In the grand and hallowed halls of the White House, a most riveting rendezvous transpired regarding the ever-elusive stablecoin yield and rewards. Alas, the affair concluded without a pact, but attendees, as reported by the intrepid journalist Eleanor Terrett, proclaimed it to be a smidgen more fruitful than previous parleying sessions, which is rather like saying a soggy biscuit is better than a broken one.

- The White House stablecoin yield talks drifted into oblivion sans agreement, though both banks and crypto firms hailed the meeting as a step up from earlier tête-à-têtes.

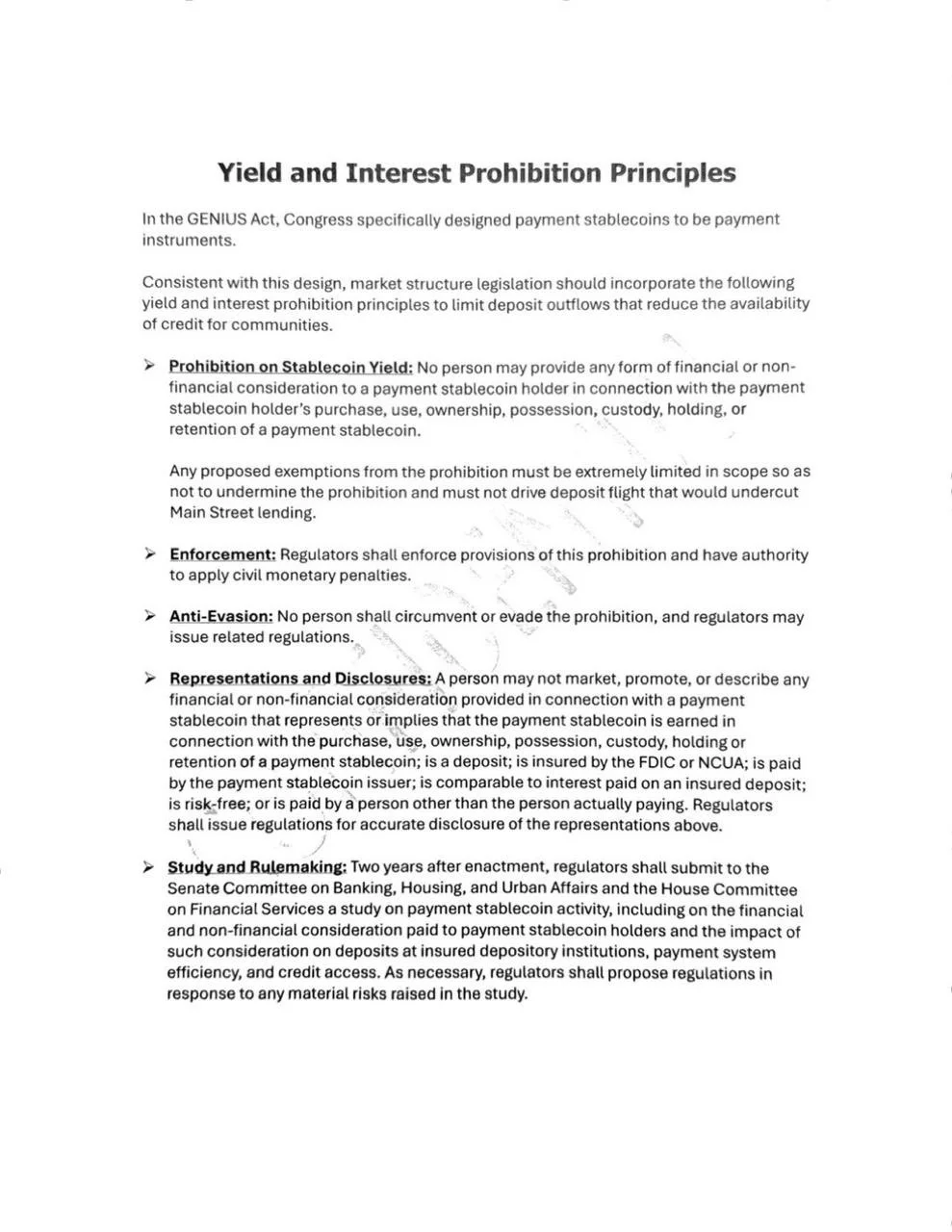

- Our financial friends from the banking sector rolled out a formal document of “prohibition principles,” indicating their penchant for rigidity while slyly hinting at possible exemptions for transaction-based stablecoin rewards-how generous!

- The White House, in its infinite wisdom, has urged these battling factions to settle their squabbles over stablecoin rewards regulation by the first day of March, with more chin-wagging on the horizon.

This illustrious gathering saw the mingling of senior banking bigwigs, crypto industry hotshots, and policy wonks, all gathered to thrash out the vital question: should stablecoin issuers be permitted to dangle the carrot of yield or rewards before our eager eyes?

While no compromise was reached (sigh), the discussions ventured into the realm of detail, which is always a good sign unless you’re discussing the finer points of wallpaper patterns.

White House stablecoin talks show progress but no final deal

The financiers, bedecked in their sharpest suits, arrived clutching a written set of “prohibition principles.” These documents outlined their immovable red lines regarding stablecoin rewards, delineating where they would not budge an inch, much like a cat stuck on the roof refusing to come down.

But lo! A notable shift appeared on the horizon. The bankers included language permitting “any proposed exemption” concerning transaction-based rewards-an unexpected twist that could have made even the stoniest heart flutter.

Sources have whispered that this counts as a significant concession, given that the banks had previously been as obstinate as a mule in a snowstorm when it came to discussing exemptions of any variety.

The crux of the debate revolved around the noble pursuit of “permissible activities.” This rather grand phrase refers to what kinds of account behavior would allow crypto firms to tempt us with rewards. The crypto companies, with all the exuberance of children in a candy store, advocated for broad definitions. Meanwhile, the banks, ever the cautious types, championed narrower limits to minimize risk and regulatory exposure-as if they were guarding the last chocolate in the box.

Ripple’s Chief Legal Officer, Stuart Alderoty, declared that “compromise is in the air,” a statement that wafted through the room with the optimism of a spring breeze, albeit one laden with unresolved issues.

White House meeting to save CLARITY Act:

Banks won’t budge on the total stablecoin yield ban.

Crypto ready to negotiate.

Briefcase stays closed. NO DEAL.

– Lark Davis (@LarkDavis) February 11, 2026

March 1 deadline looms as talks continue

This latest assembly was a tad more intimate than the initial White House soiree on stablecoins. It was helmed by Patrick Witt, Executive Director of the President’s Crypto Council, with an entourage from the Senate Banking Committee in attendance-so you know it was serious business.

Crypto representatives, including those from Coinbase, a16z, Ripple, Paxos, and the Blockchain Association, mixed with the banking elite, such as Goldman Sachs, JPMorgan, Bank of America, Wells Fargo, Citi, PNC, and U.S. Bank, along with the crème de la crème of banking trade groups. Quite the gathering, I must say!

The White House, ever the taskmaster, has set a firm deadline for both sides to reach an accord by March 1. More discussions are anticipated in the coming days, though whether we will witness another grand spectacle before the deadline remains clouded in uncertainty-much like a foggy Tuesday in November.

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Gold Rate Forecast

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Whale of a Time! BTC Bags Billions!

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- Stripe’s Latest Acquisition: A Crypto Wallet Adventure Awaits! 🚀💰

2026-02-11 10:02