In the sweltering heat of July, the United States, with all the subtlety of a sledgehammer, slammed down the GENIUS Act, a federal framework for stablecoins. Washington, in its infinite wisdom, declared that dollar-backed tokens would be the backbone of digital settlement. And the world, like a flock of startled pigeons, took notice.

Over in Asia, the air grew thick with debate, as heavy and oppressive as a summer fog. China, ever the tightrope walker, faced a dilemma: how to promote the yuan without loosening its iron grip on capital controls? Hong Kong, that scrappy little harbor city, offered a compromise-a new licensing regime that kicked in on August 1. A middle ground, perhaps, but one that smelled faintly of desperation and hope.

Hong Kong Opens Its Arms, Beijing Clenches Its Fists

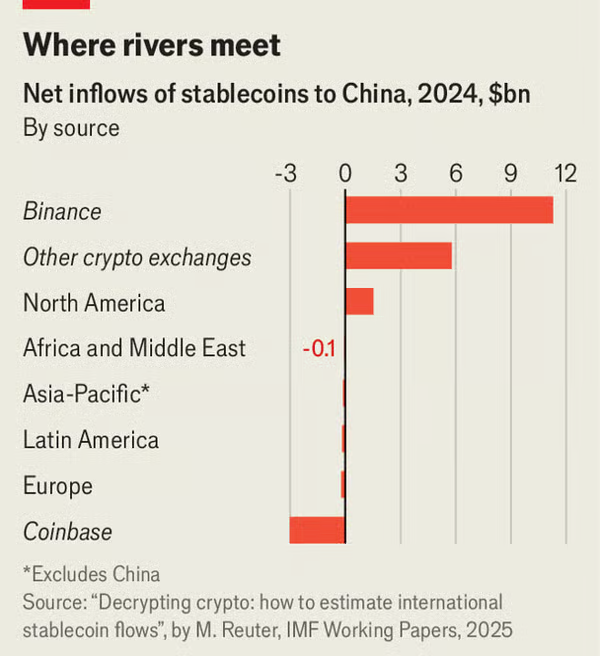

The Hong Kong Monetary Authority, with all the rigor of a schoolmarm, demanded issuers hold HK$25 million in capital, keep liquid reserves segregated, and toe the line on anti-money-laundering standards. Licenses? None granted yet. Meanwhile, on the mainland, the People’s Bank of China doubled down on its digital yuan pilots, cracking down on Tether-linked transfers and banning firms from holding crypto directly. Beijing’s message was clear: innovation, yes-but only on our terms.

“The broader challenge… is the conservative culture of its finance industry.” Emil Chan, of the Hong Kong Digital Finance Association, sighed in a CNN interview, his voice dripping with the weariness of a man who’s seen it all.

Tokenization: The New Gold Rush, But With More Paperwork

Hong Kong, ever the overachiever, paired its stablecoin rules with a broader tokenization push. On August 7, regulators unveiled the world’s first real-world asset (RWA) registry, a bureaucratic marvel designed to standardize data and valuations. Custody and OTC rules? They’re consulting on those too. Because why stop at innovation when you can drown it in red tape?

“It puts Hong Kong ahead of almost any other Asian jurisdiction… It’s going to be a blueprint for others.” Yat Siu of Animoca Brands declared on CNN, his tone a mix of pride and exasperation, like a parent bragging about their child’s straight-A report card while secretly wondering if they’ll ever move out.

Private activity, meanwhile, buzzed with the energy of a beehive. HSBC rolled out blockchain settlement for trade finance, while China Asset Management (Hong Kong) launched Asia’s first tokenized retail money market fund. Tokenized gold and green bonds? They’re in the mix too, because why not add a little sparkle to the financial ecosystem? 🌟

Analysts, ever the party poopers, poured cold water on the idea of yuan-backed stablecoins. Offshore CNH deposits, they pointed out, total less than 1 trillion yuan, a drop in the bucket compared to the 300 trillion onshore. Reserves too thin, they said, shaking their heads like disapproving aunts. Pegs to the Hong Kong dollar or US dollar? Now those are more viable. 🤑

Dollar-linked stablecoins, of course, are already hoovering up US Treasuries like a vacuum cleaner on overdrive. HKD-backed tokens? They’d tie demand to the city’s dollar peg, paradoxically strengthening the greenback. Because nothing says “financial independence” like reinforcing the currency you’re trying to compete with. 🤦♂️

China is launching $YUAN stablecoin in 2025

It will inject TRILLIONS and trigger a Chinese Bull Run

Every $450 portfolio now ≈$85K by the end of October

Here’s what’s next and list of Chinese alts with 100x upside

– Linton Worm (,) (@LintonWorm) August 22, 2025

Regional Rivalries: The Stablecoin Hunger Games

Hong Kong’s cautious openness stands in stark contrast to Beijing’s ban-and-control approach. Early stablecoin licenses are expected to go to major banks and tech groups, with the first approvals targeted by year-end. Because nothing says “innovation” like giving the keys to the established players. 🏦

Regional voices, meanwhile, are calling for a multi-currency stablecoin alliance, led by Singapore and the UAE, to reduce reliance on the dollar and boost cross-border liquidity. Because if you can’t beat ‘em, join ‘em-and then try to outmaneuver ‘em. 🌍

For now, Hong Kong’s licensing regime and tokenization drive put it ahead of its Asian rivals. But high compliance costs and a conservative finance culture may slow adoption, leaving USD-pegged tokens dominant in the region. Because sometimes, even the best-laid plans get tripped up by the weight of their own ambition. 🏗️

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- When Will the Long Traders Finally Give Up? 🤔

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- USD GEL PREDICTION

- PLUME: 60% Down?! 😱

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

- ZEC Surges 17%-Is $750 Just Around the Corner? 🚀💰

2025-09-03 21:38