In an idyllic small Siberian town, where erratic rainfall matched the temperament of local traders, sat a man named Jeff Park. From his cluttered desk littered with scribbled memos and half-drunk cups of tea, he issued his latest reflection on the curious state of Bitcoin. Its current calm was as unsettling as a hunter noticing his traps untouched. Wouldst it be mere tranquility or the calm before the storm? In the pages of a quaint journal, Jeff wrote:

“Bitcoin, with its mouth agape in silent repose, bears a resemblance more to quiet Chapayev Square than to the bustling bazaar of one moonless dreamscape. Upside momentum demands volatility like peas demand carrots in a beloved samovar.”

“In days gone by, upon the Siberian plains, people would say that still waters hide the sharpest fish. Much like the stillness of January left our dear cryptocurrency with a comatose market, a spell of tranquility that might break high as ten thousand felt boots dropped from the rafters.”

And what could the metals market tell us about the impending chaos? Why, it was in the tale of silver‘s antics, a subplot so intricate it demanded a story all its own. Silver, ever the unpredictable neighbor, danced a wild tango, its prices above $117 per ounce in what twitched as the town’s most intriguing plot twist.

Weren’t some inspired by silver’s frenetic seesawing-a captivating performance worthy of any elaborate diversion-the scribblers over at X exclaimed on the 27th of January, “The tape, Lollo, as still as a beheaded Snow, thus making it an entertainer’s market.” Low implied volatility and minimal participation, dubbed unsuitable escorts, danced around as companions of Bitcoin’s reluctant move higher.

Jeering at their luck, the villagers rubbed their hands, “The spectacle of this desolate volume cannot compare to any summer of yore.” Supported by merry metals and excited chatter was the town’s opinion, “What a setup for disappointment this is, indeed!”

The Gryphon as Old as Silver

And yet, silver, with its spur of momentum, engaged in a domino of unforeseeable day-trading. The next act found itself on the sixth day of January, where the most-active silver futures contract rose a staggering 14%. It was a crescendo unseen since the years of reform. Concurrently, trading akin to an overpopulated summer bazaar erupted across all silver contraptions-whispers of a “seismic shift,” they said.

“Drat the magnitude in SLV’s traffic!” cried out an analyst known by the name Eric Balchunas; “shots of energy comparable scarcely to anything we’ve seen unless you would chance upon a Game Stop, one more animated than usually quaint.”

“Drat the magnitude in $SLV traffic.. that 15x its average inundation, more spirited than any global security known. Context-the daily volume in SPY was a mere $24b, NVDA and TSLA just at $16b. Opulence bold and audacious as rare Game-Stop adventures.” -Eric Balchunas

The Sarcasm of Synthetic Bitcoin

Within our tale, Park wounded many a heart with his words, arguing not splendor but an undercurrent stronger. He conjured images of financial peculiarity, invisible forces like kites whipping themselves to impossible heights. “Nay,” he thundered, “it is not paper sovereigns that mislead, but their mute cousins who stir the pot of volatility!”

His tale concluded with all the prescience of a seasoned soothsayer: “A \r\nfondness for Bitcoin is akin to betting on tempests. Anyone feigning calm harbors naught but folly.” In the white frost of Bitcoin, this whimsy therein whispers of futures both vivid and untold, yearning for the day volatility would finally play its hand.

