Markets

What to know:

- U.S.-listed bitcoin, ether and XRP spot ETFs saw broad net outflows on Feb. 18, signaling institutions are cutting exposure rather than buying the dip. It’s like watching a group of very serious people throw their goldfish into a blender and then act surprised when the blender doesn’t make soup.

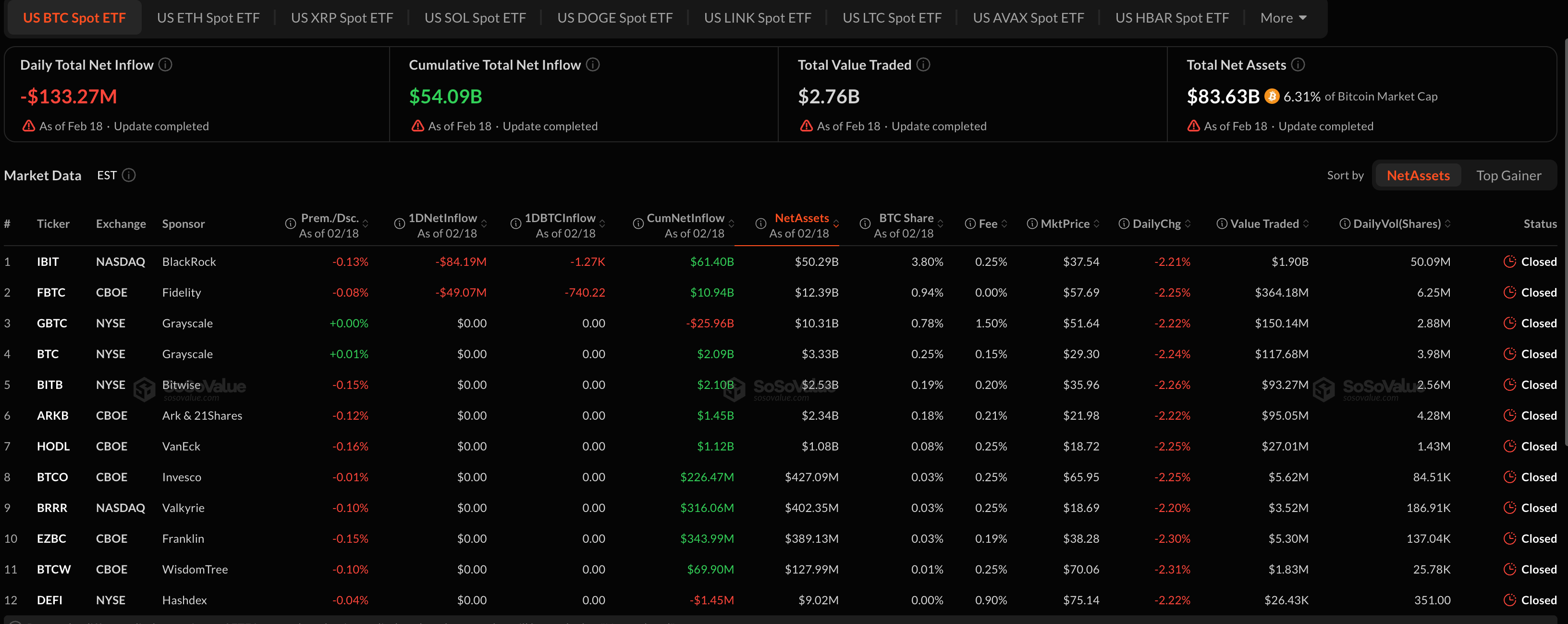

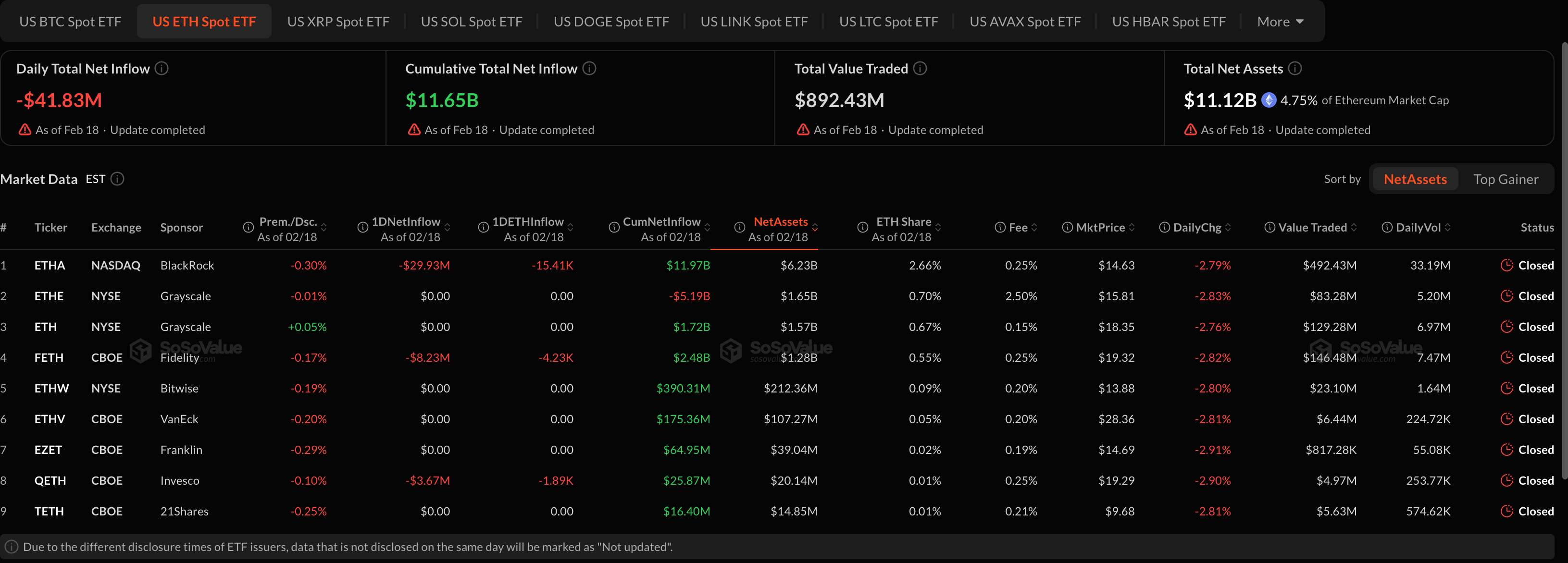

- Bitcoin spot ETFs shed $133.3 million and ether products lost $41.8 million in a day, even as their funds represent 6.3 percent and 4.8 percent of each asset’s market value, respectively. This is what happens when you trust algorithms to handle money: they panic-sell a toaster.

