In a turn of events that would make even the most seasoned market analyst raise an eyebrow, it appears that our dear Bitcoin has once again decided to waltz into what the experts call a “historic buying zone.” Ah, the sweet smell of panic and opportunity mingling in the air!

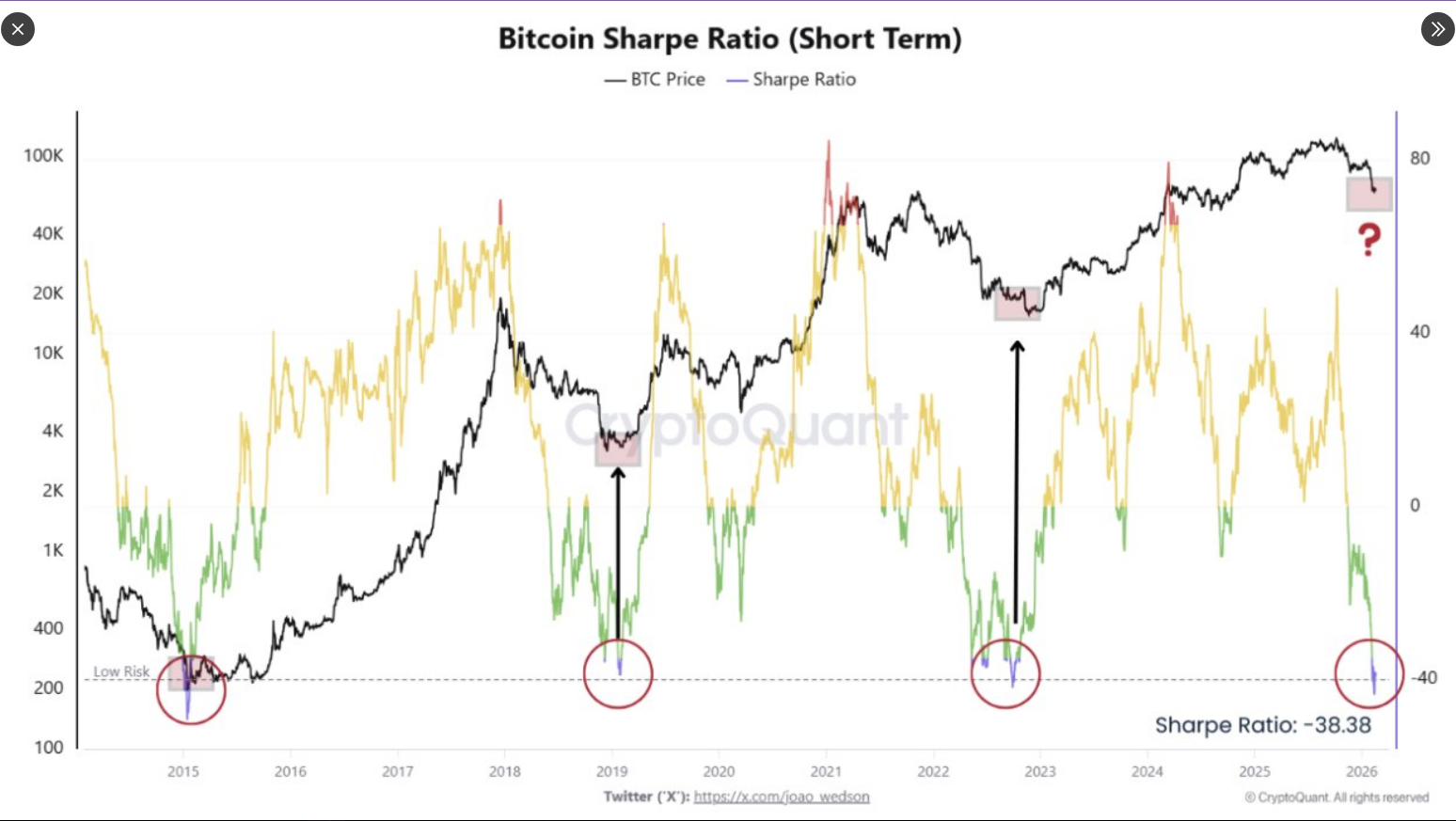

According to the latest reports-because who doesn’t love a good report-the short-term Sharpe Ratio has plummeted to the delightfully absurd figure of -38.38. Such numbers are the stuff legends are made of, or perhaps just the stuff that leads to awkward silence at dinner parties. Traders, ever the optimists, wax lyrical about how this level has previously heralded times of bottom-feeding opportunity, notably around the lows of 2015, 2019, and late 2022. One can only hope that this time is no different, as CryptoQuant’s own sage, Moreno, attests.

The Sharpe Ratio: A Dismal Affair

This fabled Sharpe Ratio, which ostensibly measures returns against volatility, has hit a low that even gravity would envy. When it dives below zero with such ferocity, it suggests that investors have been wading through losses akin to a poet lost in existential despair, all while the market frolics about like a carefree child in a field of daisies.

Indeed, a reading of -38.38 is so rare that one could almost consider it a collectible item. Reports suggest that such dire straits have graced Bitcoin’s ledger only four times before, each occurrence followed by a recovery so robust it could put a phoenix to shame. The implication here is clear: even amidst the gloom of charts that resemble a toddler’s crayon drawing, selling may eventually tire itself out.

“The arrows in the chart illustrate this clearly: each prior extreme negative reading was followed by violent recoveries to new highs.” – By @MorenoDV_

– CryptoQuant.com (@cryptoquant_com) February 19, 2026

A History of Lows and Highs

What do past cycles tell us? Well, one might say they tell a rather dramatic tale. In 2015, we saw Bitcoin languishing at a paltry $287, only to rise from the ashes later; similarly, the early days of 2019 saw it hovering around $4,100, and late 2022 offered a tantalizing glimpse at $15,000. Each of these occasions, marked by dismal moods and thin trading volumes, eventually gave way to rallies that left previous losses in the proverbial dust.

Bitcoin Price Action

Yet, one mustn’t forget the temperament of our beloved Bitcoin, which has proven sensitive to headlines more fickle than a cat on a hot tin roof. Recently, it has slipped beneath psychological thresholds, much to the chagrin of traders everywhere. As diplomatic spats and tales of conflict swirl, Bitcoin’s price has reacted with all the grace of a drunken ballet dancer, sometimes holding steady, other times plunging deeper when liquidity decides to play hide and seek.

While reports may hint at a signal of hope, let it not be mistaken for a golden ticket to instant riches. External forces, much like an uninvited guest at a party, can impose their will longer than any trend analysis might predict. The recent nosedive from a dizzying high of $126,200 to approximately $65,700 was a showstopper, but alas, the drama may not be over yet. Risk management, dear friends, is paramount. Those wishing to partake in this rollercoaster must prepare with position sizing and clear plans, lest they find themselves clinging to the handlebars in sheer terror.

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Crypto Riches or Fool’s Gold? 🤑

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- SOL’s October Drama: ETFs, Upgrades, and $350 Dreams? 😱💸

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Silver Rate Forecast

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- BitMine’s 4M ETH Hoard: Stock Valuation Shenanigans 💰💸

2026-02-21 04:18