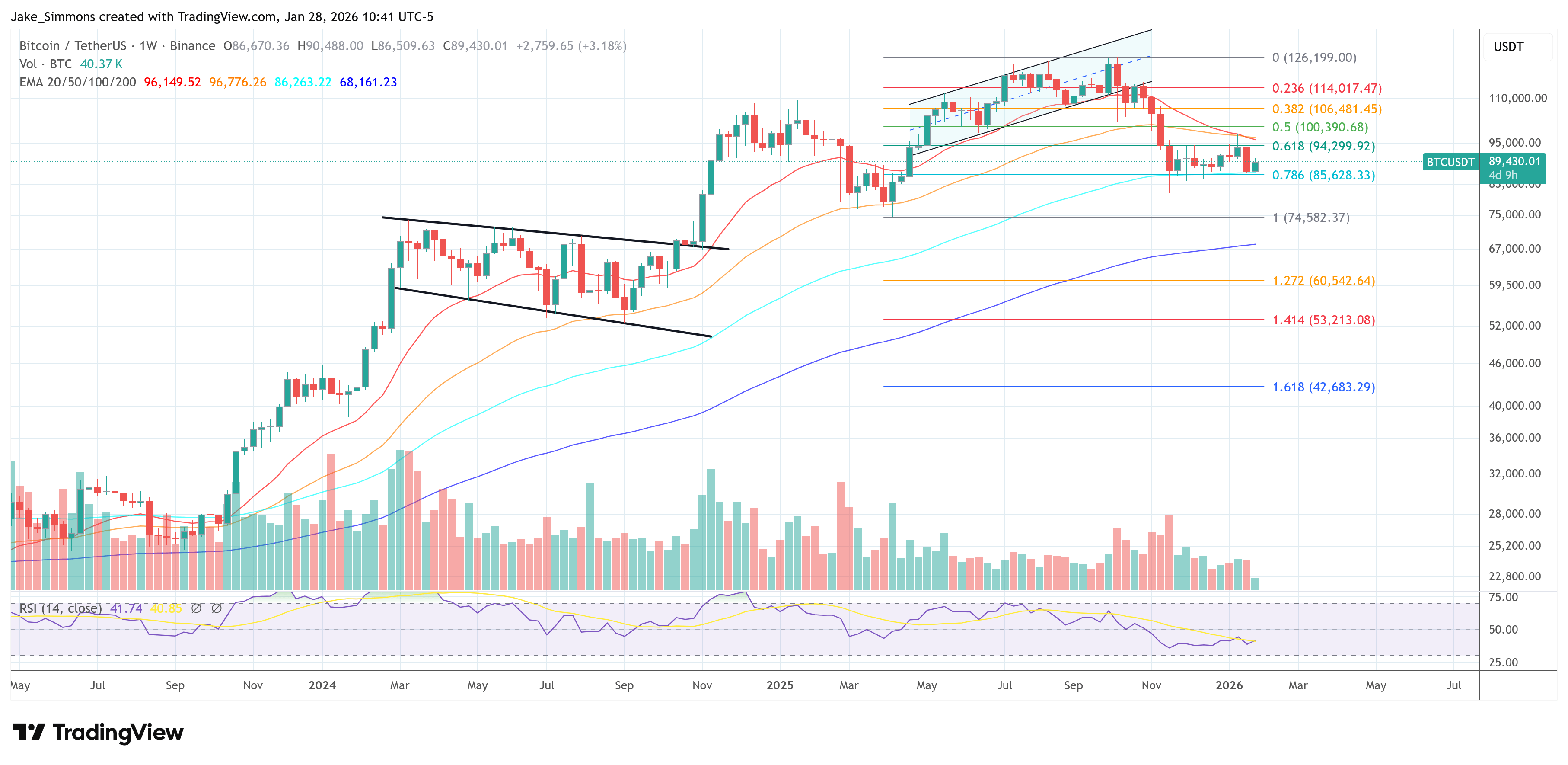

At the hour of writing, BTC traded with the dignity of an opulent bride, her gauze dress brushing the earth at $89,430.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Brent Oil Forecast

- New ETF: Bitcoin and Gold Tango to Save Your Wallet from Currency Woes!

- USD TRY PREDICTION

- SEI’s Suicide Dive to $0.20! 🚀😱 Or the Greatest Trick Since Woland Came to Moscow?

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Fantasy.top’s Desperate Dash to Base: A Crypto Comedy 🎭

2026-01-29 07:16