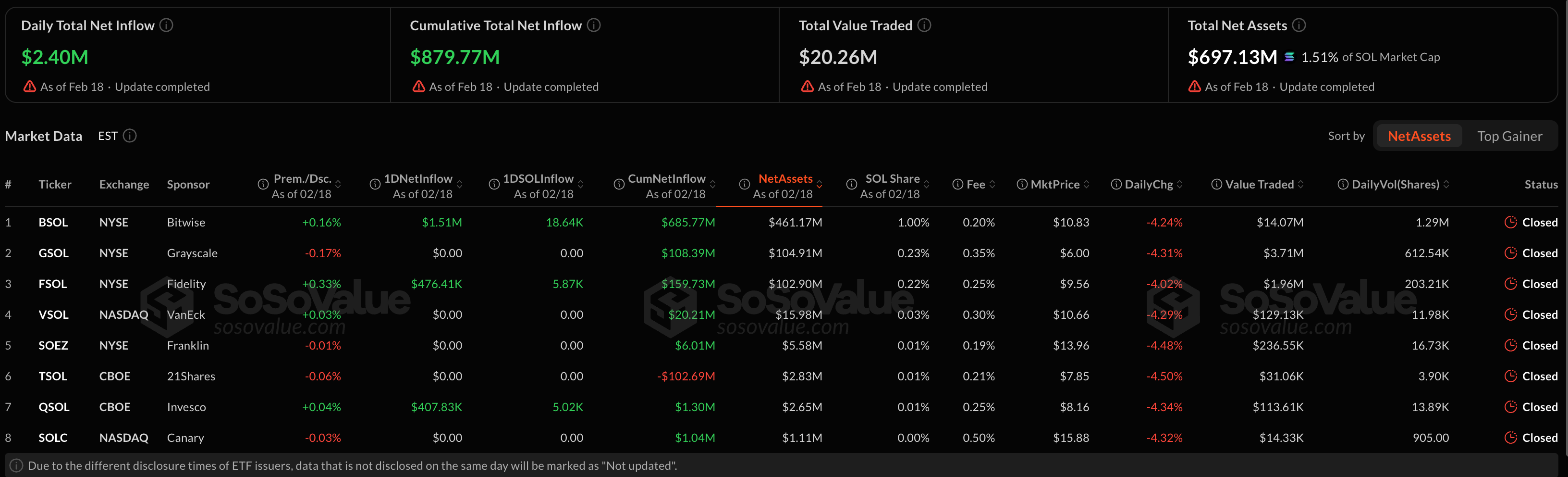

- Solana spot ETFs bucked the trend with $2.4 million in net inflows, suggesting investors are rotating within crypto rather than exiting the asset class amid macro uncertainty. Solana must’ve whispered, “Don’t worry, I’m just here to make you feel silly for doubting me.”

U.S.-listed crypto ETFs are flashing red across the board, with one notable exception. It’s the financial equivalent of a zombie apocalypse where everyone’s screaming except the guy in the clown costume.

