On the fateful day of October 10, 2025, the digital currency realm witnessed a seismic shift, akin to an autumn gale stripping leaves from the trees. This day etched itself into history as the grandest liquidation of crypto derivatives ever, a staggering $19 billion in futures positions unraveled as swiftly as a poorly knit sweater on a chilly evening.

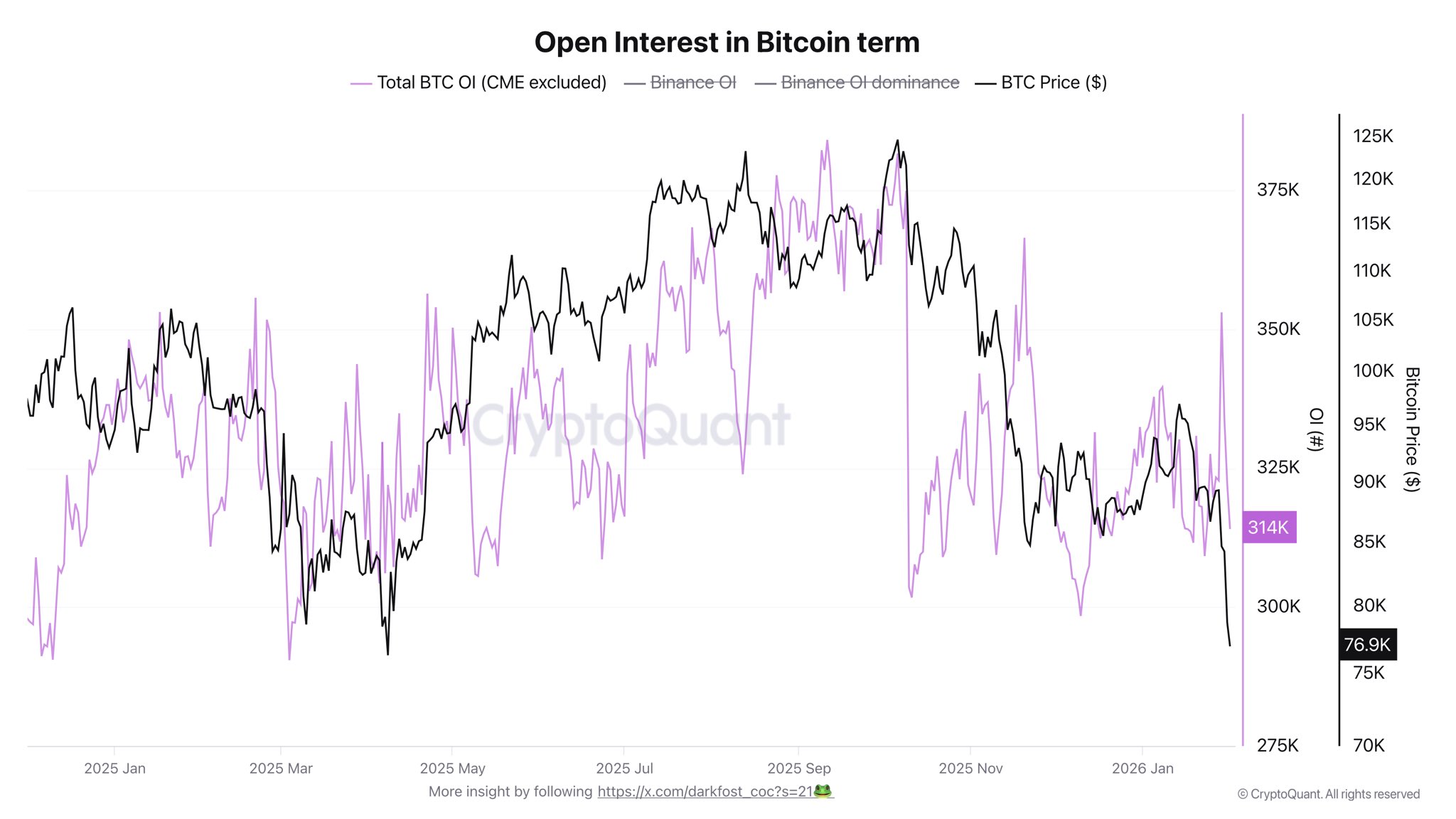

In the words of the sage Darkfost, this was not merely a directional descent but a structural calamity; like a bulging dam that finally bursts, approximately 70,000 BTC evaporated from open interest, casting months of speculative dreams into an abyss. It was this very event, he asserts, that flung Bitcoin into bear territory, with the speed of a fox fleeing a field of hounds.

The Dawn of Darkness: Why October 10 Marked the Bitcoin Bear’s Arrival

Darkfost paints a grim portrait of that singular day: “Seventy thousand BTC vanished into thin air, returning open interest to its humble April 2025 levels,” he lamented. “That’s akin to erasing half a year’s worth of anticipation in but a heartbeat.” Since then, the open interest has languished, hesitant to rise from its grave.

