What to Know:

- Rumor has it Goldman Sachs has taken a fancy to XRP ETFs, but the filings merely show exposure to trust products, not the actual US spot ETFs doing the foxtrot just yet.

- The chatter reveals a growing appetite among the big wigs for altcoins, while also exposing the ghastly fragmentation of liquidity across blockchains-like a row of hedges that refuses to be neatly pruned.

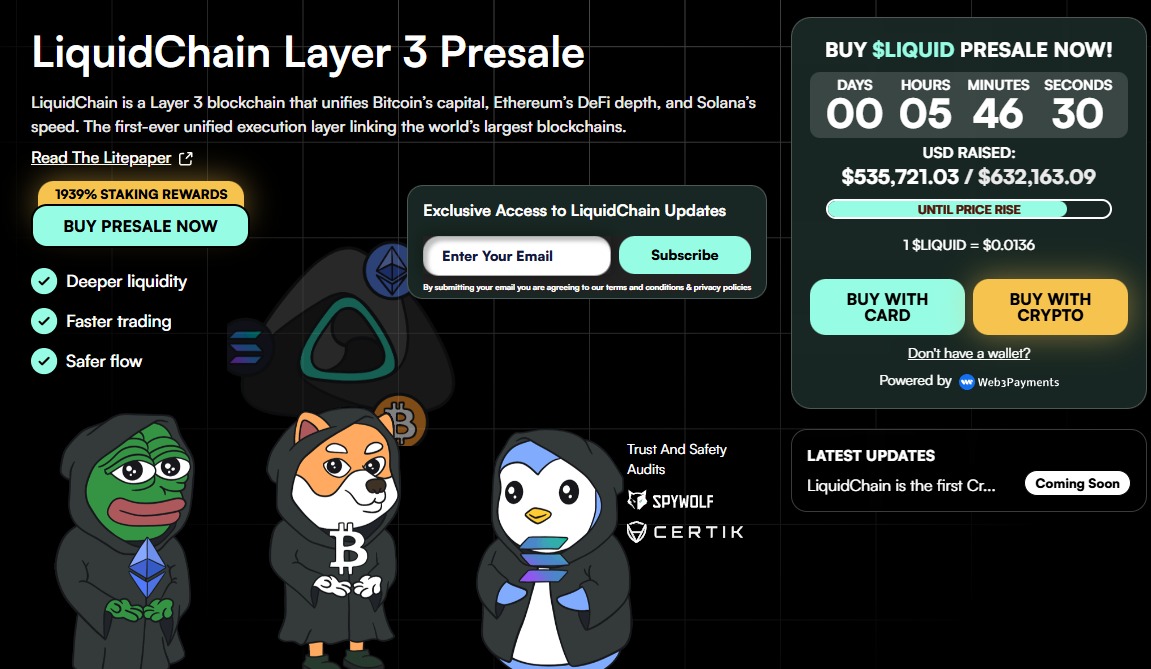

- Enter LiquidChain, a jaunty Layer 3 contraption promising to stitch together liquidity from Bitcoin, Ethereum, and Solana into one tidy, well-dressed suit of a market.

- As institutional coin-tidying continues, the call for sturdy cross-chain plumbing becomes louder than a brass band at a wedding reception.

Recent market gabfest has been all the rage about filings indicating heavyweight players, including Goldman Sachs, dipping a toe into XRP, a crisp $153 million, to be exact.

The filings show holdings in existing trust products, and not some magical doorway into XRP-on-the-spot-land. The big capital seems to be carving out territory for Bitcoin, Ethereum, and now XRP, as the digital economy grows mighty, though a bit like a cathedral built on shifting sands.

Adoption by institutions isn’t a single, thunderous flourish; it’s a gradual, polite cough that refuses to go away. First comes Bitcoin, then Ethereum, and now the market tests the waters for other large-cap altcoins. Each new product-whether a trust or a future ETF-creates another little liquidity silo. Capital can drift into XRP, to be sure, but ferrying that value over to Bitcoin or Solana remains a jolly complicated business of wrapped assets and rickety bridges.

The market cheers for validation while tilting at windmills of cross-chain walls.

What good is a multi-trillion-dollar market if its value is marooned on a string of digital islands? This tension is all part of the welcome committee for the next spree of innovations: infrastructure designed to poke holes in those walls.

This is where LiquidChain ($LIQUID) makes its entrance-like a new butler who promises to keep the drawbridge up and the goblets polished.

Buy $LIQUID here.

The Problem Hiding Behind the Headlines

As the market chitchats about which single asset will win the institutional race, a smarter question presents itself: how will these assets eventually dance together?

An XRP ETF would be a grand milestone, lending legitimacy to a new class of investors. Yet it does nothing to cure the chronic nuisance of fragmented liquidity that keeps DeFi from strutting onto the main stage.

A portfolio manager holding $BTC via an ETF can’t waltz that cash into a Solana-based yield farm without a tedious reel of selling, wiring fiat, and re-purchasing on a different chain. That friction is the obstinate gremlin at the heart of DeFi’s grand scale.

That’s precisely the itch LiquidChain ($LIQUID) aims to scratch. It operates as a Layer 3 protocol, a cross-chain liquidity layer that bundles Bitcoin, Ethereum, and Solana into one agreeable ménage. No more cobbling together separate dApps for each ecosystem-LiquidChain offers a Deploy-Once Architecture.

A protocol can be deployed once and access users and capital from three of the largest blockchains at once. For users, its Single-Step Execution takes the sting out of cross-chain swaps, letting the multi-chain world feel rather like one polite little platform.

Explore the $LIQUID presale.

An Infrastructure Play for a Multi-Chain World

As institutional interest stamps its approval on individual assets, the value of the underlying plumbing grows in leaps and bounds-like a fancy new furnace for a very drafty manor.

That’s LiquidChain’s angle. Not just another DeFi gadget, but a foundational layer aiming to be the go-to plumbing for value transfer between major blockchains. The project is in its sprightly youth, offering a charming entry point for those who have a nose for where the market is nibbling next.

According to its official site, the LiquidChain presale has already hatched about $546k, with the $LIQUID token priced at a mere $0.0136.

This sort of traction hints at a real appetite for solutions that address proper, persistent problems. The tokenomics favor utility, with $LIQUID used for liquidity staking rewards and as gas for transactions on the network. A neat, direct link between the chain’s growth and the token’s value, with less smoke and mirrors than a magician’s elbow.

While the market ponders the ETF intrigue, LiquidChain puts forth a more fundamental thesis: the winner won’t be the loudest chain, but the one that can stitch them all together. For the prudent investor, it’s a proper ground-floor moment to wade into a project building for the next era of DeFi.

Get your $LIQUID here.

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Gold Rate Forecast

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- Whale of a Time! BTC Bags Billions!

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Bitcoin Bonanza: Strategy Scoops 525 BTC Like It’s Free Pizza!

2026-02-11 13:55