent investors are advised to keep their umbrellas at hand ☂️

Old chap, Stellar [XLM] has experienced a rather undignified 14.5% tumble in the last 24 hours. This came in the wake of Bitcoin [BTC] sashaying down to $74.5k, mere hours before the press, as global stock markets threw themselves into a tizzy following some rather uncouth tariff shockwaves. Altcoin traders, bless them, must proceed with the caution of a nervous valet – it appears the bearish winds have only grown mightier in the past three months.

In these perplexing times, buyers might do well to adopt the patience of a seasoned butler waiting for tea; there’s no unmistakable sign that the market bottom has even been formulated yet. One might also keep a jolly eye on BTC trends for whispers of broader market happenings.

Stellar set to cavort below $0.2 as the selling frenzy gathers pace

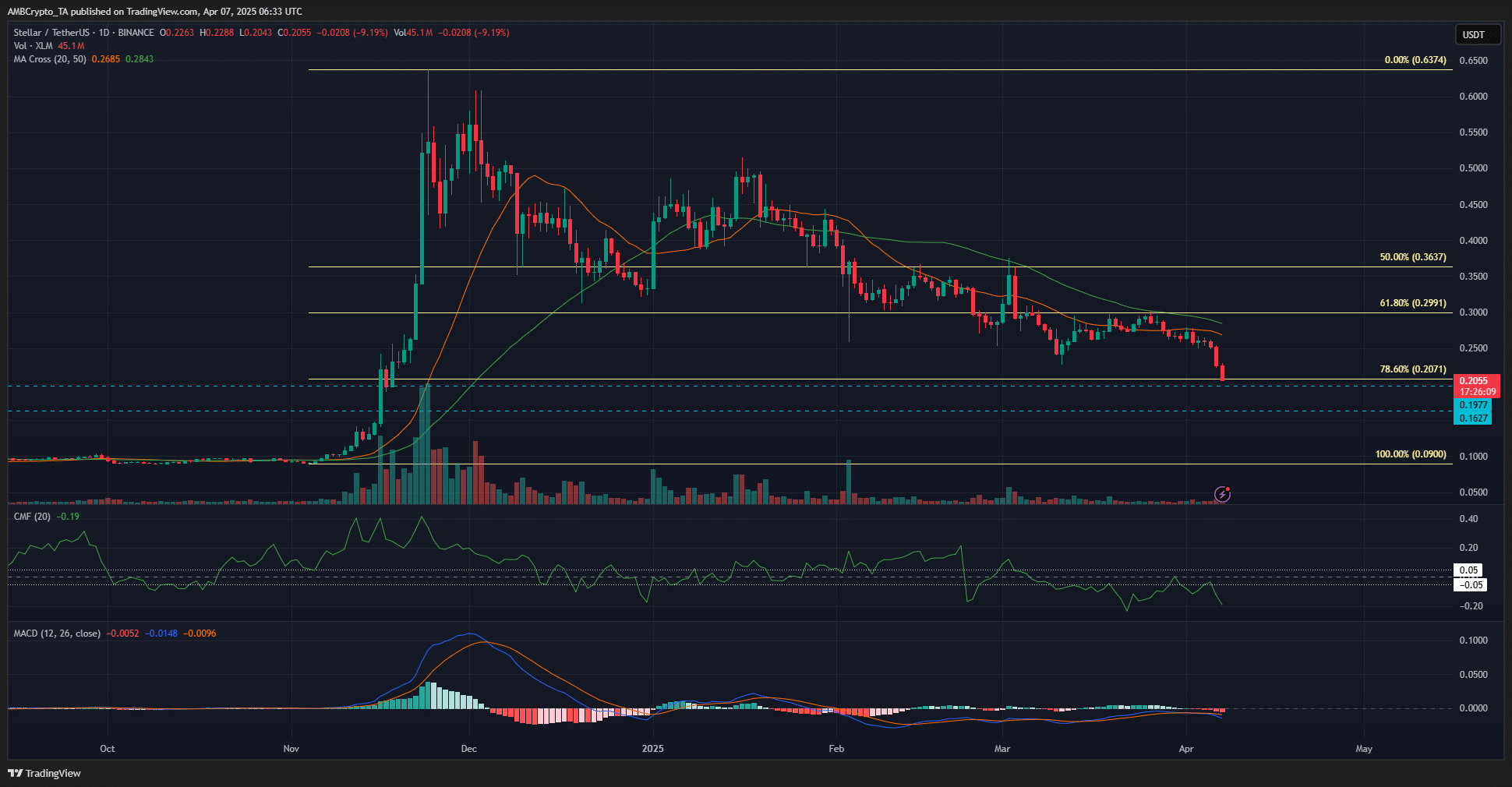

The one-day trend has developed a rather spectacularly gloomy air. The 20 and 50-period moving averages, perched high above the price like snooty upper-crust aristocrats, confirmed that bearish momentum was reigning supreme. The MACD, having flirted briefly with a rise, now plunge-dived lower as if propelled by a clumsy butler on a slippery floor.

