In the grand theater of markets, where fortunes rise and fall with the capricious whims of the crowd, Bitcoin, that enfant terrible of the financial world, has momentarily steadied itself upon the stage. At $67,000, it stands-a fragile prima ballerina, poised yet trembling, as the orchestra of traders whispers of crash protection and the specter of Iran looms like a disapproving chaperone.

What to know:

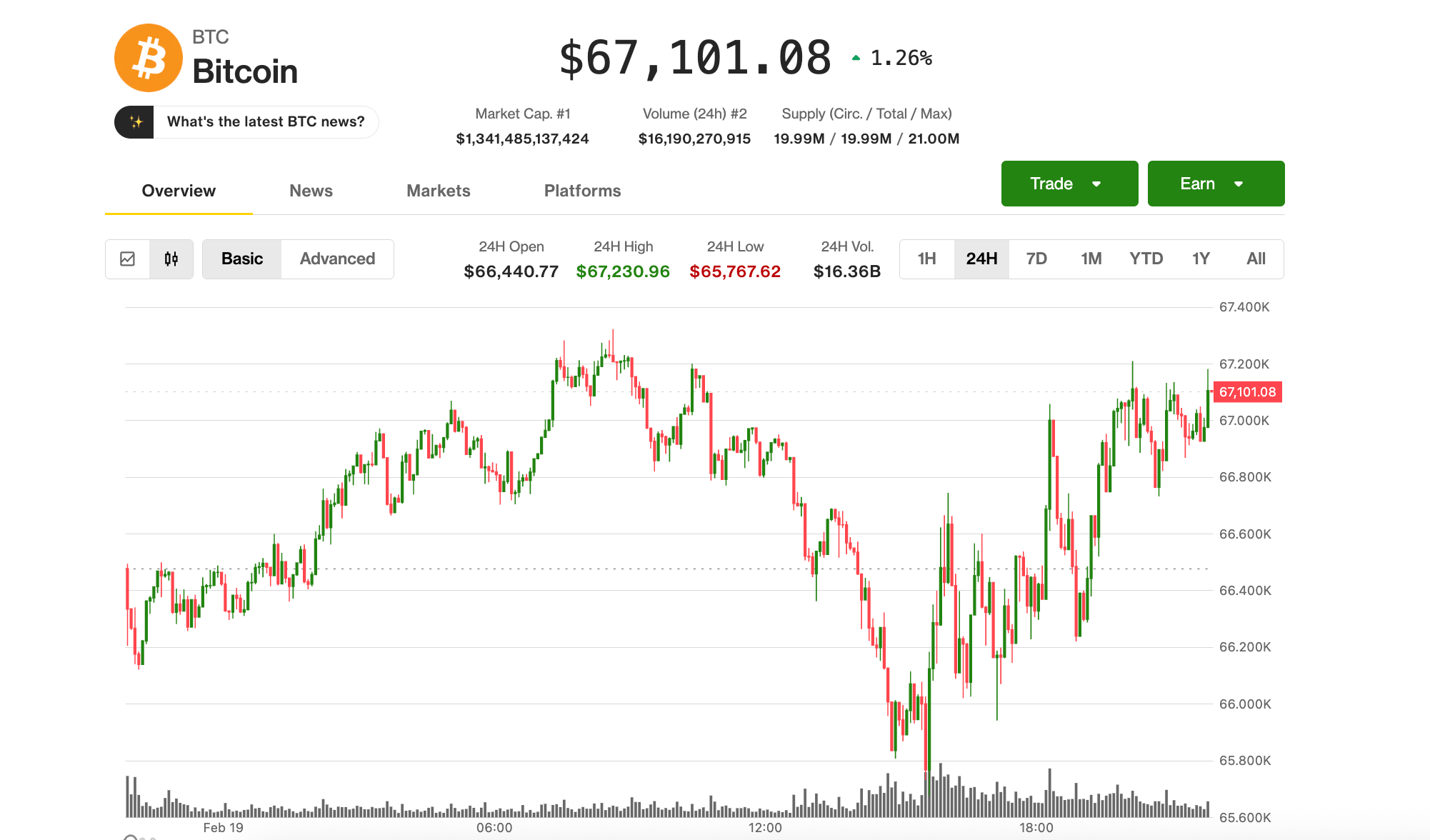

- Bitcoin, that restless soul, has found a fleeting moment of peace at $67,000, while its lesser companions, the altcoins, lag behind like forgotten extras in a grand opera.

