What to Know, in a Wink and a Giggle:

- Bernstein’s wizards predict Bitcoin to prance up to $150,000 in 2026, spurred by hulking ETF inflows and supply bottlenecks that make the coins flutter like startled moths.

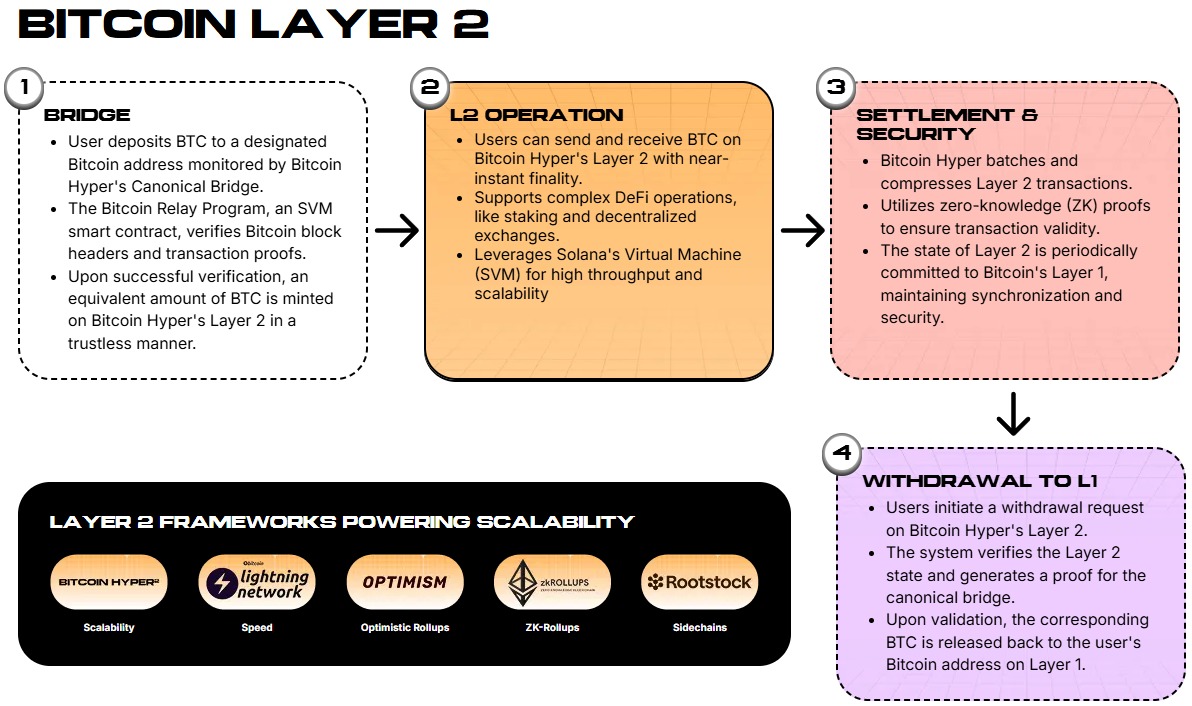

- Bitcoin Hyper uses the Solana Virtual Machine (SVM) to lace high-speed smart contracts into Bitcoin’s sturdy old coat.

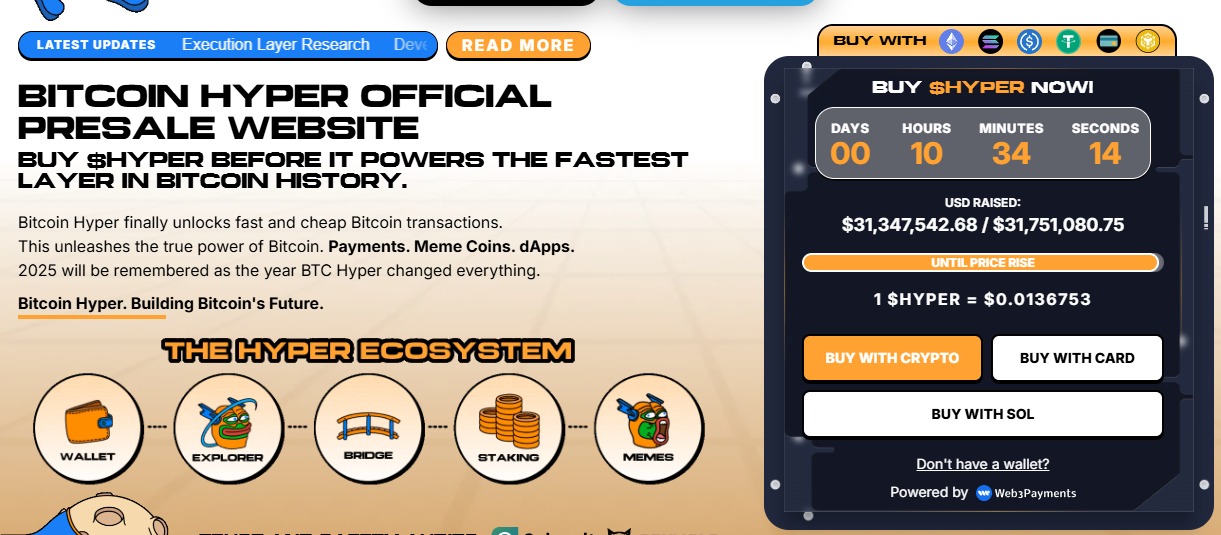

- Whale gossip confirms institutional interest, with over $31.3M hoovered up in the ongoing presale.