The crux of the matter lies not in the spark that lit the fire but rather the charred remains left behind. On Darkfost’s canvas, the October 10 saga was a cataclysmic reduction of the market’s capacity for leverage-a blow to the heart of speculation that has left it gasping for breath.

“In an already shaky crypto landscape, the obliteration of liquidity is hardly the welcome mat for speculation,” he quipped, highlighting the irony that this very speculation is the lifeblood of the crypto world.

This sentiment echoed through the halls of Bitcoin Capital, who proclaimed with a hint of melodrama, “Nothing has been the same since 10/10,” suggesting that perhaps the universe itself had shifted on that day. Darkfost, with a pragmatism befitting of a weary prophet, remarked, “Rebuilding will take time-months, perhaps. It’s a delicate task, like mending a shattered mirror.”

In a subsequent missive, Darkfost widened his gaze, revealing a tableau where spot participation has also dimmed. Bitcoin now finds itself in a fifth consecutive month of correction, while the fateful October 10 serves as a pivotal player, though not the sole culprit in this tragic play.

He noted a broader liquidity squeeze, akin to a drought in the fertile fields of stablecoins: the outflow from exchanges has paralleled a $10 billion descent in the aggregate stablecoin market cap, a chilling breeze against the already quaking foundations of risk-taking.

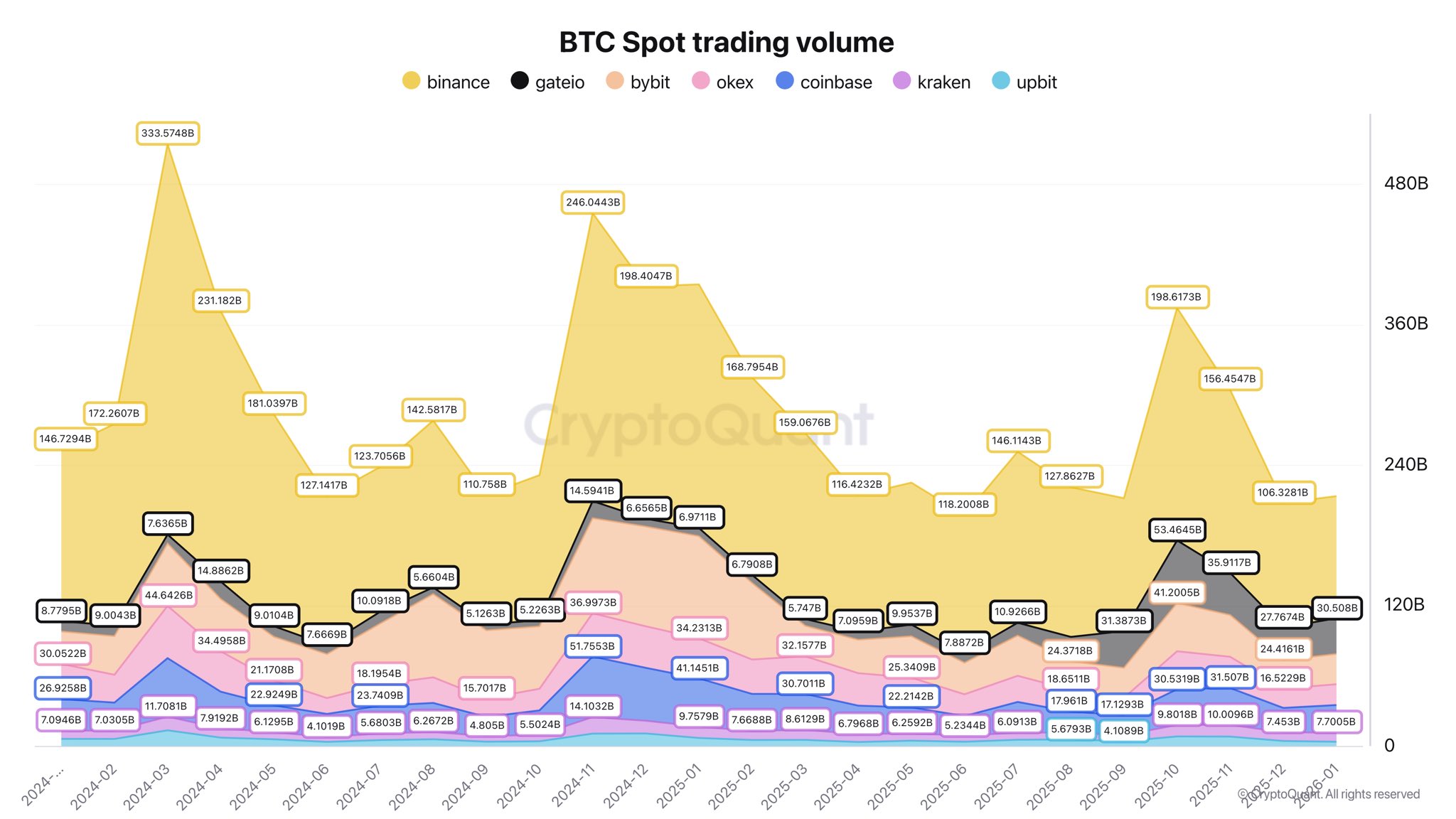

The narrative of dwindling spot volumes continues, with BTC trades halved since October. Binance still reigns supreme with $104 billion in volume, a shadow of its former self when it nearly touched $200 billion in October, alongside Gate.io and Bybit, whose volumes felt like echoes in a vast canyon.