All this ruckus can be traced back to a conservative consolidation phase around $0.25-$0.3 in March, which was followed by abrupt and sharp losses in April. The CMF, ever the gloomy companion, has remained below zero since March, nosediving further below -0.05 to signal a mass exodus of capital from the Stellar party.

With such a confluence of misfortune and manic selling pressure, it seems further losses may be on the horizon for Stellar. The Fibonacci retracement levels, based on November’s gallivant, suggest that the 78.6% level has now nested around $0.207.

At the time of writing, our dear Stellar was languishing just a whisker below this pivot, with the $0.197 and $0.162 echelons serving as long-term support – along with a healthy dose of trepidation.

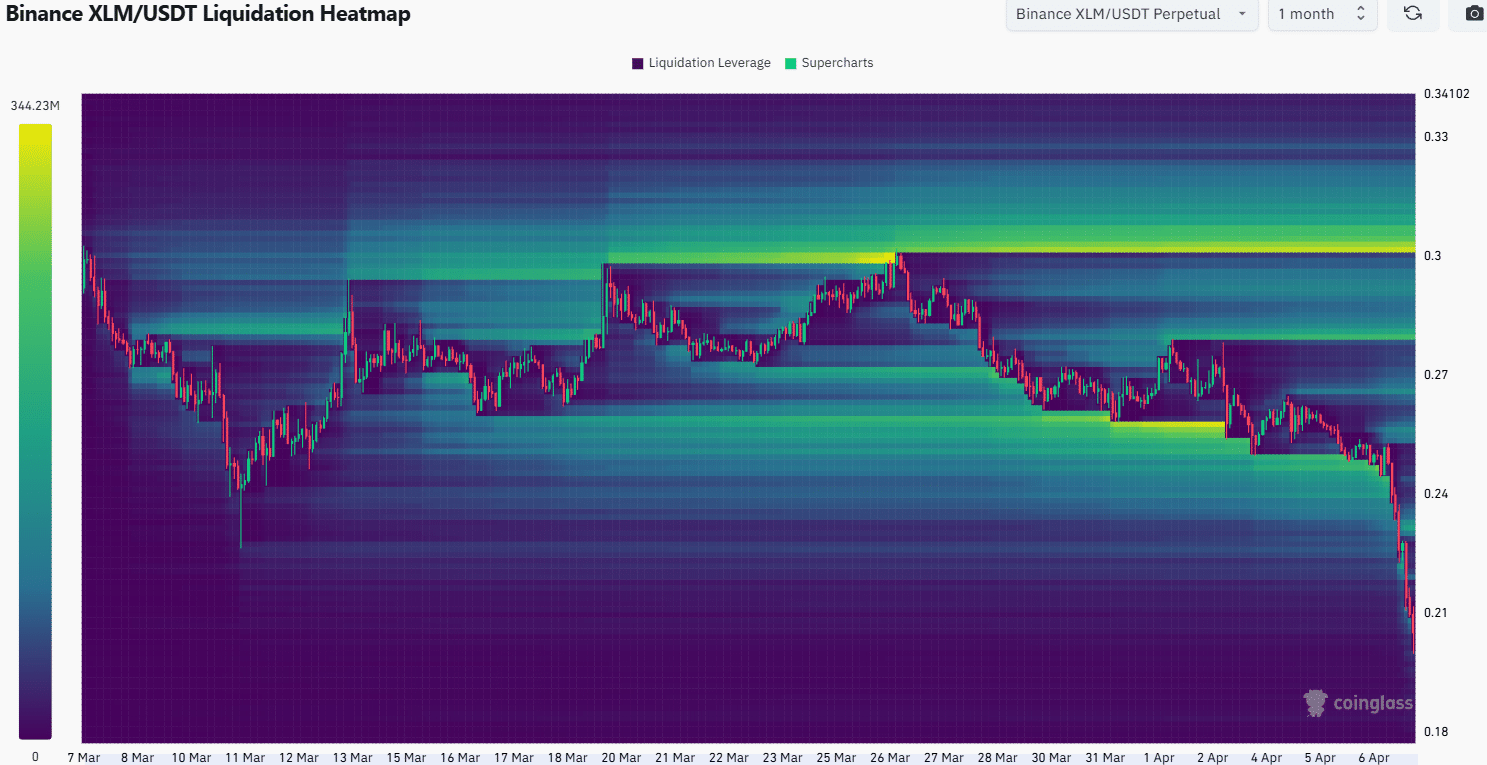

The one-month liquidation heatmap disclosed that the $0.246-$0.26 zone has been rather thoroughly sapped of long positions – as if a debonair host had unceremoniously shown them out.

