Markets

What to know:

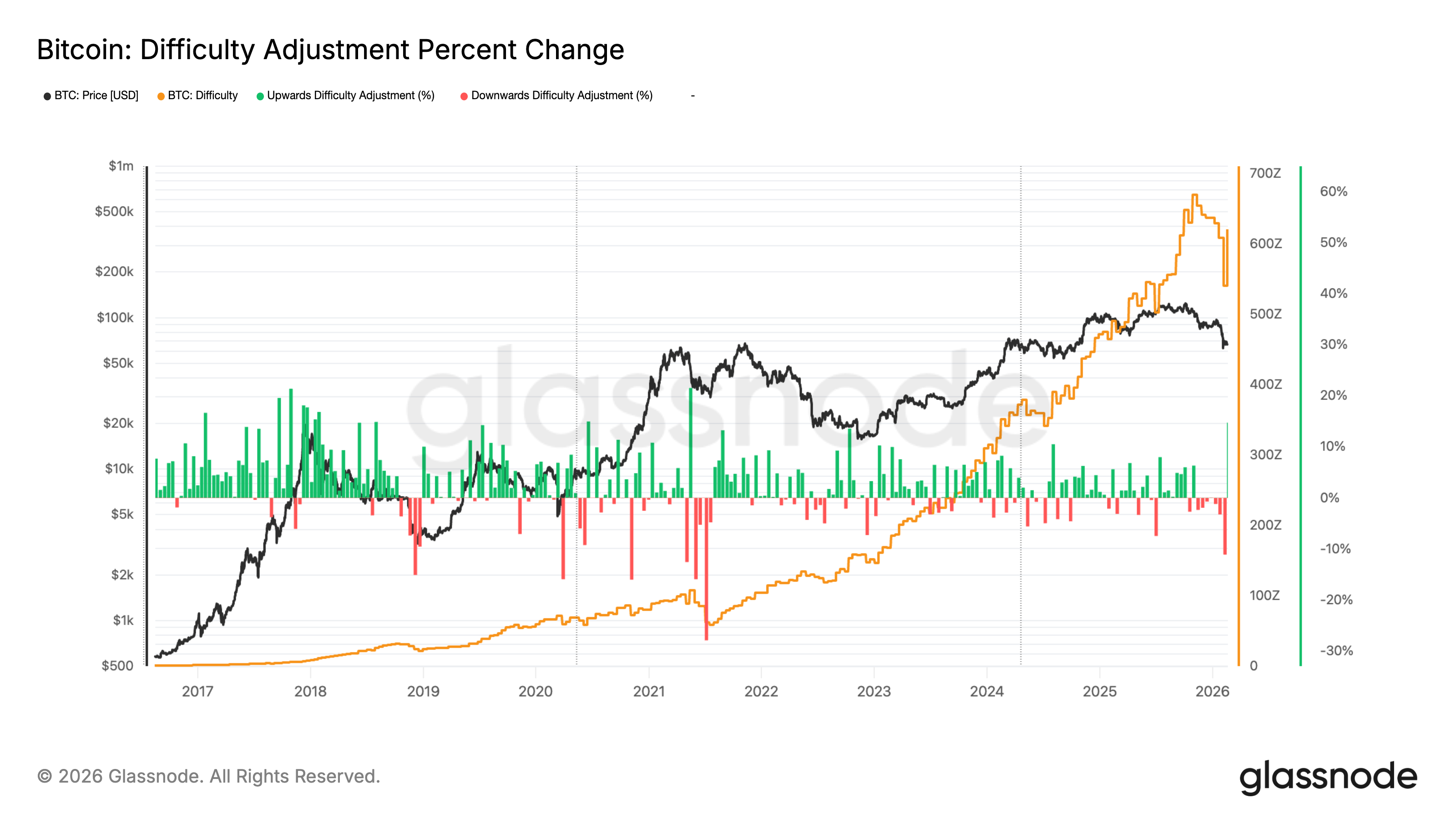

- In a twist worthy of a theatrical production, Bitcoin mining difficulty has soared to a staggering 144.4 trillion (T), leaping 15%-the largest percentage increase since the grand year of 2021.

- Meanwhile, hashrate has done a miraculous recovery act, bouncing back to 1 ZH/s from a not-so-glamorous 826 EH/s, all whilst the hashprice languishes at multi-year lows of approximately $23.9 per PH/s. Ah, the irony!

Yes, dear reader, Bitcoin mining difficulty has indeed ascended to the dizzying heights of 144.4 trillion (T). It’s a 15% leap that takes us back to when the very fabric of mining was thrown into turmoil by the infamous China ban in 2021, which, as you might recall, was preceded by a rather dramatic 22% adjustment as the network sought its bearings once more.

What is this adjustment, you ask? It’s the cosmic measure of how arduous it is to conjure a new block into existence on the network. This ritual recalibrates every 2,016 blocks-roughly every two weeks-ensuring that blocks are birthed every 10 minutes, regardless of the capricious whims of the hashrate.

This recent surge follows a rather dismal 12% decline in difficulty after an unfortunate dip in the bitcoin hashrate, that fickle beast securing the network with computational power. Just picture it: mining operations halted in their tracks by a tempestuous winter storm in the United States, reducing several major operators to mere shadows of their former selves.

Back in October, when Bitcoin reached its euphoric pinnacle of around $126,500, the hashrate peaked at a majestic 1.1 zettahash per second (ZH/s). Yet, as the price plummeted to a humble $60,000 in February, the hashrate fell to a paltry 826 exahash per second (EH/s). But fear not! The hashrate has rebounded to 1 ZH/s, whilst the price has danced back up to around $67,000.

Alas, the joy of miners is tempered by hashprice-a cruel mistress-remaining at multi-year lows ($23.9 PH/s), squeezing profitability tighter than a corset at a soirée.

And yet, despite these financial constraints, those large-scale operators with magical access to low-cost energy continue to mine as if there were no tomorrow! Take the United Arab Emirates, for instance, reclining on a cushy $344 million in unrealized profit from its mining escapades.

Well-capitalized entities capable of efficient mining are the unsung heroes keeping the hashrate buoyant and resilient, even in the midst of the subdued Bitcoin prices. What a spectacle to behold!

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Crypto Riches or Fool’s Gold? 🤑

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

2026-02-20 10:00