- In the marble halls of the White House, policy talks on the crypto market structure bill proceed with the glacial pace of a Tolstoy novel, while the private credit markets crack like a poorly strung violin and the drums of war with Iran grow louder.

- Crypto derivatives traders, ever the pragmatists, are donning their armor, buying downside protection as if preparing for a duel in a world where honor is measured in satoshis.

On Thursday, Bitcoin, that tempestuous lover of the markets, found its footing after a brief dalliance below $66,000. It now trades at $67,000, a modest 1% rise in 24 hours-a mere flutter of a fan in the grand ballroom of finance.

The CoinDesk 20 Index, however, remains as cautious as a maiden at her first ball, with ether (ETH), XRP, BNB, and solana (SOL) barely moving, their steps tentative amidst the shaky rhythms of the crypto markets.

Crypto-related stocks, those faithful courtiers, climbed modestly, with bitcoin miners CleanSpark (CLSK) and MARA (MARA) leading the dance with 6% gains. Meanwhile, the S&P 500 and the Nasdaq 100, those stalwart nobles, dipped 0.3% and 0.6%, respectively, as if retiring early from the festivities.

On the policy front, the digital asset market structure bill inches forward like a tortoise in a race of hares. White House talks between crypto industry representatives and bankers have yielded the faintest hint of progress, though compromise remains as elusive as a happy ending in a Tolstoy novel.

Yet, the cracks from the recent crypto downturn continue to spread, like a stain on a fine tablecloth. Chicago-based crypto lender Blockfills, having suffered a $75 million lending loss, now seeks a buyer, its clients’ deposits and withdrawals suspended like a frozen moment in time. Investors, scarred by the specters of Celsius and FTX, brace for potential blowups, though the fallout thus far seems contained-neither a catastrophe nor a cleansing fire.

Beyond the crypto sphere, risks abound like uninvited guests at a dinner party. Private-equity firm Blue Owl (OWL) has permanently curbed redemptions in its $1.7 billion fund, sending its shares tumbling 6%. Other private credit managers, including Apollo Global (APO), Ares Capital (ARES), and Blackstone (BX), followed suit, their shares sliding more than 5% as if fleeing a sinking ship.

Geopolitical tensions, ever the unwelcome specter, linger like a storm cloud on the horizon. The prospect of U.S. military action against Iran looms large, sending crude oil rallying 2.8% to over $66 per barrel, its highest since August.

Traders play defense

In the crypto derivatives markets, caution reigns supreme, as Jake Ostrovskis, head of OTC at Wintermute, observes. Traders, ever the pragmatists, are buying downside protection while limiting upside participation-a financial hedge against disaster, though it caps their potential gains like a tight corset restricting a dancer’s movements.

The average U.S. bitcoin ETF cost basis now sits near $84,000, leaving many investors underwater, nursing 20% paper losses and vulnerable to “capitulation selling” should prices fall further. Yet, total ETF holdings remain within 5% of their peak, suggesting institutions are trimming their sails rather than abandoning ship entirely.

And so, the dance continues-a delicate ballet of fear and greed, hope and hesitation, as Bitcoin pirouettes at $67,000, awaiting the next movement in this grand, unpredictable symphony of markets.

Read More

- Gold Rate Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Brent Oil Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Crypto Riches or Fool’s Gold? 🤑

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Silver Rate Forecast

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

2026-02-20 00:49