These liquidations coincided neatly with the local support levels of early March. The latest price plunge saw XLM’s value tumble well below the $0.24 liquidity cluster, much to the chagrin of its admirers.

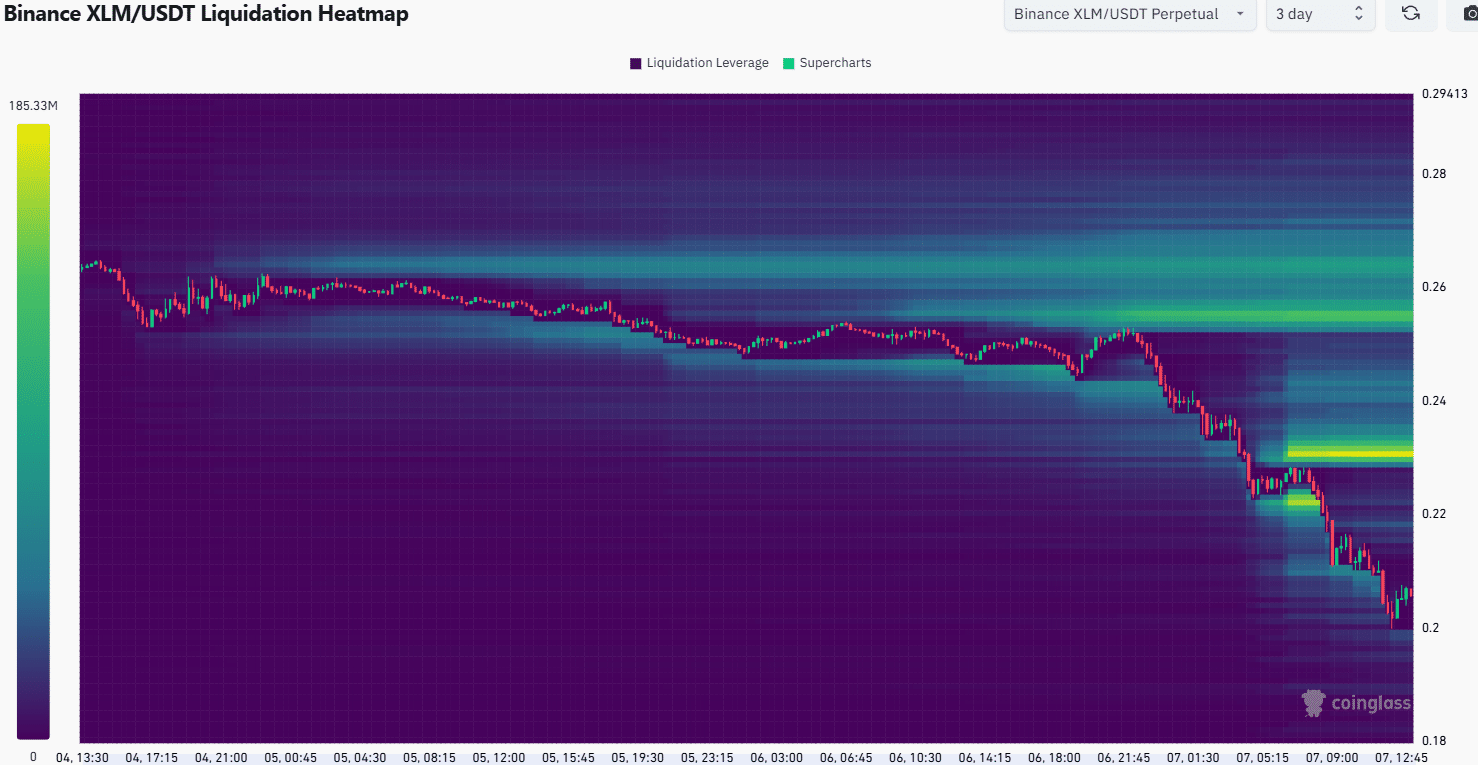

A more intimate examination of the local liquidation levels reveals some tantalizing hints about XLM’s next gambit. The liquidity amassed around $0.23 presents an almost irresistible target and a potential harbinger of a bearish reversal should a fickle price bounce occur.

Beyond this, the $0.255-$0.265 enclave stands as the next magnetic zone to keep an eye on. Stellar traders, much like a cautious chap steering clear of dubious culinary experiments, would do best not to attempt purchasing the bottom in haste 😉.

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Crypto Riches or Fool’s Gold? 🤑

- BitMine’s 4M ETH Hoard: Stock Valuation Shenanigans 💰💸

- Silver Rate Forecast

- SOL’s October Drama: ETFs, Upgrades, and $350 Dreams? 😱💸

- Brent Oil Forecast

2025-04-08 00:11