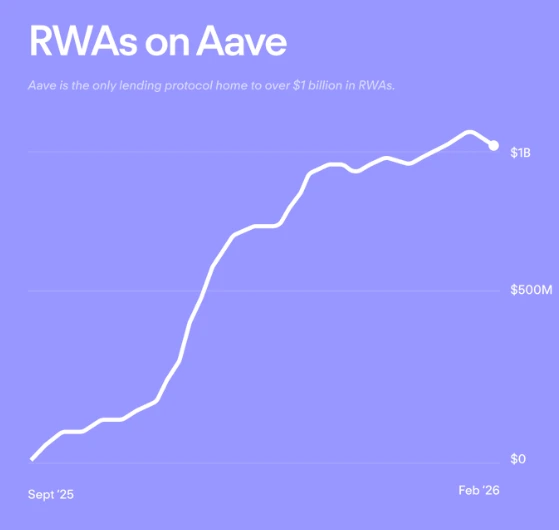

In an era where financial trends waltz like intoxicated peacocks, Aave-ever the debonair swan-has pirouetted its way to a staggering $1 billion in Real World Assets (RWA). By January 2026, Aave Horizon, its flagship market, had already amassed $600 million in tokenized RWA deposits, a feat akin to teaching a goldfish to recite Shakespeare. Yet, in less than a month, the platform doubled this figure, achieving $527 million in both active and on-chain RWA. One might call it financial alchemy, though turning leaden crypto sentiment into gold seems more like a parlor trick.

source: X

Aave: The Belle of the Bankruptcy Ball

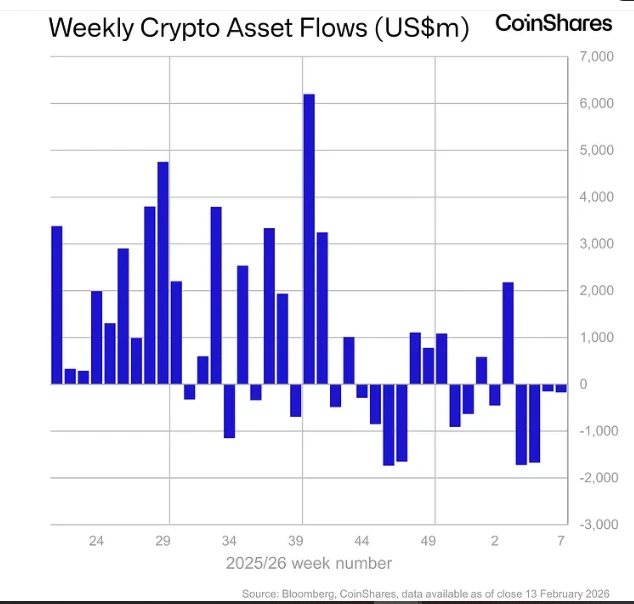

While the crypto market staggers through its fourth consecutive week of outflows-a grand total of $3.74 billion, with last week alone bleeding $173 million-it’s almost poetic that Aave thrives. Bitcoin, that temperamental diva, suffered $133 million in disposals, while Ethereum, ever the dramatic sidekick, followed with $85 million. “Crypto funds,” quipped a markets commentator, “have now seen withdrawals in 11 of the last 16 weeks. The US-listed Bitcoin ETFs? A paltry $8.5 billion vanished since October 2025. How very tragic.”

CoinShares, ever the bard of market woes, noted that US markets coughed up $403 million, while Europe and Canada-apparently the only regions with their heads screwed on straight-saw $230 million in inflows. How delightfully bourgeois.

Yet amid this circus of collapsing portfolios, Aave’s tokenized assets have become the belle of the ball. The SEC, that fickle arbiter of legitimacy, “cleared its name,” which in crypto terms means “they briefly stopped yelling.” Institutional adoption followed, because nothing says “trust me” like a regulator’s shrug.

AAVE Token: A 0.7% Triumph (Or, A Blip on the Richter Scale)

At press time, AAVE traded at $123.69, having risen a thrilling 0.7% in 24 hours. This movement, while less dramatic than a yawn, has the community’s collective pulse racing-83% of whom are “bullish,” which in internet parlance means “we’re either geniuses or sleep-deprived gamblers.” The protocol’s TVL? A record $26.7 billion, making it the Louvre of DeFi platforms, though one wonders if the Mona Lisa’s smile is this enigmatic.

And so, while the crypto market continues its daily flirtation with irrelevance, Aave stands tall-a bastion of innovation, or perhaps just a very expensive placebo. Either way, the show must go on. After all, as Wilde might say: “The world is a stage, but the real tragedy is paying full price for a front-row seat.”

Read More

- Gold Rate Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Brent Oil Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Crypto Riches or Fool’s Gold? 🤑

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Silver Rate Forecast

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

2026-02-20 03:46