Darkfost characterized this contraction as a return to the dark ages of trading-a time not seen since 2024. He interprets this phenomenon not merely as a lull but as weak demand shrouded in uncertainty. To navigate back to brighter days, he argues, one must keep a keen eye on liquidity conditions and, above all, await the resurrection of spot trading volumes.

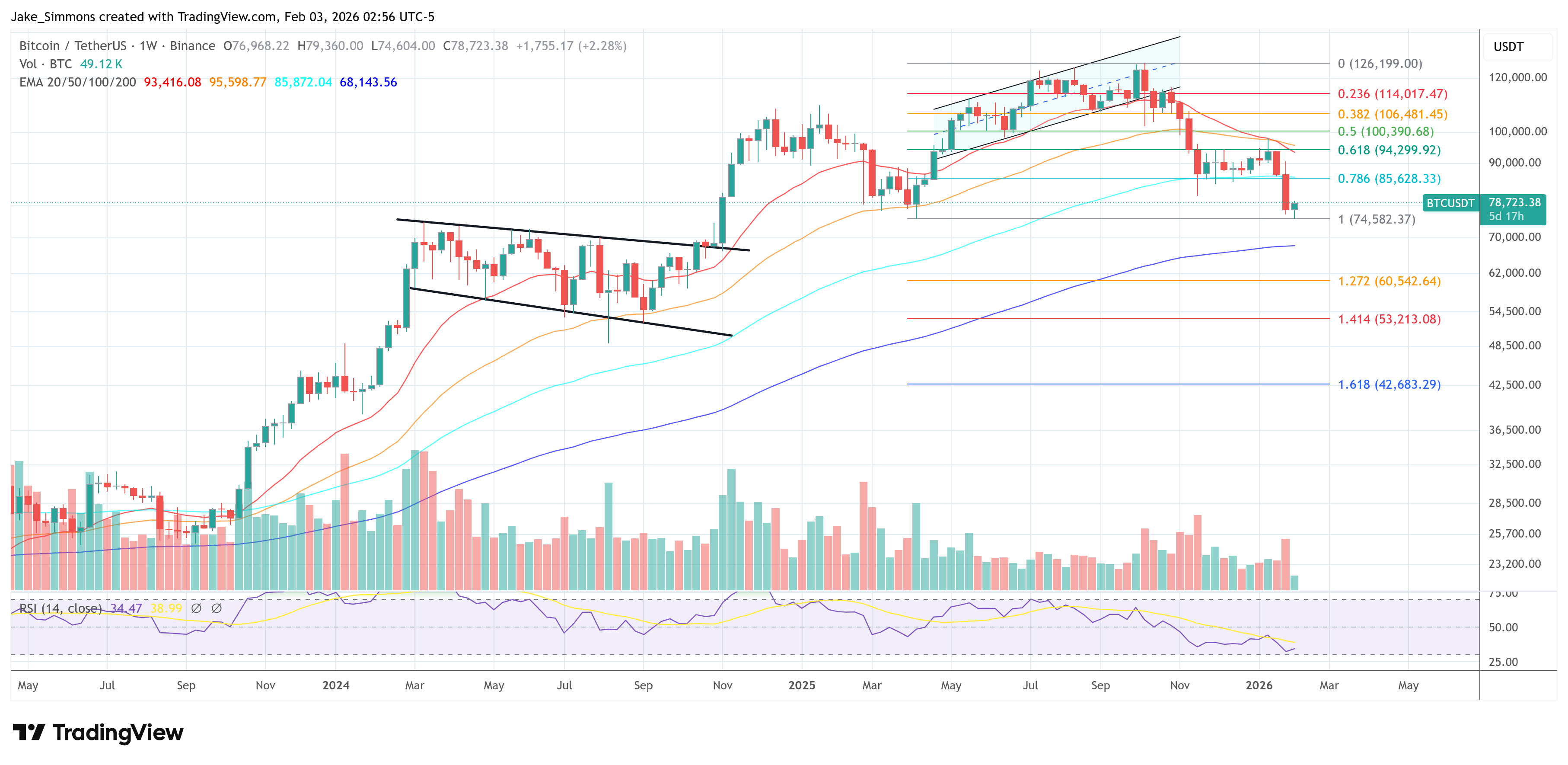

As the curtain draws near, Bitcoin finds itself priced at a dismal $78,723, a somber reminder of its erstwhile glory.

Read More

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Silver Rate Forecast

- Gold Rate Forecast

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- NFTs Soar to New Heights: Is the Bull Run Truly Back? 🚀💰

- Crypto Courtroom Bombshell: The Surprising Maneuver That Could End It All

- Pudgy Penguins: The Meme Coin That Dares to Be Different 🐧✨

2026-02-03 17:32