November has been a rollercoaster of despair for most investors, and even several ‘made in USA’ coins have slipped like a greased weasel. The broader trend has been weak, with few assets holding their levels while traders wait for a clearer direction-aka, the crypto version of “I’ll be there in 5 minutes.”

But as the market tries to stabilise, three of these US-based coins are showing early signs that they could rebound. One has a rare negative correlation with Bitcoin. Another is forming a clean reversal structure. And the third coin has drawn sudden whale activity. These factors make them worth watching this week-assuming you enjoy gambling with your savings. 💸

Litecoin (LTC)

One of the first made in USA coins to watch this week is Litecoin (LTC). It has climbed a little over 8% in the past 30 days and about 7% in the past 24 hours, showing unexpected resilience during a rough November. 🧘♂️

A big reason behind this strength is its negative correlation with Bitcoin. The Pearson correlation coefficient between LTC and BTC sits at -0.01 over the past month. 🤯

The Pearson coefficient measures how two assets move relative to each other; a negative reading means they move in different directions. Like a bad relationship. 💔

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Since Bitcoin has dropped more than 13.5% in the same period, Litecoin’s lack of correlation has actually helped it hold better than most top coins. It’s like having a friend who doesn’t judge you when you’re crying into your cereal. 🥣

But correlation is not the only factor here. The chart is also forming a clean inverse head and shoulders pattern, with the price now hovering near $102. 🤷♂️

If LTC manages a daily close above $119, it would complete the pattern and open the door to a move toward $135 or higher if broader conditions improve. This resistance level has capped upside attempts before, so a break would signal real momentum. 🚀

The Smart Money Index, which tracks how informed or early-moving traders position themselves, has also begun turning up since November 13. 📈

That shift shows some early confidence returning as LTC pushes toward the pattern’s neckline. The combination of a curling Smart Money Index and price pressing into a breakout zone makes this week especially important for this setup. 🎯

If buyers fail to lift Litecoin above resistance, the first key support sits at $93. A drop below that level weakens the reversal structure, and falling under $79 would invalidate the pattern entirely. 😱

Solana (SOL)

Among the ‘made in USA’ coins gaining attention this week, Solana (SOL) stands out for a different reason. It has had a rough month, dropping almost 27% over the past 30 days. Even so, the chart is starting to show hints of a possible short-term reversal that traders cannot ignore. 🤯

The signal comes from the Relative Strength Index (RSI), which measures price momentum to show when an asset may be overbought or oversold. 📊

Between November 4 and November 14, Solana’s price formed a lower low, while RSI formed a higher low. This formation is known as a bullish RSI divergence, and it often appears just before a trend attempts to turn, even if the reversal is brief. 🔄

If this divergence plays out, Solana’s immediate test is $162. It is a strong resistance level that has held since November 5 (breaking once in between). 🛑

Breaking above $162 would open the door toward $170. And if momentum strengthens, the price could push as high as $205 in the short term. 🎉

But the setup only holds if buyers defend $135. A drop below that support would weaken the structure and expose $126. 🤷♂️

Chainlink (LINK)

The final pick on this week’s list is Chainlink (LINK), which has had a tough month of its own. It has declined by more than 20% over the past 30 days and has logged an additional 10%+ drop during the past week. 💸

Even so, something unusual has appeared in its holder activity, making LINK a key token to watch this week as the market attempts to stabilise. 🤔

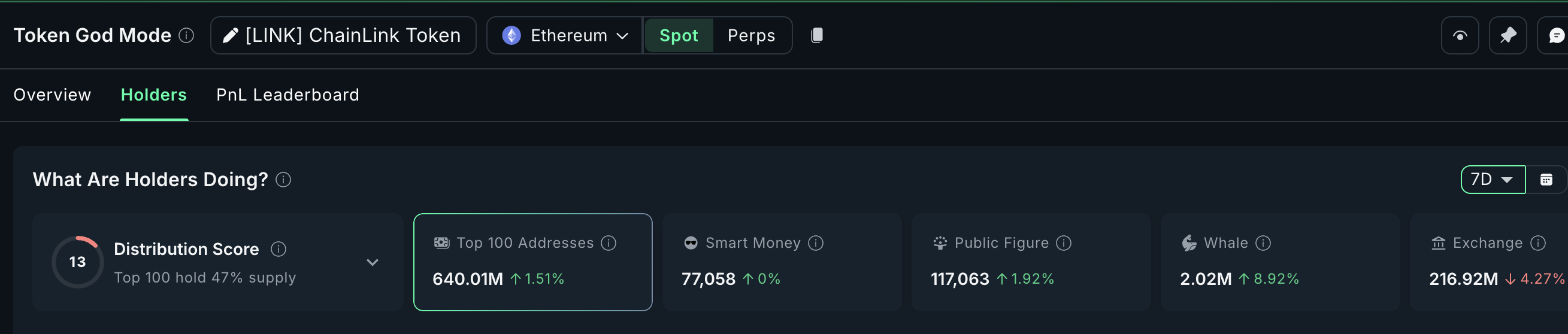

Despite the decline, whale accumulation has surged in the last seven days. Regular whale holdings have jumped 8.92%, while the top 100 addresses-larger “mega whales”-have increased their combined stash by 1.51%. 🐟

When whales buy into weakness instead of exiting, it often hints at early positioning for a potential reversal. 🕵️♂️

The chart explains why they may be stepping in. Between October 10 and November 14, LINK’s price made a lower low, while its RSI formed a higher low. This created a standard bullish divergence. This is the same momentum shift seen in Solana, and it often appears near the early stages of trend reversals. 🔄

For the setup to activate, LINK needs to reclaim $16.10, which requires roughly a 17% move from current levels. Clearing $16.10 opens the path toward $17.57. 🎯

If a daily close forms above that zone, LINK could stretch toward $21.64 or higher if broader market conditions improve. 🚀

If buyers fail to hold support, the key level to watch is $13.72. A daily candle close below it would break the current structure and likely invalidate the bullish reversal signal. The reversal, then, would have to wait longer. 😢

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- USD THB PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- You Won’t Believe How $3B in Real Estate Is Now Just Tokens. Mind-Blowing, Right?

- 🚀 Worldcoin: $1.50 or Bust? Analysts Predict Crypto Chaos! 🌌

2025-11-15 16:48