My dearest companions, pray allow me to regale you with the most curious tidings: Bitcoin found itself in a whirlwind of exaltation, soaring quite briefly above the remarkable threshold of $80,000. This unanticipated flutter was inspired by a mischievous rumour suggesting that our esteemed President Donald Trump intended to grant a heavenly reprieve of tariffs for ninety days—excluding, perhaps most ironically, the nation of China. 🤔

This very morning, the president’s advisor, Mr. Kevin Hassett, intimated in an interview that the president might indeed revise his tariff notions. When pressed with the question, “Would Trump consider a 90-day pause in tariffs?” he responded in a delightfully cryptic manner: “I think the president shall do precisely as he pleases, good sir. And even if trade disputes should nibble at our great economy, it remains but a small morsel of our GDP.” 😏

Alas, certain parties seized upon these hints and soon proclaimed—with no small flourish—that a 90-day pause was all but decided. The news then spread faster than gossip at a country ball.

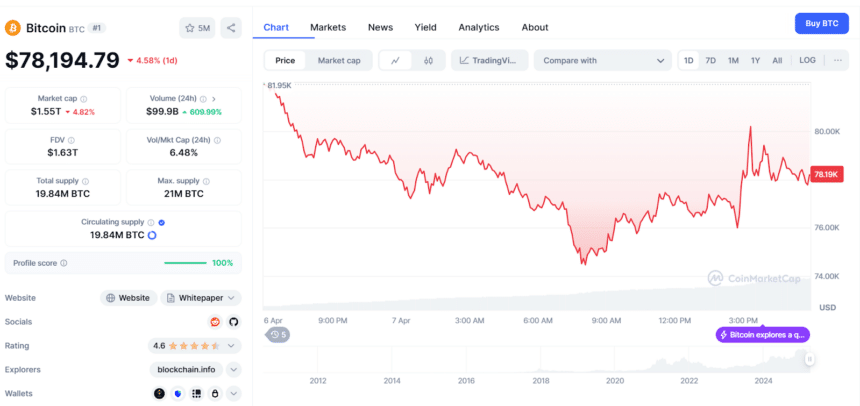

In their haste, many investors hurled their funds back into Bitcoin, resulting in a sudden surge worthy of any dramatic novel, though it disappeared sooner than a summer romance. The White House, in its infinite wisdom, declared the entire rumour to be “false,” prompting the markets, in their heartbreak, to fall back to more reasonable tones.

At this very instant, Bitcoin lounges at a genteel $78,000, marking a modest 5% descent within the past day, according to CoinMarketCap, as though politely conceding it had been a touch dramatic. one might say. ☕

President Trump also declared that tariffs remain of paramount importance to safeguarding the nation’s trade and labour interests, citing China’s role as the most persistent offender in these affairs. I daresay he might be Lady Catherine de Bourgh’s match in forthright declarations. 🤨

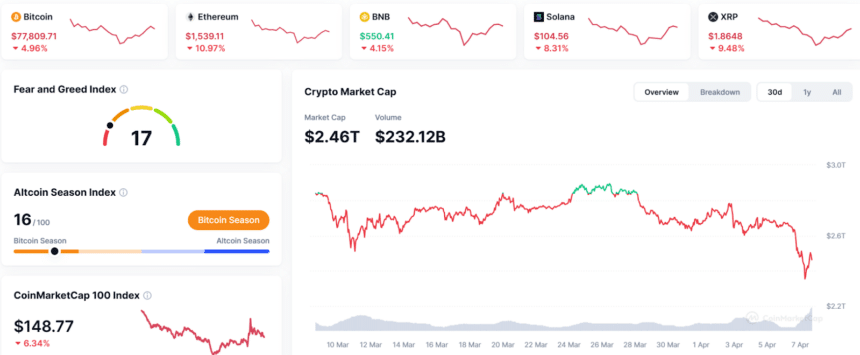

Other virtual coins, not wishing to be left out of the spectacle, also partook in a brief moment of upward fancy: Ethereum tiptoed up to $1,567.92 (rising by 2.04%), XRP flounced to $1.88 (up 4.88%), and Solana gained a demure 4.69%, reaching $106.84. Dogecoin, never one to be outdone, pranced upward by 5.5% in a single hour—indeed, quite the scandalous display! BNB, perhaps feeling shy, managed only a 1.49% improvement.

But, dear readers, the broader crypto realm remains somber, with an overall valuation trimmed by 5.64% in the last day, according to CoinMarketCap. It would appear that one cannot rely solely on rumours to sustain the giddy heights of fortune. 😬

Astonishingly, the trading volume spiked by over 400%, like a particularly lively dance floor; countless individuals were selling and buying with unrestrained glee. Meanwhile, over $600 million worth of cryptocurrency was swept away in liquidations, quite like a drama in which the suitors all suddenly dash away from the ball.

Goldman Sachs has graciously cautioned that even should Mr. Trump indulge the whimsical notion of pausing tariffs, recessionary clouds may still gather. The firm attributed this foreboding to thorny monetary measures, hesitations about American products, and a dollop of policy confusion. The Crypto Fear & Greed Index, presently at 23, suggests that investors are in a state of pronounced anxiety—rather reminiscent of nerves before a grand ball. 😰

In summation, a single fanciful tale propelled Bitcoin and its brethren skyward for a fleeting instant. Yet it must be confessed that such fortune was short-lived, leaving us all pondering whether the next grand dance shall bring delight or despair.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Bitcoin’s Wild Ride: Is It a Rally or Just a Bunch of Greedy Investors? 🤔💰

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- XRP: The Calm Before the Storm?

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Silver Rate Forecast

- Oh No, Not Again! 87K+ Americans’ Data Leaked in Healthcare Hack 🤯

2025-04-07 21:09