Bitcoin spot ETFs saw $133.3 million in daily net outflows as of Feb. 18, led by BlackRock’s IBIT, which shed $84.2 million, and Fidelity’s FBTC, which lost $49 million. Total net assets across bitcoin funds stand at $83.6 billion, roughly 6.3% of bitcoin’s market cap, but recent flows suggest institutions are trimming exposure rather than adding on dips. In other words, they’re acting like adults who suddenly remember they’re not immortal.

Ethereum products followed a similar pattern. U.S. ETH spot ETFs recorded $41.8 million in net outflows on the day, with BlackRock’s ETHA losing nearly $30 million. Total net assets across ether funds sit at $11.1 billion, about 4.8% of ETH’s market cap. This is what happens when you try to build a blockchain-based utopia while still charging rent.

The steady bleed comes as ether trades below $2,000 and struggles to build momentum despite broader expectations of rate cuts later this year. It’s like waiting for a bus that’s stuck in a time loop and keeps forgetting its route.

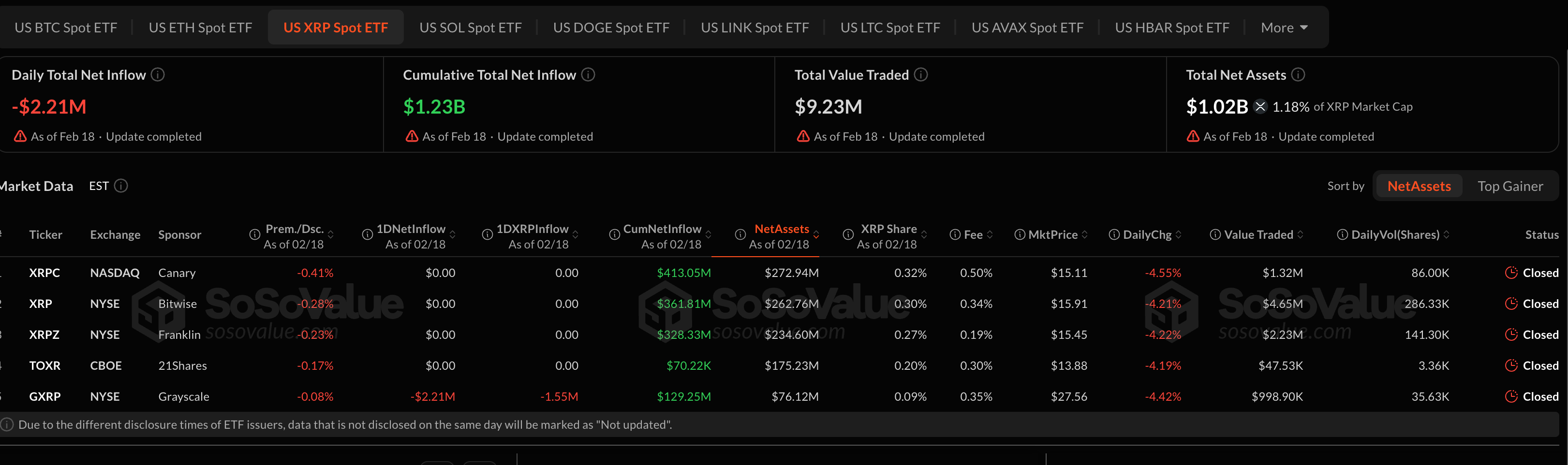

XRP ETFs also slipped into negative territory, posting $2.2 million in daily outflows. Total net assets across XRP funds are just over $1 billion, or roughly 1.2% of XRP’s market cap. Price action in XRP has mirrored the cautious tone, with the token down over 4% on the day. It’s the crypto equivalent of a magician who forgets the punchline to their own trick.

Solana, however, stood out.

U.S. SOL spot ETFs recorded $2.4 million in net inflows, pushing cumulative inflows to nearly $880 million. Bitwise’s BSOL led with $1.5 million in fresh capital. While modest in absolute terms, the inflow contrasts sharply with the broader risk-off positioning across bitcoin and ether products. Solana is the crypto world’s answer to a polite dinner guest who brings wine and remembers to compliment the host’s questionable interior design choices.

Elsewhere, smaller altcoin ETFs such as LINK saw marginal inflows, but the overall picture remains one of selective exposure rather than broad-based accumulation. It’s like trying to build a sandcastle during a tsunami while wearing a tuxedo.

The divergence suggests investors are rotating within crypto rather than exiting entirely. With macroeconomic uncertainty lingering and the dollar firming, ETF flows offer a real-time read on where institutional conviction remains and where it is fading. In short: the universe is still expanding, and your portfolio is still shrinking. Welcome to the infinite improbability of finance.

Read More

- Gold Rate Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Crypto Riches or Fool’s Gold? 🤑

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Silver Rate Forecast

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

2026-02-19 11:22