- As prices of Bitcoin L1 soar, folks drift toward Layer 2 wonder-workers for cheaper, speedier transacting.

Bernstein’s latest forecast has whipped up a fresh pastry of institutional excitement: Bitcoin aiming for $150,000 in 2026.

Analysts at the firm, led by the ever-cheerful Gautam Chhugani, point to an ‘unprecedented institutional adoption cycle,’ driven by Spot ETF inflows and post-halving supply shocks. This isn’t merely a price target; it’s a whistle that the asset class is growing up from a candy-store folly into something a wee bit sovereign-grade.

But there’s a snag. A six-figure Bitcoin is a bit of a squeeze-box: scalability. As the network grows plump and valuable, base layer fees have a tendency to climb the stairs. The main chain becomes less a playground and more a ledger for mammoth settlements. That leaves a yawning hole for Layer 2 infrastructure, protocols that borrow Bitcoin’s security while doing the running about.

Smart money is already tiptoeing ahead of this bottleneck. While Bitcoin holds its ground, capital is scampering into scalability spells designed to wake up dormant liquidity.

You can glimpse this shift in the rapid ascent of Bitcoin Hyper ($HYPER), a jaunty new high-performance Layer 2 project that has already snapped up over $31 million in funding. The thesis is as simple as a box of chocolate: if Bitcoin becomes the global vault, protocols like Bitcoin Hyper are the gleaming high-speed rails that move the cash.

Read more about $HYPER here.

Fusing SVM Speed With Bitcoin Security

The current Bitcoin Layer 2 landscape is crowded. Bitcoin Hyper ($HYPER), however, is carving out a sunny corner by jamming the Solana Virtual Machine (SVM) directly into Bitcoin’s settlement layer. Most existing solutions face a stern trade-off: secure but slow, or fast but centralized.

By using the SVM, Bitcoin Hyper aims to deliver the execution speed developers expect from Solana-blazing fast, low-cost-while anchoring finality to the Bitcoin network.

This clever hybrid tackles the core limits hindering Bitcoin’s DeFi ecosystem: glacial block times and no native smart contract programmability. Through a Decentralized Canonical Bridge and modular architecture, the protocol allows seamless transfer of $BTC into a high-performance environment.

Suddenly, complex DeFi applications, from lending protocols to NFT platforms, aren’t just possible; they’re scalable.

That matters for market dynamics. If Bernstein’s $150K prediction holds water, demand for ‘productive $BTC’-assets used as collateral rather than sitting idle-will likely surge. Bitcoin Hyper’s approach allows it to serve as the execution layer for this liquidity. Developers are particularly keen on the Rust-compatible SDK, which lowers the drawbridge for builders migrating from Solana’s ecosystem to Bitcoin’s liquidity.

$HYPER is available here.

Whale Accumulation Signals Confidence in L2 Narrative

Capital flow into the Bitcoin Hyper presale suggests high-net-worth investors are betting big on this ‘SVM on Bitcoin’ narrative. Official data show the project has raised a staggering $31.3M. In the current fundraising climate? That figure stands out. The token is priced at $0.0136753, tempting early backers looking for leverage against Bitcoin’s main-layer moves.

On-chain analysis reveals this interest isn’t limited to retail participants. Etherscan records show two whale wallets have piled in, accumulating over $1M ($500K, $379.9K, $274K) in recent transactions.

The risk for any new Layer 2 is fierce competition from established players like Stacks or the rise of zero-knowledge rollups. (Competition is fierce in this sector). Yet Bitcoin Hyper’s staking model offers a tempting incentive structure to keep liquidity locked. The protocol offers high APY staking immediately after TGE, with a short seven-day vesting period for presale participants.

This setup rewards loyalty over mercenary capital. For investors watching Bernstein’s target, $HYPER represents a leveraged bet on the infrastructure needed to support that lofty valuation.

Buy $HYPER here.

Read More

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Gold Rate Forecast

- Crypto Cowboy Fights Back: CZ Tells WSJ to Take a Hike! 🚀😏

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- Saylor Shrugs Off ‘Junk’ Rating, Buys More Bitcoin 🚀💸

- Crypto Investors Laughing All the Way to the Bank, But They’re Not Selling Yet!

- Bitcoin’s Droll Dance: Profits Plummet While Prices Prance! 💃🕺

2026-02-09 15:45